A Market That Wants to Believe: TwinFocus 2023 Year-End Views & 2024 Market Outlook

In a world where belief often shapes reality, akin to a child’s unwavering trust in Santa Claus, the investment landscape is not immune to the power of faith. The recent pivot by the Federal Reserve, reminiscent of only a handful of historic shifts, has ignited hope in the market. Much like an 8-year-old’s ability to change their mind, genuine Fed pivots are rare. As we navigate 2024, there are signs that some caution is warranted. The market’s unwavering confidence in the Fed’s ability to orchestrate a soft landing may be challenged by underlying economic realities.

Santa Claus

A few years back, I posed a question to my then 8-year-old: “Does Santa exist?” His response was eloquent and contemplative: “I want to believe.” It struck me as a mature and wise perspective— what is the harm in holding onto belief? If Santa exists, the world retains its magic; if not, what is the harm in cherishing the notion? Perhaps his reply was a form of FOMO (fear of missing out) or a desire for things not to change. As an investor, I have encountered similar sentiments over the past few decades—sentiments that have often served investors well, propelling many towards the best-performing equities and concepts of our time. These assets continue As we embark upon the new year, it seems fitting to discuss where we stand in the markets. Everyone seems inclined to believe that Jay Powell, Chair of the Federal Reserve, can steer the economy away from a slowdown with powerful declarations like “inflation is not a problem” or the ever-enticing “our policy has worked, so let’s continue believing.” Or even more plainly, “we can stimulate an economy that has just hit 5% GDP growth with sub-4% unemployment without significant risk of overheating.” Like my 8-year-old and Santa, as an investor whose client benefited from a tremendous move in asset prices in 2023, I want to believe in Jay Powell! Believe in what you might ask? Believe that a central bank can manipulate asset prices without consequences. Personally, I see no harm in believing in Santa. However, I also believe that over time, the cost of suppressing economic reality breeds a dangerous conviction that the economy is impervious to the implications. If the 2008 housing crisis taught us anything, it is that continual government and policy support for an asset breeds speculation in that asset. Perhaps that was tolerable for housing, constituting only 4% of the economy. But now, we are orchestrating a plan to reduce the real cost of borrowing, a factor influencing the entire economy. Interestingly, the repercussions from the housing crisis were enough to depress forward-twelvemonth S&P 500 earnings expectations to $61/share at the trough in April 2009, a level not witnessed since 2003 as the economy was emerging from another recession. When risk aversion seeps into the economy, the ramifications are challenging to fathom or predict. For context, S&P 500 earnings in 2007 were $94, underscoring how seemingly minor issues can snowball into major problems, even for an economy as diverse as the United States. What is intriguing about the current enchantment with the Fed is its ability to sway market sentiment with just a few words. It feels akin to the folklore of Santa Claus—how parents would warn, “At any moment, Santa can alter his judgment on whether you’re ‘naughty or nice’ and if you fall on the wrong side, coal lands in your stocking.” I never dared to test my parents’ conviction on that, and now anyone who has tested Santa (or rather, Powell) has felt the burn over the last few years. On the other side, investors who have consistently believed in the skills of the Federal Reserve to stabilize a bumpy economy have generally been rewarded. Most times the Fed has put its mind to stabilizing the economy it has worked. Believing in the Fed has served market participants extremely well over the past few years. In fact, this may be the reason the market is yet again expecting Powell and the Fed to bring us presents in the New Year. The issue I have with that expectation is that we might be pushing our luck. The market is so confident in the reflexivity of the Fed’s response, that it now rallies in anticipation of their actions, rather than as a function of their actions. But just like Santa to those who believe, like my 8-year-old, there yet seems to be no consequences.

Personally, I see no harm in believing in Santa. However, I also believe that over time, the cost of suppressing economic reality breeds a dangerous conviction that the economy is impervious to the implications. If the 2008 housing crisis taught us anything, it is that continual government and policy support for an asset breeds speculation in that asset. Perhaps that was tolerable for housing, constituting only 4% of the economy. But now, we are orchestrating a plan to reduce the real cost of borrowing, a factor influencing the entire economy.

A CHRISTMAS PIVOT

The ability to change one’s mind is commonplace for an 8-year-old, but genuine Fed pivots are rare.

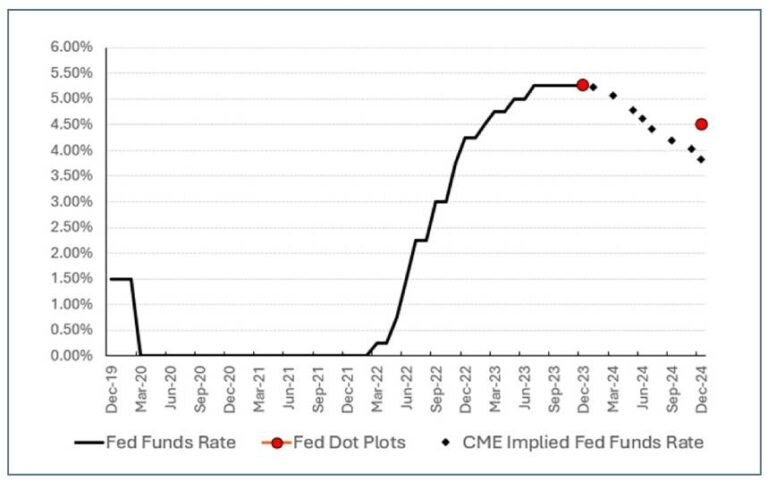

There have been only 20 or so pivots, swift shifts in rates from restrictive to accommodative within a short span, in the last 70 years. We recently witnessed one of the most abrupt pivots in market history. After robust economic and stock market performance, the Fed signaled a sudden change in the rate trajectory with the dot plots indicating a 25 bps and 50 bps drop in the December 2023 and December 2024 forecasts, respectively. It is worth noting that the market predicted this about six weeks before the Fed’s official announcement. The timing is uncanny, with the market anticipating the Santa Rally before the Fed.

Some instances of Fed pivots have yielded robust performance in risk assets, as seen in the significant pivot of 2020, and today the market expects a pivot coupled with a so-called “soft landing”, driving risk assets much higher as 2023 came to a close.

However, upon studying these pivots, a distinct pattern emerges among the successful ones. The market and the economy received “coal” the year preceding the pivot, characterized by exceedingly low starting valuations and unfavorable unemployment trends.

