Certain Uncertainty – Tariffs Kicking Off The Trump Presidency

“In order to be a successful gambler you have to have a complete disregard for money.”

-Doyle Brunson

Our research team spent a good deal of time talking about the ramifications of the last few days, the implications of tariffs, and possible changes to our outlook and recommendations.

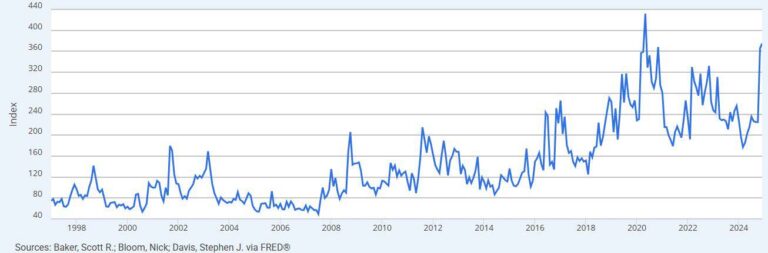

Our only clear takeaway is that policy uncertainty is higher today than it was 90 days ago. Given the volatility that accompanied the last Trump presidency, this should sound like common sense, but it has been cemented over the last 72 hours.

Sources: Baker, Scott R.; Bloom, Nick; Davis, Stephen J. via FRED

On February 1st, President Trump fulfilled a campaign promise and announced tariffs against our three largest trade partners, albeit at tempered rates, and not as broad-based as he proposed during the election, including:

- 10% on energy and 25% on everything else from Canada;

- 25% on everything from Mexico; and

- 10% additional tariffs on goods from China.

In quick response in what appears to be an unexpected move by the administration:

- Canada announced retaliatory 25% tariffs on spirits, fruits and juices, and household goods;

- Mexico promised it would also retaliate;

- China announced it was filing a complaint with the WTO and threatened countermeasures; and

- The EU also stepped in, threatening tariffs, citing the large trade deficit.

By the end of day on February 3rd, the Canadian and Mexican tariffs were delayed 30 days. Trump may have achieved one of his goals of leveraging the US economy for geopolitical ends, although the longer-term geopolitical implications are uncertain.

We asked ourselves what comes next, and our view is that the broader answer is unknowable. This isn’t just because we don’t have a line to the White House, but once a poker hand is put in motion, it is impossible to predict what the rest of the table will do next.

Trump made a gamble over the weekend, educated to be sure, but anyone suggesting the acquiescence of Mexico and Canada was guaranteed is overly confident in our view, especially given their immediate reactions and counter-threats. These gambles are likely to continue, and although they may “work” (as we realize they have in the past), this is how we know policy uncertainty is the only definite outcome.

If the Tariffs do come to bear next month, what are the broader and longer-term market implications?

We have some precedent that is worth discussing – namely, when the US did the same thing in 2018.

Early that year, the US imposed tariffs on solar panels, steel, aluminum, and more across most countries, leading to an estimated $80B tax increase, or roughly half the $150B expected tariff revenue (Strategas) from the recent proposal. There were various negotiations, changes to which countries and products were affected, and lawsuits, but at the end of the day the result was lower imports, particularly a result of decreased trade with China, higher prices, including less expected places like food, and economic growth that studies show either declined or did not improve relative to a non-tariff environment. Were these the expected policy results?

The magnitude of impact can be debated, and the merits of them as a political tool are also open for debate, but the broad consensus of research we have reviewed highlights higher real prices, lower real income, increased risk of recession or at the very least, slower economic growth. Tariffs impact domestic consumers and the domestic economy, while benefiting domestic exporters.