According to one metric, Market Cap/Gross Value Add, (effectively a modified version of the Buffet rule of market cap relative to GDP) successful pivots have occurred when market valuations were significantly depressed.

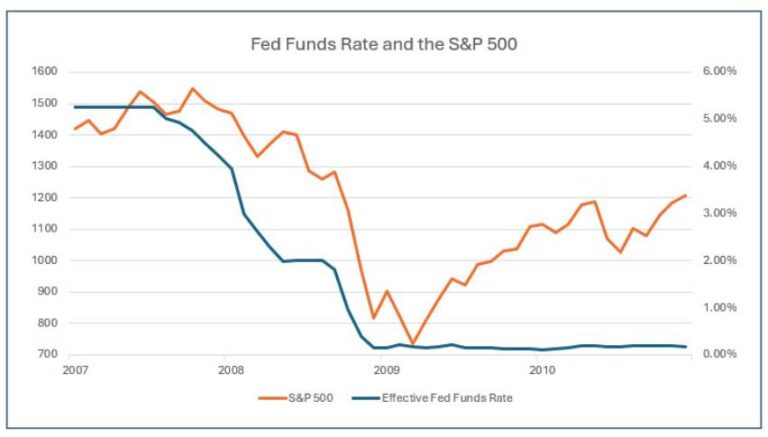

However, in other pivots, the Fed has not had quite enough in the tank to keep the economy and the markets from tipping over. For example, while the Fed pivoted in late 2007, it would prove too late.

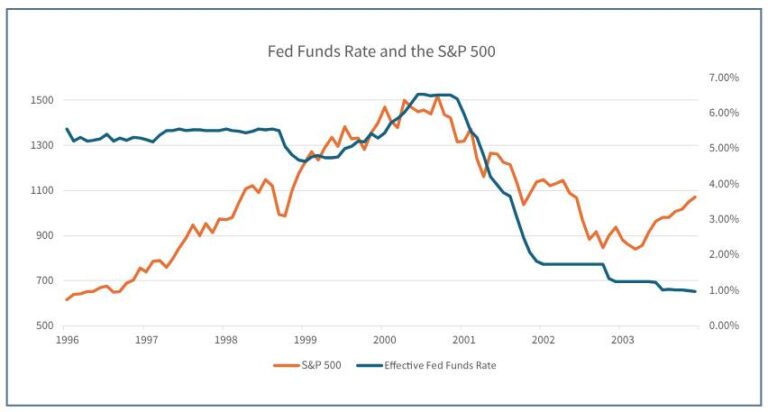

In another example, the Fed pivoted sharply in late 2000, yet the economy would have sluggish growth for another two years, with the market not bottoming until 2002.

Today, the signal from the pivot is unclear, and therein lies our problem. We wish to believe that there are no repercussions to sudden Fed pivots aimed at averting market and economic slowdowns. However, our intuition suggests otherwise.

A MARKET THAT WANTS TO BELIEVE

The market, judging by its remarkable performance last year, particularly in Q4, believes that we are on the brink of a “favorable” pivot. As we entered recessions in 2000 and 2007, the Fed continuously slashed rates, yet the market took nearly 18 months or more to reach its lowest point. So, why does the market place more faith in Santa Claus today than it did in those periods?

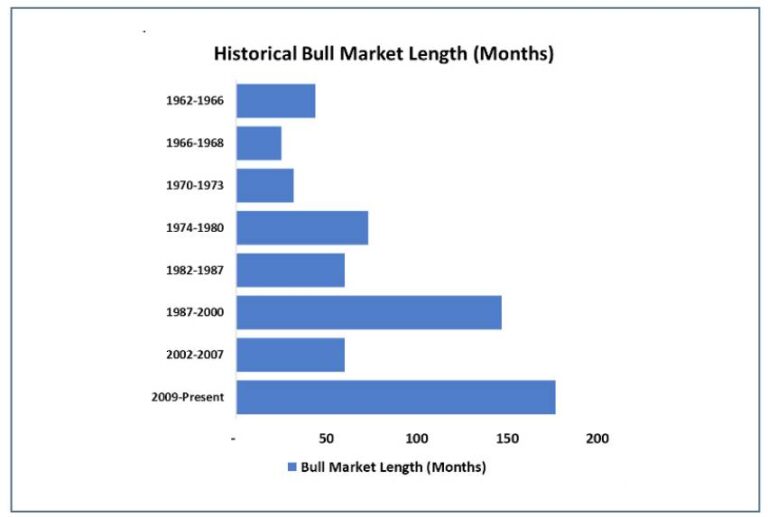

I wish I could pinpoint the exact reason. However, my intuition tells me that recency bias and conditioning play a significant role. Over the last 15 years, the market has invariably thrived when the Fed initiated a loosening cycle or adopted a more dovish stance. As a result, it has been better to believe in Santa and risk being wrong, than the alternative.

Indeed, we have witnessed a unique event—we are currently in the longest business cycle on record (the COVID slowdown is removed due to its swift reversal).

For those entrenched in market financing, the only rate that truly matters in capital markets is the risk-free rate minus inflation, often referred to as the real rate. It is akin to candy for my kids—enough to excite them and instantly turn around any misbehavior, but often leading to a crash within hours.

The Fed understands this dynamic, which is why they are increasingly prompt in responding to economic slowdowns with their version of “candy”—lowering real rates. The Fed, much like a parent, is offering treats quicker as market behavior becomes more entwined in capital market pricing.

As any parent of young kids understands, rules can be broken, especially in emergencies. For instance, in church, a bit of screen time or a piece of candy might pacify a restless child, constituting an “emergency”. This parental tactic resonates with me. However, while I concurred with the Federal Reserve’s decisions post-2008’s dire moments, I question the prudence of constantly appeasing the economy with “candy” to alleviate momentary “pain.”

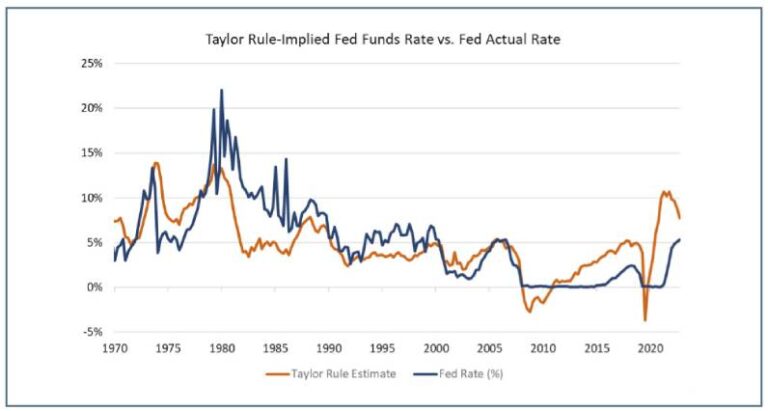

Comparing the Fed funds rate versus the Taylor rule, a proxy for the appropriate Fed funds rate (or the amount of “candy” in the economy), leads to a straightforward conclusion: there has been more “candy” in the market now than in any other period, and it is extreme. The chart below shows this stark contrast: in the late 1980s the Fed was tight, and arguably overly restrictive; during the 1990s and 2000s the Fed was generally balanced; but recently, the Fed has been highly accommodative most of the time.

This candy has led the market to be at ease. Over the last few months most leading economic indicators were softening, some at an accelerating rate, but now the market is anticipating a reversal in this data. Nearly every market measure of complacency suggests Fed success is consensus with the Greed/Fear index firmly in the greed range.

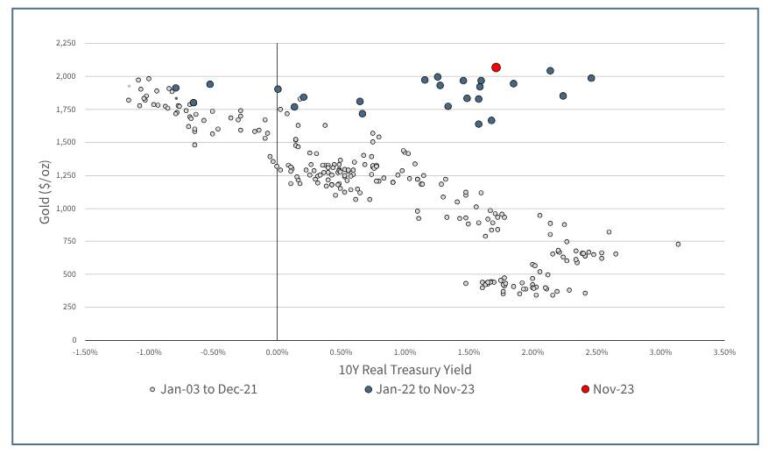

Are there any doubters of Santa or of a central banks’ ability to solve most crisis with a few words? It does appear that the dramatic change in the price of gold relative to treasury yields is an indication that a few investors are looking for protection by buying this off-the-run asset.

WISDOM OR MADNESS OF THE CROWD?

You may ask, what should I deduce from all of this? The question now is whether the market is correct and why this Fed pivot might be different from other late-cycle pivots.

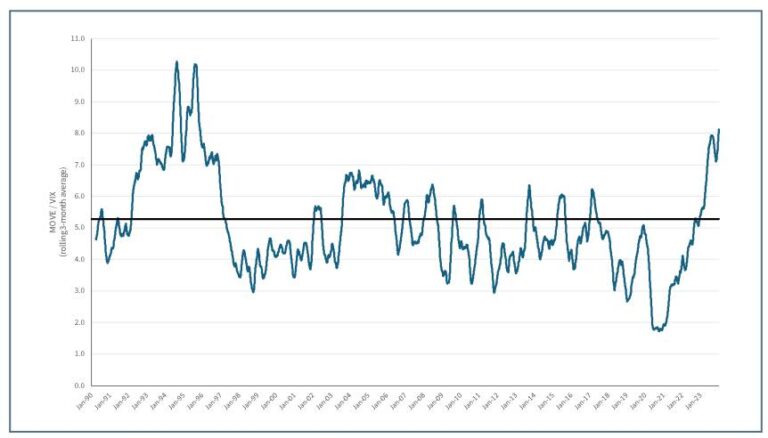

Interestingly, the bond markets do not appear as sanguine as the equity markets. The divergence in outlook is shown clearly by the relative changes in the MOVE index (a measure of interest rate volatility) and the VIX index (a measure of equity

market volatility). Expected volatility in the treasury markets remains elevated while expectations in the equity markets remain below the long-term average. The bond markets are far less certain that a Fed pivot will be the candy the market needs.

It is also worth noting, this divergence has historically closed with the VIX converging to the MOVE, or in other words, the bond markets are usually more correct.

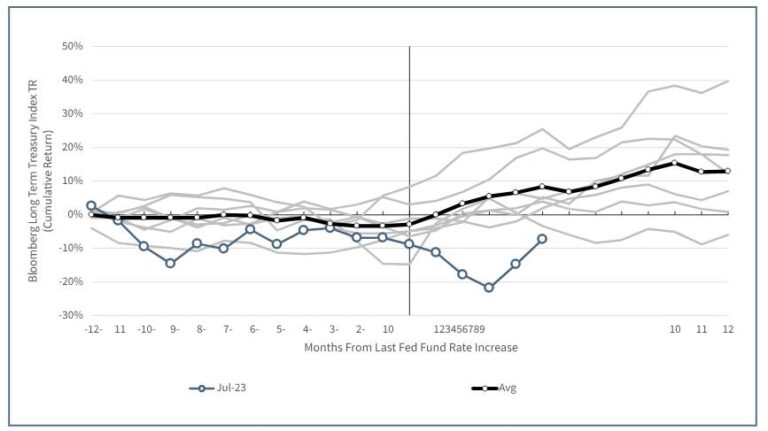

Another signal from the bond markets; long-term rates typically fall after the last rate increase of a Fed tightening cycle. That was not initially the case, with the term premium rising and long-term Treasury prices falling, due in part to factors outside Fed control. However, the pattern reemerged in late Q4 with falling long rates.

Foreign Treasury demand has trended lower while the supply of Treasuries is expected to increase. Lower demand has been driven by the desire of foreign central banks to diversify reserves while slowing China exports results in fewer US dollars to recycle. The increasing budget deficit, in part due to increasingswelling interest payments, is expected to result in increased Treasury auctions across maturities. Our hunch from the increased supply in treasuries and the reduced demand from foreign banks is that risk premium on treasuries will be slightly higher than in the past decade.

Additionally, the pivot comes despite strong GDP growth and a resilient labor market as CPI remains above the 2% target, raising the potential for renewed inflationary pressure.