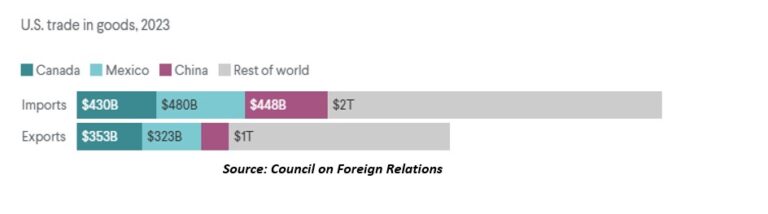

Regarding the recently announced tariffs, below are some recent statistics for consideration:

- ~50% of all US imports are from Canada, China and Mexico;

- Canada is ~17% of U.S. imports, and the U.S. represents ~78% of Canada’s exports, largely in pharmaceuticals, steel, and auto parts. One estimate suggests that auto parts move across the US’s northern border five times before reaching the end consumer;

- Mexico is ~16% of U.S. imports, and ~78% of its exports are to the U.S., largely in automobiles and petroleum; and

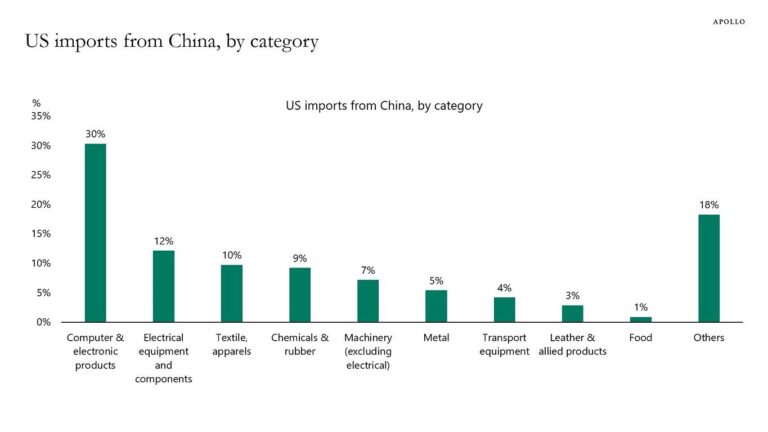

- China is ~14% of U.S. imports, and ~15% of its exports are to the U.S., which is much lower of late due to prior tariffs as it shifted trade to the EU, Mexico, and Vietnam (potentially circumventing the last round, rendering tariffs even less effective and more distortive).

Meanwhile, economists have come out with varying projections, though directionally the same, generally speaking:

- Economists project that the proposed tariffs could reduce economic output by 0.4% to 1.2% (Bloomberg, TaxFoundation)

- U.S. imports could decline by as much as 15% (Bloomberg).

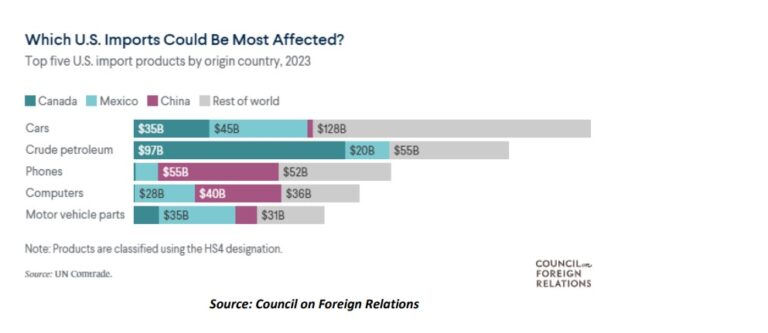

- Without exemptions, prices will rise significantly in foods (Mexico supplies ~60% of our fresh produce and ~50% of our fruit and nuts), energy (which is ~6.4% of the CPI calculation), and autos and parts which are also ~6.4% of CPI. This assumes importers will pass higher tariff costs to the ultimate domestic consumer.

- Expectations for a Fed cut have fallen materially (largely due to above expectation for higher prices), with expectations for a March cut falling from 31.5% to 15.5% over the past week.

What is the trade?