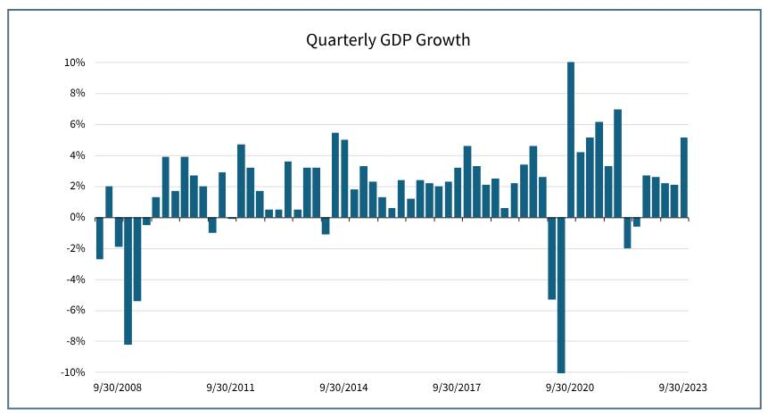

Q3 real GDP grew at over 5%, incredibly robust performance for a late cycle economy.

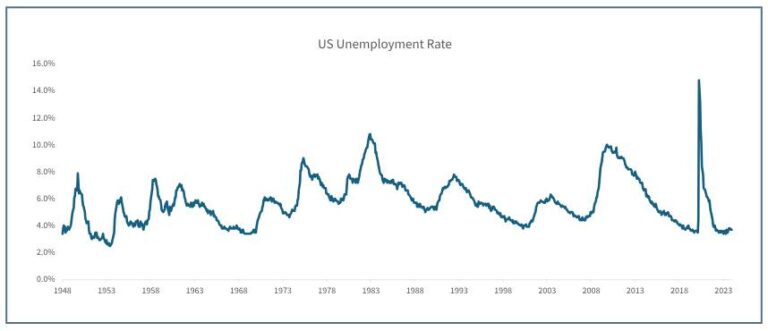

The labor market has remained resilient, with unemployment still near historical lows …

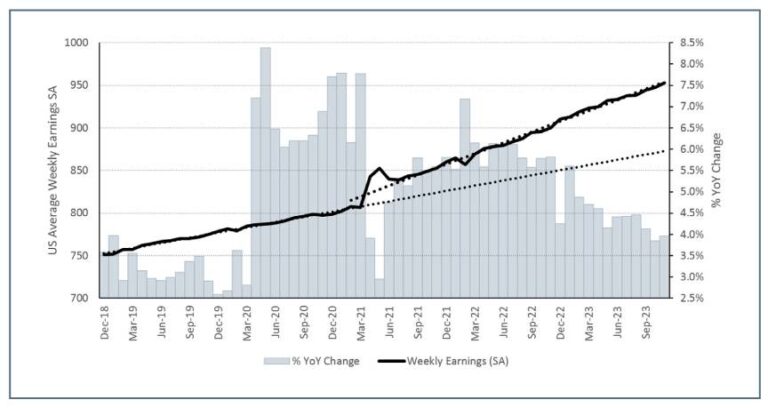

… with wage growth near 4%.

According to forward forecasts, the market believes we are going to see six rate cuts in the next six quarters. To us, something seems awry here; robust economies typically should not require such rapid stimulus to recalibrate themselves.

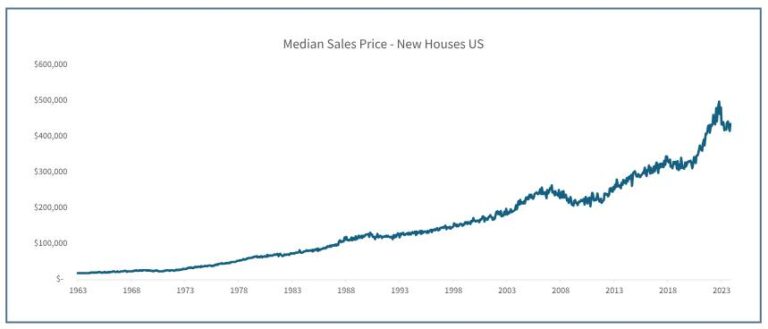

On the one hand, CPI has eased, rising just 3% YoY in November with a 4% core CPI print. However, it is not clear the inflation cycle has ended. One data point shows housing prices, a large component of the index, recently turned higher.

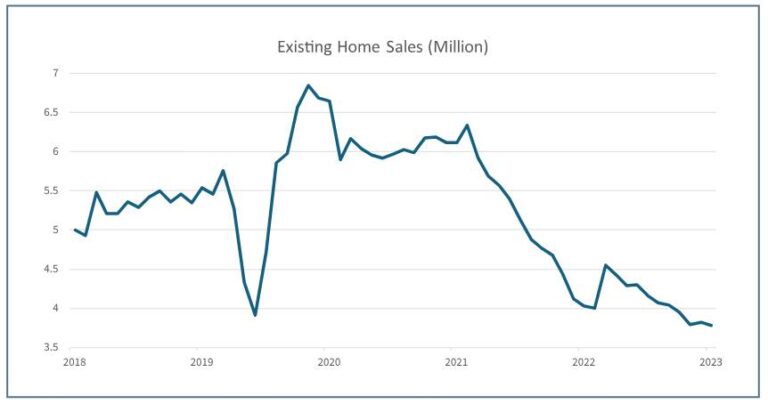

Historically, higher rates have impacted housing activity, and the resilience of prices might reflect the lack of transactions for measuring pricing.

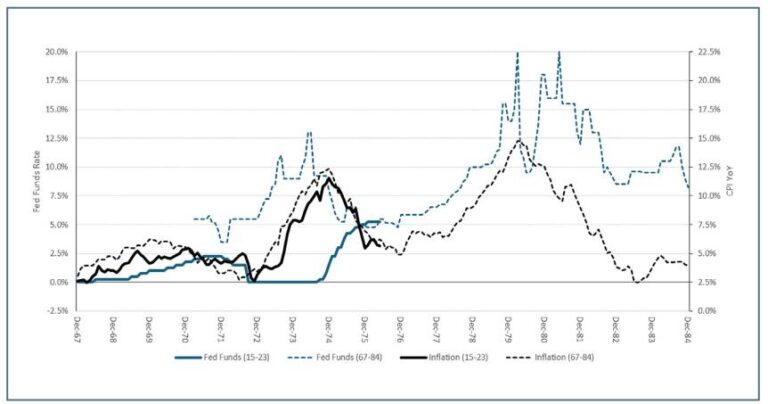

In fact, the inflation cycle to date looks eerily similar to that of the 1970s. The Fed proactively cut rates as the first inflation wave was cresting only to be followed by a second higher wave that triggered a reversal to even tighter policy (the Fed funds rate peaked at 20%) and a recession. We’re not saying history will repeat, but we know it can rhyme and so does the Fed.

In this sense, a loss of faith in the Fed is an existential risk. We don’t know if, when or why markets will stop believing, but there is the potential for seemingly unrelated events to have an outsized impact on markets if they turn greed into fear.

And importantly, not all is cured by a Fed pivot, even if one happens as quickly as markets expect. Although consumption has been strong, there are signs of consumer weakness. Unlike previous recessions, US household excess savings rose at the start of the 2020 recession due to fiscal programs. While those savings have supported the economy, they are nearly spent. The rate of change here is dramatic and if there is economic pain in the next year, this is potentially the source.

The resumption of student loan payments could further pressure spending. The Department of Education reported that 9 MM student loan borrowers (40% of 44 MM) missed their 1st payment (due mid-November) after the end of the pandemic-related pause.

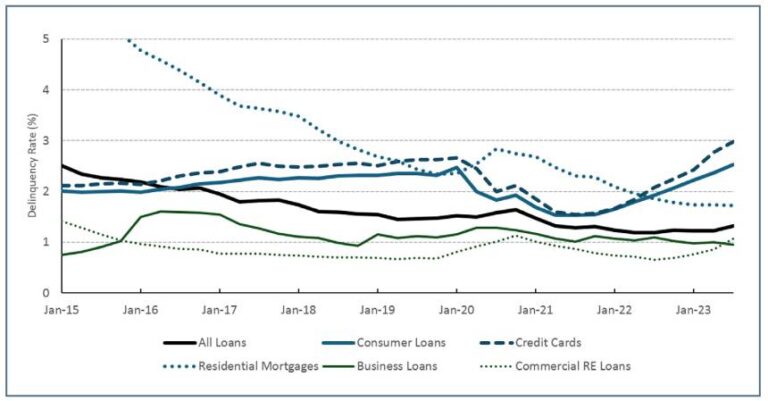

Consumer cracks are beginning to show. Credit card debt servicing as a percentage of income rose to the highest level since 2008 while consumer loan delinquencies are trending higher.

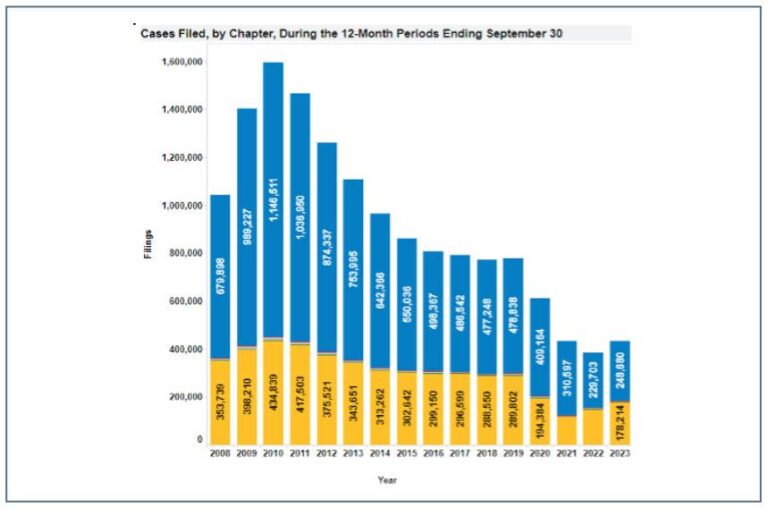

Corporate defaults have been rising quickly

Chapter 11 filings have turned higher.

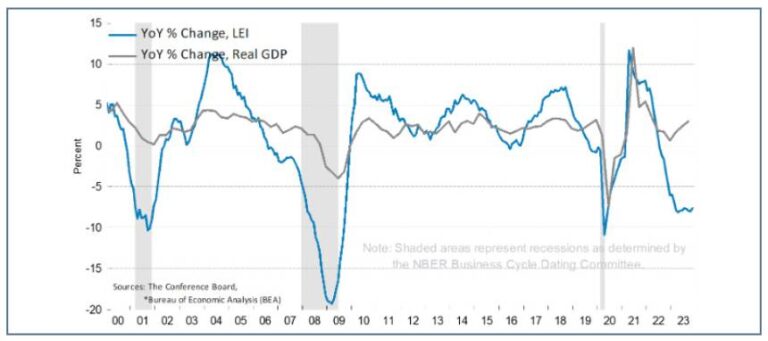

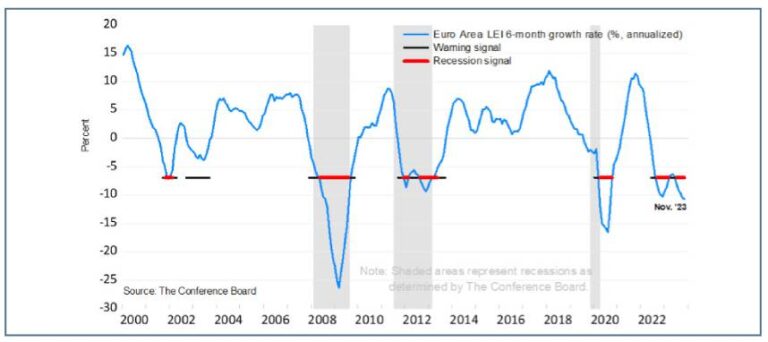

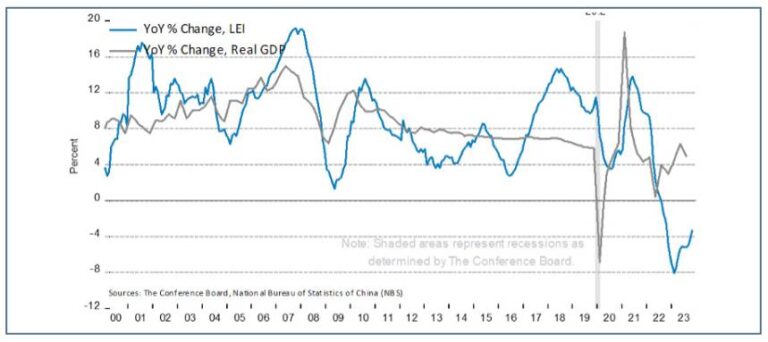

Leading indicators have shown signs of rebounding in China and the US, but remain weak globally, and have gotten weaker in Europe.