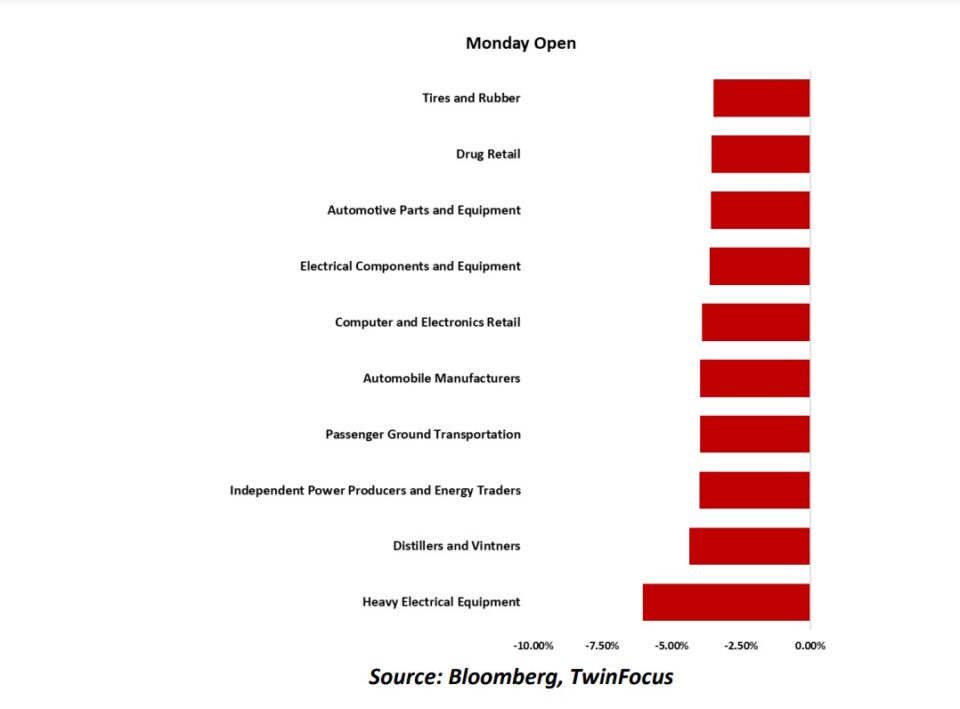

The market isn’t perfectly efficient, but it often offers us clues to look out for. In the case of the recent announcement, we looked at the average gap down at open of every S&P 500 industry.

The worst 10 are about what we would expect:

Autos and parts, electronics, distillers, drugs, all potential risks due to the tariffs.

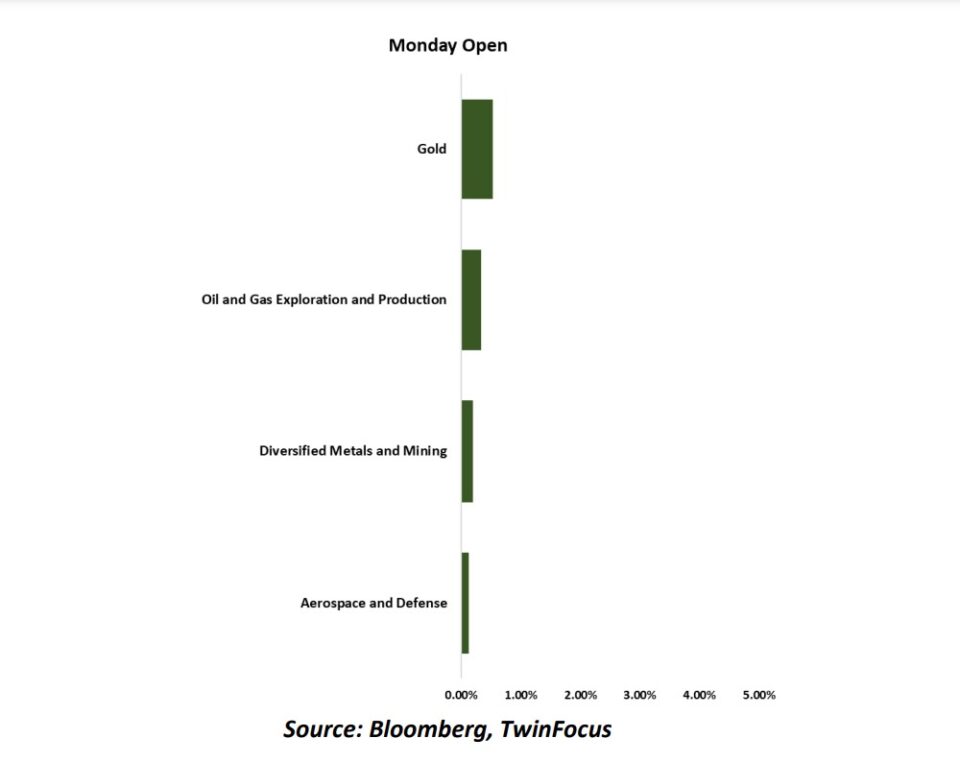

Only four opened in the green, a flight to safety and protectionism:

If we were confident in our ability to know the next phase of the plan, we might trade these themes accordingly.