When investors lean towards speculation, their actions tend to lack discrimination and conviction. This implies a tendency to move all assets in a similar direction with the potential for sharp reversals. Today, measures of volatility, equity prices and credit spreads all convey the same message: “Keep calm and carry on,” even though the economic data doesn’t support that same view.

This positivity feels indiscriminate to us. When one considers the potential domestic headwinds today, the fact that the second and third largest economies, Europe, and China, are in a recession, one of the US’s major assets, the office sector, is in forbearance, and numerous long-term private equity assets are either frozen or at least delayed in returning principal, this could leave indiscriminate investors mispositioned.

If this recent spike in inflation is a much shorterterm phenomenon and as a result, is now truly defeated, and the Fed brings rates down as markets expect, equity multiples can remain elevated and credit spreads narrow vis-à-vis historic long-term averages. To be clear, we hope the markets are right. However, at these levels of valuation and extreme positioning, one needs to have faith in a near-omnipotent force capable of supporting capital markets and economies.

WHAT IF THIS TIME IS NOT DIFFERENT?

Our ultra-high-net worth policy portfolio, primarily geared for the ultra-high net worth client, is developed for resilience, durability and endurance to perform across multiple economic outcomes, with strategic targets based on longrun expected returns across asset classes, rather than the short-term speculation around Fed policy. Our objective as it relates to balance sheet positioning for our clients is to protect our clients irreplaceable wealth, and then grow it on a tax efficient manner. As a result, we remain fully invested across policy asset classes.

We place our trust in the skill and wisdom derived from a bottom-up analysis and investment approach to identify potential value-add exposures in the event that this time isn’t different. In uncertain times, we look to where the market offers investors value, and today we believe there are several intriguing themes.

Global Equities

Our global equity targets remain in line with historical levels, giving investors exposure to positive economic outcomes, growth and falling real rates should the Fed pivot prove successful. We believe valuations matter over the long-term, and our specific geographic focuses within the global equity space continue to be informed by that bias. As a result, we are growing optimistic on emerging economies in specific cases.

Within Domestic Equity markets, we have seen several trends that warrant consideration in 2024:

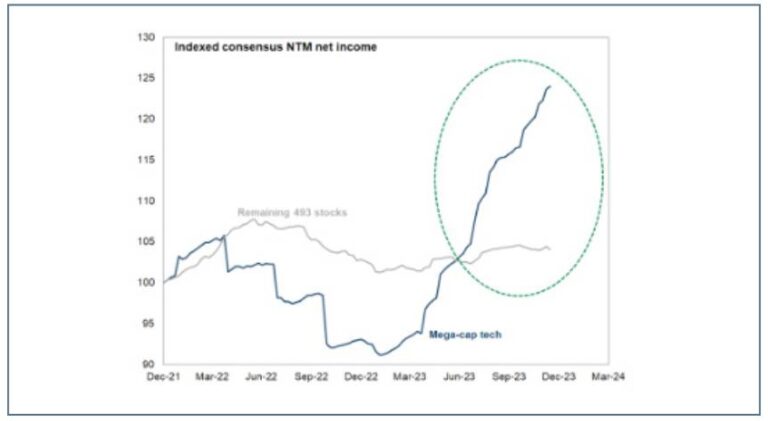

- Mega-cap technology firms (the Magnificent Seven or M7) have supported the market and are expected to have a blowout year for earnings in 2024 as demand for AI, networks and consumption continue to support growth. While we continue to believe the sector benefits from positive long-term digitization and AI trends, current expectations may be difficult to fulfill in the short term. Meanwhile, valuations for non-M7 stocks are more interesting, but the consensus outlook is much less rosy. Given that the M7 account for nearly 30% of the S&P 500, passive domestic equity exposure is highly exposed to the idiosyncratic risks of these firms.

- As we move away from financial-centric stimulus (e.g. lower rates), we believe the economic cycle will move to a more fiscal-centric economy. As a result, we are exploring themes of larger fiscal government, such as beneficiaries of the Inflation Reduction Act, CHIPS Act, or whatever the government has in store for the economy next.

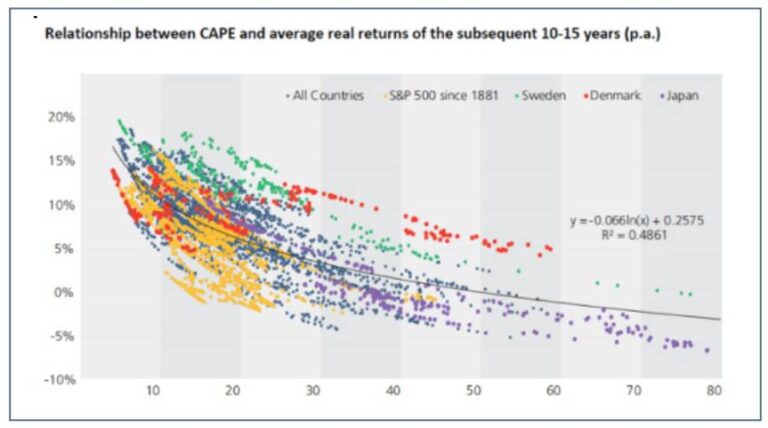

- Today’s domestic equity valuations as measured by Shiller’s P/E are relatively high (sitting at 32x as-of year-end). The chart below highlights subsequent real returns at different valuations, and it is obvious the higher the valuation, the lower the expected returns. If history is a guide, with CAPE north of 30x, expected returns are lower than they have been in several years. The result to us is a relative unattractiveness of broad domestic equity compared to alternatives.

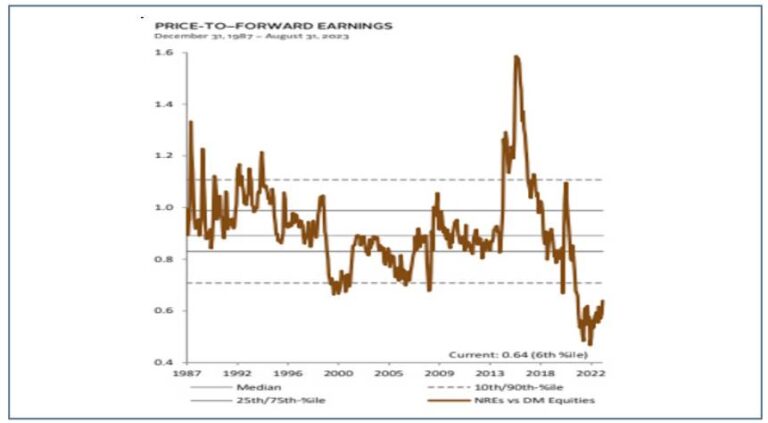

Inside International Equity markets, we have spent a considerable amount of time researching emerging markets, which have been the laggers over the past. The below chart is a quick highlight as to why– valuations in emerging economies are historically cheap compared to developed markets. There are a host of reasons why this may be, and we believe it is our job to determine whether this is justified or makes for an attractive investment opportunity.

We anticipate limiting new commitments to Private Equity until the uncalled capital overhang starts to clear, which would require the IPO market to reopen. There are signs we are in the early stage of thawing, but it is unlikely to fully open in the near-term. That said, we are continuing to see potentially interesting investment opportunities, and will continue to bring these to client attention as they arise.

Global Equities

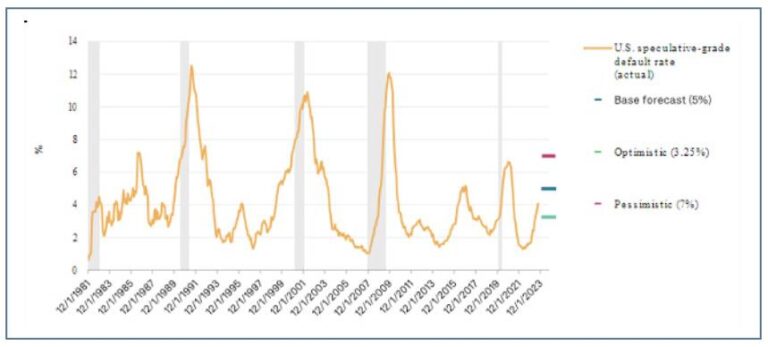

As we enter what appears to be the beginning of a new default cycle, we are seeing several dislocations within Global Fixed Income and opportunities to generate strong returns on a contractual basis. These dislocations suggest a bias towards quality and real asset lending. As rates have increased along the treasury curve, we have been increasingly positive on Sovereign Debt and have recommended laddered duration to take advantage of higher rates along the curve.

US Treasuries and Agency debt are yielding north of 3.8% along each point of the curve and above 4% over the near-term and longterm parts of the curve. Although down since peaking in October, rates remain at highs since 2008, giving investors material risk-free returns.

US Municipal bonds have tax equivalent yields north of 7% in some vehicles, making for incredibly attractive returns in tax-conscious accounts. In particular, we have identified several closed end funds trading at material discounts to NAV, giving cheap exposure to Muni yields, with the potential for incremental upside.

Meanwhile, we are underweight public Corporate Debt, given the current level of credit spreads in the public markets.

At these spread levels, both Investment Grade and High Yield credits have only outperformed treasuries in benign economic environments. It is our view that investors are not being appropriately compensated for credit risk in the public credit markets, making for a relatively unattractive investment unless the Fed is successful in engineering a soft landing.

A default cycle appears to be starting, with higher rates and slowing growth affecting a broad number of companies. The amount of debt outstanding is significant, and even with a Fed pivot, rates are expected to remain high enough to present problems for a meaningful number of firms.

That said, according to a number of investment managers we have talked to, the credit markets are safer than they were several years ago, as higher rates and the COVID slowdown have cleared out risky firms. Meanwhile, the Fed pivot may provide breathing room for firms to refinance, which would be augmented by a potential increase in activity at attractive spreads.

Conversely, we are overweight Private Credit, to tactically take advantage of more attractive spreads and the default cycle through managers with experience in distressed investing.

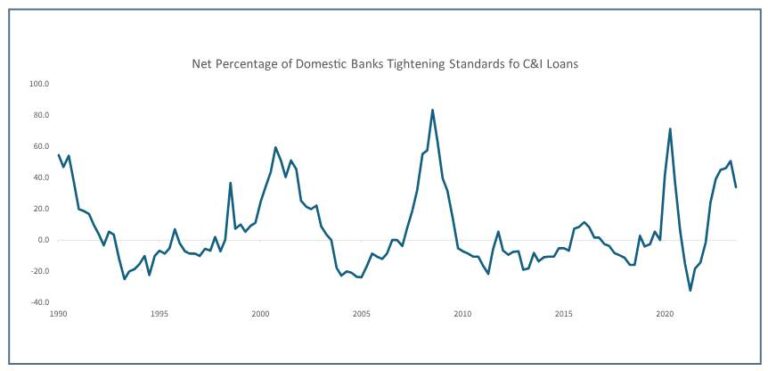

We are exploring niche opportunities created by the slowdown in bank lending, prompted by balance sheet issues and regulatory changes in the banking industry. For instance, the senior loan officer survey, which gauges banks’ propensity to take balance sheet risk, has reached recessionary levels, signifying a significant decrease in lending. We have met with numerous credit managers claiming to be beneficiaries of banks exiting lending, although we remain cautious, as not all may be successful. However, a few of these opportunities align with our research team’s assessment.

Real Assets

Given recent trends in inflation and geopolitics, we are strategically more interested in real assets than we have been historically.

Broadly, Commodities are trading near 50-year lows on relative valuation, while supply forecasts are constrained, pointing towards what would historically be a positive setup. The one concern, the largest buyer of commodities the past 15 years, China has an economy that is slower than forecast and appears on the verge of tipping into a protracted recession.

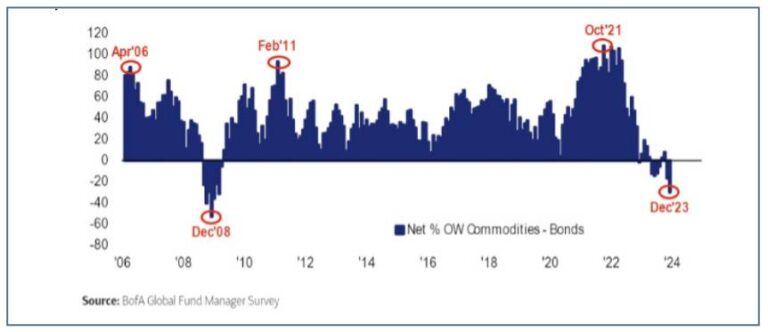

Contrarians take note, according to the BofA survey of market participants, record tilt to overweight bonds vs overweight commodities.