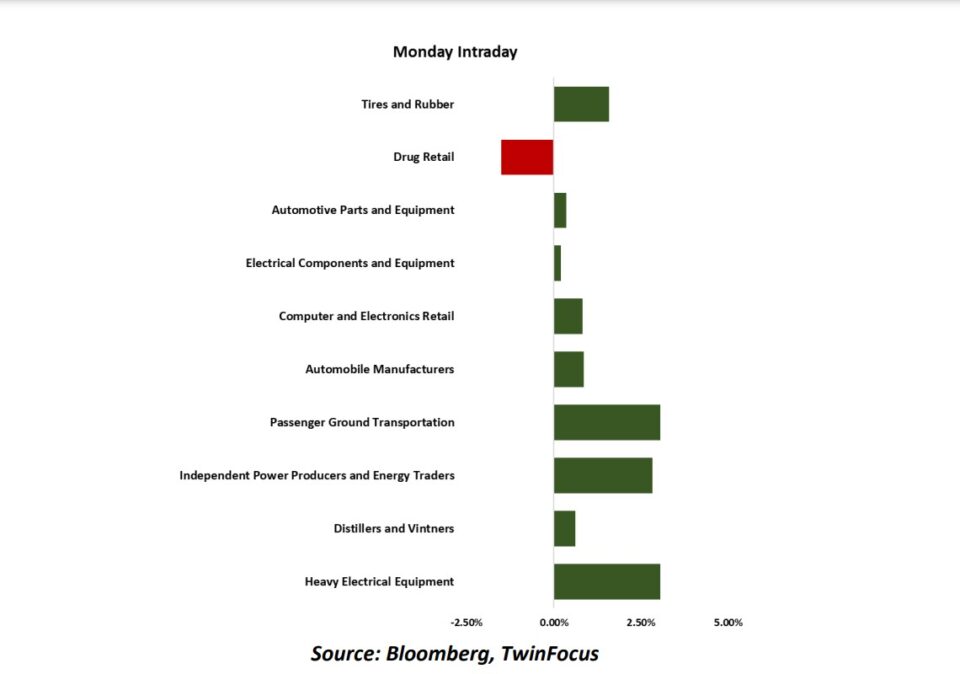

Unfortunately, we are in uncertain times, and as soon as the tariffs were delayed, most industries snapped back. The chart below highlights the returns from open until close for each of these industries on Monday. Only one continued to fall:

Concluding Thoughts: TwinFocus’ Portfolio Positioning Considerations

Over the last year, our team has focused on several key themes for broader portfolio positioning that are worth considering here. When we think about portfolio construction, we often look for where the market is offering value and only act tactically when there is significant probability on our side. Today, given uncertainty as a certainty, we do not have probability on our side, and defer to where the market is offering value:

• Rates have remained higher for longer than most expected, and we continue to see value in pockets of the fixed income market where spreads offer appropriate compensation for risk. With inflationary flames fanned by tariffs, we expect this to continue.

• On a related note, opportunities across broader commodities, including precious metals, continue to exist particularly if inflation surprises to the upside, and supply/demand remain imbalanced in the asset class.

• We have identified a number of liquid opportunities that perform well in higher volatility, higher inflation, higher rate environments, including places like trend following that outside of select years have fallen out of favor.

• Idiosyncratic trades with less (or no) sensitivity to economic growth continue to be attractive as diversification tools for portfolios.

Although it is clear that it is not business as usual, what is not clear is which gamble to take today. We are likely entering an environment that has higher volatility, and maybe lower growth, and we believe investors should position accordingly.

Memorandum Waivers & Disclaimers

This Memorandum is confidential and may contain legally privileged and proprietary information of Twin Focus Capital Partners LLC. It is intended solely for the use of the Parties or Entities to which it is addressed. If you are not the intended recipient, you are hereby notified that any dissemination, copy, disclosure, use or action taken based on this message or any information herein is strictly prohibited and may be unlawful. If you received this Memorandum in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy.