ESG investing policy and the energy transition have created opportunities to invest in fossil fuel assets (which are expected to remain critical for intermediate- to long-term base load energy needs) at an attractive discount. We have identified several potential vehicles for this exposure and will be bringing them to clients as they materialize.

As geopolitical pressures have increasingly localized production, we are increasingly interested in identifying attractive agricultural exposure. This is an area in which our clients are generally underexposed, particularly compared to metals and energy assets, and will be a target focus in 2024.

Meanwhile, within Real Estate we remain relatively neutral from a policy perspective but have met with a number of allocators and sponsors over the last year with compelling strategies supported by capital imbalance tailwinds, such as affordable housing construction and mortgage servicing rights. As liquidity and interest permits, we will continue to make these available to clients for consideration.

Finally, we are increasingly encouraged by some long Carry and Volatility trades. Each has its own idiosyncratic attributes, but each makes intuitive sense to us. Equity volatility is in the 1st percentile of its historical distribution, suggesting more room to rise than fall.

within Real Estate we remain relatively neutral from a policy perspective but have met with a number of allocators and sponsors over the last year with compelling strategies supported by capital imbalance tailwinds, such as affordable housing construction and mortgage servicing rights. As liquidity and interest permits, we will continue to make these available to clients for consideration.

CONCLUSION

The Fed signaled a sudden change in the rate trajectory at the December FOMC. Historically, pivots have been in response to economic or market weakness, characterized by exceedingly low starting valuations and unfavorable unemployment trends.

That is not the case now, with the pivot coming against a backdrop of robust economic and stock market performance. Yet markets have reacted positively, indicating a belief the Fed can manufacture a soft landing. While we do not know if this time will be different, we want to be positioned in case it isn’t.

MEMORANDUM DISCLOSURES & DISCLAIMERS

This Memorandum is confidential and may contain legally privileged and proprietary information of Twin Focus Capital Partners LLC (“TwinFocus”). It is intended solely for the use of the Recipients to which it is addressed. If you are not the intended recipient, you are hereby notified that any dissemination, copy, disclosure, use or action taken based on this Memorandum is strictly prohibited and may be unlawful. If you received this Memorandum in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy.

This Memorandum may not be otherwise redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the express written consent of TwinFocus.

Investments involve numerous risks, including, among others, market risk, counterparty default risk and liquidity risk. In some cases, securities, strategies and other financial instruments may be difficult to value or sell and reliable information about the value or risks related to the security, strategy or financial instrument may be difficult to obtain. Income from such securities, strategies and other financial instruments, if any, may fluctuate and the price or value of such securities, strategies and instruments may rise or fall and, in some cases, investors may lose their entire principal investment. Foreign currency rates of exchange may adversely affect the value, price or income of any security or financial instrument mentioned in this Memorandum. Investors in such securities and instruments effectively assume currency risk.

Hedge fund and other alternative investments are generally unregulated and considered inherently very risky and you can lose material portions of your principal in very short periods of time. Prior to making any investments in any hedge fund managers and alternative investment strategies, you should thorough review all subscription documents and confidential offering memoranda provided by the managers/strategies, paying particular attention to the risk disclosures. You should not invest in such managers/strategies if you are not thoroughly comfortable with these risk disclosures or do not understand and/or appreciate the increased levels of risks associated with such strategies. Additionally, this Memorandum may provide information regarding private funds/strategies/investments which are exempt from registration under the Investment Company Act of 1940 pursuant to Section 3(c)(1) and/or 3(c)(7) which were offered as private placements in reliance on Regulation D of the Securities Act of 1933. Each individual fund/ strategy and NOT TwinFocus shall have the sole responsibility for (i) formally qualifying prospective investors to ensure they meet the suitability criteria to invest in each relevant fund/strategy and, once qualified, (ii) sending the formal offering documents and other materials to each prospective investor.

Any information relating to the tax status of financial instruments and/or strategies discussed herein is not intended to provide tax advice or to be used by anyone to provide tax advice. Recipients are urged to seek tax advice based on their particular circumstances from an independent tax professional.

Any waiver by TwinFocus of any section of this Memorandum Disclaimer Statement should not be construed as a general waiver of any other section and/or the entire Memorandum Disclaimer Statement.

The information, including but not limited to forecasts and estimates, in this Memorandum was obtained from various sources and TwinFocus does not guarantee its accuracy. Although the information contained in this Memorandum is from sources believed to be reliable, no representation or warranty, expressed or otherwise, is made to, and no reliance should be placed on its fairness, accuracy, completeness or timeliness.

This Memorandum may contain multi-year financial pro forma planning projections, predictions, return assumptions, as well as other financial, legislative, statutory and client balance sheet assumptions that are for illustrative purposes only and no representations or warranties, expressed or otherwise, are made to, and no reliance should be placed on their fairness, accuracy, completeness, or timeliness.

Past performance is not indicative of future results and there can be no assurance that the future performance of any specific investment, investment strategy, or product will be profitable, equal any corresponding indicated historical performance level(s), be suitable for client portfolios or individual situations, or prove successful. Due to various factors, including changing market conditions and/ or applicable laws, the content may no longer be reflective of current opinions or positions. As such, all opinions, projections and estimates are as of the date of the Memorandum and are subject to change without notice. TwinFocus is under no obligation to update this Memorandum and Recipients should therefore assume that TwinFocus will not update any fact, circumstance or opinion contained in this Memorandum unless specifically requested. TwinFocus and any director, officer or employee of TwinFocus do not accept any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this Memorandum or its contents.

This Memorandum may contain current opinions of third-party authors and not necessarily those of TwinFocus. Such opinions are subject to change without notice.

This Memorandum may contain references to market indices. Such information is presented to show general trends in certain markets for the periods indicated and is not intended to imply that the strategy(s) discussed and/or reviewed are similar to the indices either in composition or element of risk. TwinFocus does not make any representations as to whether the indices may or may not be unmanaged, not investable, have any expenses and may or may not reflect reinvestment of dividends and distributions. Index data is provided for comparative purposes only. A variety of factors may cause an index to be an inaccurate benchmark for a particular portfolio/manager/ strategy and the index does not necessarily reflect the actual investment strategy of the portfolio/ manager/strategy discussed and/or presented in the Memorandum. Current period returns may be estimates. Actual index returns and/or estimates are calculated and presented to Twin Focus through third party software providers and as such, may differ from the final figures produced by the index provide.general waiver of any other section and/or the entire Memorandum Disclaimer Statement.