This Memorandum may not be otherwise redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the express written consent of Twin Focus Capital Partners LLC. This Memorandum should not be regarded by the Parties stated hereunder as a substitute for the exercise of their own judgment and they are encouraged to seek independent, third-party research on any strategies or economic outlook covered in or impacted by this Memorandum.

This information has been distributed for educational informational purposes only and neither the information nor any opinion expressed constitutes an offer or an invitation to make an offer, to buy or sell any securities, strategies or other financial instrument or any derivative related to such securities or instruments (e.g., options, futures, warrants, and contracts for differences). This Memorandum is not intended to provide personal investment advice and it does not take into account the specific investment objectives, financial situation and the particular needs of any specific person. All Parties stated hereunder should seek financial advice regarding the appropriateness of investing in financial instruments and implementing investment strategies discussed or recommended in this Memorandum and should understand that statements regarding future prospects may not be realized.

Securities, strategies and other financial instruments discussed in this Memorandum may not be insured by the Federal Deposit Insurance Corporation and are not deposits or other obligations of any insured depository institution. Investments in general and, derivatives, in particular, involve numerous risks, including, among others, market risk, counterparty default risk and liquidity risk. In some cases, securities, strategies and other financial instruments may be difficult to value or sell and reliable information about the value or risks related to the security, strategy or financial instrument may be difficult to obtain. Please note that income from such securities, strategies and other financial instruments, if any, may fluctuate and that price or value of such securities, strategies and instruments may rise or fall and, in some cases, investors may lose their entire principal investment. Foreign currency rates of exchange may adversely affect the value, price or income of any security or financial instrument mentioned in this Memorandum. Investors in such securities and instruments effectively assume currency risk. Additionally, before investing in any mutual fund strategies, it is recommended and emphasized that the Parties Stated hereunder should obtain and closely review prospectuses for those strategies before making any final investment decision.

To the extent this Memorandum discusses any legal proceeding or issues, it has not been prepared as nor is it intended to express any legal conclusion, opinion or advice. The Parties stated hereunder should consult their own legal advisers as to issues of law relating to the subject matter of this Memorandum. Any information relating to the tax status of financial instruments and/or strategies discussed herein is not intended to provide tax advice or to be used by anyone to provide tax advice. The Parties stated hereunder are urged to seek tax advice based on their particular circumstances from an independent tax professional. Any waiver by Twin Focus of any section of this Memorandum Disclaimer Statement should not be construed as a general waiver of any other section and/or the entire Memorandum Disclaimer Statement.

The information, including but not limited to forecasts and estimates, in this Memorandum was obtained from various sources and TwinFocus does not guarantee its accuracy. While the information contained in this Memorandum are from sources believed to be reliable, no representation or warranty, expressed or otherwise, is made to, and no reliance should be placed on its fairness, accuracy, completeness or timeliness. Additionally, this Memorandum may contain links to third-party websites. TwinFocus is not responsible for the content of any third-party website or any linked content contained in a third-party website. Content contained on such third-party websites is not part of this Memorandum and is not incorporated by reference into this Memorandum. The inclusion of a link in this Memorandum does not imply any endorsement by or any affiliation with TwinFocus.

The returns presented in this Memorandum are calculated in methodologies consistent with calculation methodology outlined in the Global Investment Performance Standards (GIPS®). However, Twin Focus does not claim compliance with GIPS®, nor have these returns been examined as part of a GIPS® verification or performance examination.

All opinions, projections and estimates are as of the date of the Memorandum and are subject to change without notice. TwinFocus is under no obligation to update this Memorandum and the Parties stated hereunder should therefore assume that TwinFocus will not update any fact, circumstance or opinion contained in this Memorandum unless specifically requested. TwinFocus and any director, officer or employee of TwinFocus do not accept any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this Memorandum or its contents.

This Memorandum may contain forward-looking statements within the meaning of the United States federal securities laws. Forward-looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters. For example, forward-looking statements may predict future economic performance, describe plans and objectives of management for future operations and make projections of revenue, investment returns or other financial items. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “believe,” expect,” “anticipate,” intend,” contemplate,” “estimate,” “assume,” or other similar expressions. Such forward-looking statements are inherently uncertain, because the matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond the Funds’ control. No representations or warranties are made as to the accuracy of such forward-looking statements. Past performance is no guarantee of future results. This Memorandum may contain current opinions of third-party authors and not necessarily those of TwinFocus. Such opinions are subject to change without notice.

This Memorandum may contain references to Market Indices. Such Index information which may be provided is presented merely to show the general trends in certain markets for the periods indicated and is not intended to imply that the strategy(s) discussed and/or reviewed are similar to the indices either in composition or element of risk. TwinFocus does not make any representations as to whether the indices may or may not be unmanaged, not investable, have any expenses and may or may not reflect reinvestment of dividends and distributions. Index data is provided for comparative purposes only. A variety of factors may cause an index to be an inaccurate benchmark for a particular portfolio/manager/strategy and the index does not necessarily reflect the actual investment strategy of the portfolio/manager/strategy discussed and/or presented in the Memorandum. Current period returns may be estimates. Actual index returns and/or estimates are calculated and presented to Twin Focus through third party software providers and as such, may differ from the final figures produced by the index provider.

Please note that all trading requests originated by the Client(s) must be communicated to TwinFocus through oral communications. Trade requests/instructions made solely in writing will not be accepted. Upon receipt of Client trading requests/instructions, TwinFocus will use best efforts to execute in a timely manner with respective custodians through the use of limit orders, stop limit orders, market orders and/or any other trading conventions that TwinFocus deems in its full discretion suitable to effectuate such trading requests/instructions. TwinFocus cannot guarantee that such trading requests/instructions will be executed within a certain period of time upon receipt of such trading requests/instructions from clients. TwinFocus will not be held responsible for any trading errors by the custodian to the extent such errors are not within the direct control of TwinFocus. Upon subsequent execution, the client will receive a written summary confirmation by TwinFocus via electronic mail.

Hedge Fund and other Alternative Investments are unregulated and considered inherently very risky and you can lose material portions of your principal in very short periods of time. Prior to making any investments in any hedge fund managers and alternative investment strategies, you should thorough review all subscription documents and Confidential Offering Memoranda provided by the managers/strategies, paying particular emphasis on the risk disclosures. You should not invest in such managers/strategies if you are not thoroughly comfortable with these risk disclosures or do not understand and/or appreciate the increased levels of risks associated with such strategies. Additionally, this Memorandum may provide information regarding private funds/strategies/investments which are exempt from registration under the Investment Company Act of 1940 pursuant to Section 3(c)(1) and/or 3(c)(7) which may have been conducted as private placements in reliance on Regulation D of the Securities Act of 1933 and/or other exemptions provided by pertinent federal/state securities laws. Each individual fund/strategy and NOT TwinFocus shall have the sole responsible for (i) formally qualifying Prospective Investors to ensure they meet the suitability criteria to invest in each relevant Fund/strategy and, once qualified, (ii) sending the formal offering documents and other materials to each Prospective Investor.

This Memorandum may be in the form of an encrypted PDF file. Twin Focus employs encryption technologies provided by the Adobe Acrobat software for this service. The purpose of encryption is to prevent unauthorized distribution of inherently personal and sensitive information, data and intellectual property. All of TwinFocus’s encrypted memoranda, presentations, and reports will be secured in this format unless otherwise stated. As this technology is owned by Adobe Acrobat and Twin Focus has no control over this technology or encryption methodology, Twin Focus will not be held liable under any circumstances on the product and any damages of any nature occurring as a result of malfunction of this technology. Additionally, for those clients who specifically request that Twin Focus not encrypt memoranda, reports and presentations, Twin Focus will not be held liable under any circumstances for damages, both direct and indirect, as a result of failure to encrypt this Memorandum as per the client’s request.

IRS CIRCULAR 230 DISCLOSURE: To ensure compliance with requirements imposed by the IRS, we inform you that any U.S. federal tax advice contained in this Memorandum (including any attachments, exhibits or addendums) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein.