Emerging Markets | China – Is This Time Different?

INTRODUCTION

On September 24, 2024, China announced a major stimulus package, its largest since the pandemic, pledging to ramp up fiscal support. The package aimed to address the country’s slowing economic growth and declining consumer confidence. Key measures included

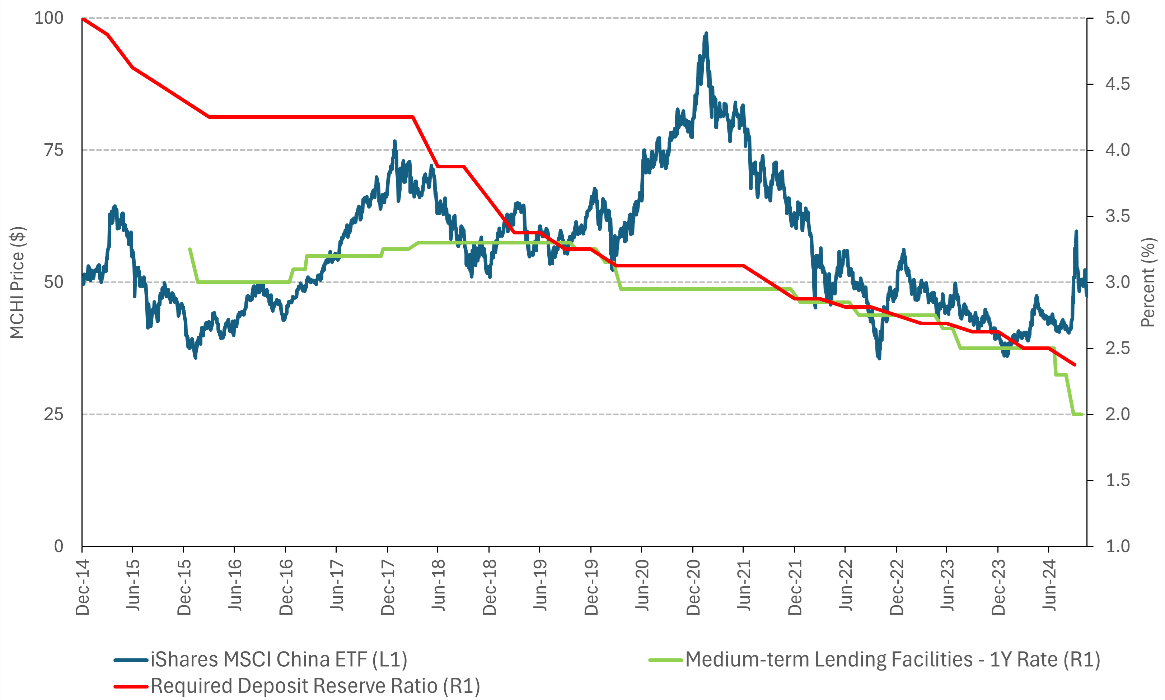

• Cuts to key lending rates and the reserve requirement ratio.

• Support for the equity markets, featuring a liquidity facility to assist companies and shareholders with stock buybacks.

• Direct aid for unemployed graduates and the introduction of a monthly allowance for children.

• Bond issuance to stimulate consumption, including subsidies for replacing consumer goods and upgrading business equipment.

• Housing market support, with the government purchasing housing supply through loans provided to developers, commercial banks and re-lending institutions.

Bloomberg described the stimulus package as a “sea change” in how China will manage its economy, with a greater focus on supporting consumer demand, rather than monetary stimulus which has historically only offered temporary support.

So, is this time different? Is the stimulus package China’s “whatever it takes” moment that changes the long-term view of investors?

ANALYSIS

The stimulus comes as China risks missing its official economic growth targets for the year. Companies are scaling back investments and consolidating operations in response to slower growth and shrinking profits, according to recent reports from the EU and American Chambers of Commerce.

China’s markets have been under pressure since regulatory changes in 2021, which included greater supervision of ride hailing companies and firms listed outside the country along with new rules for afterschool tutoring firms. These actions came after China had passed a data-security law that gave the state more power to compel private-sector firms to share data with authorities and controls/limits data that can be sent overseas and several technology giants (including Alibaba, Tencent and Meituan) were cited for violations, including inconsistent pricing, working conditions and data security, and ordered to conduct internal reviews and rectify issues to avoid legal action.

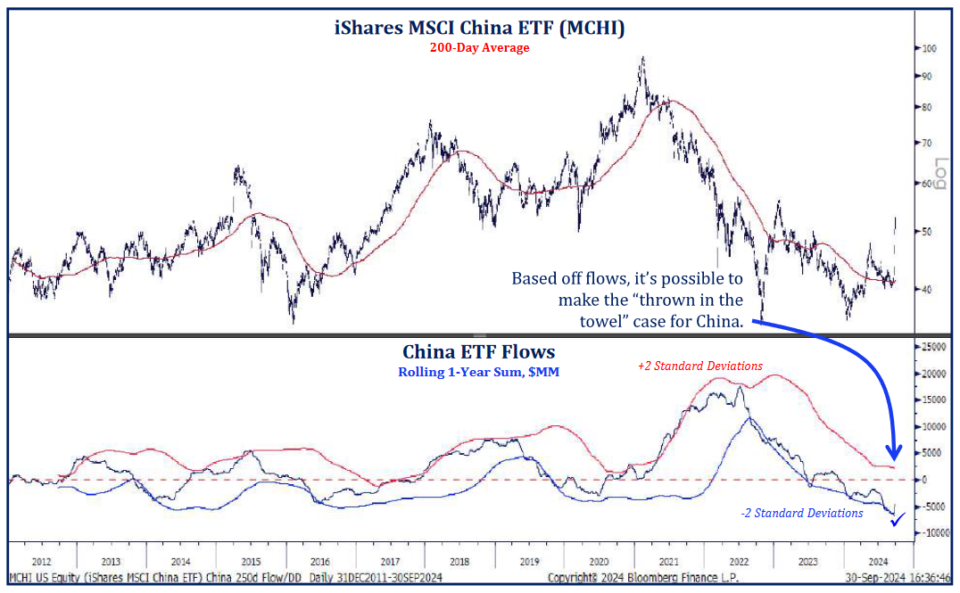

Since 2021, China-focused ETFs have seen outflows and EM funds have shifted away from the country. Gross and net allocations to Chinese equities had dropped to five-year lows.

Source: Strategas

Source: Strategas

The markets seem to agree with Bloomberg. Turnover, flows and returns all turned sharply higher, creating one of the largest one-week rallies for a large country market on record. The iShares MSCI China ETF (MCHI) rose +19.5% for the week. Goldman Sachs reported trading volume for the iShares China Large-Cap ETF (FXI), largely by US macro hedge funds, and net buying across their prime brokerage book reached record highs.

So, is this time different? Does the stimulus package reflect a change in how China will manage its economy? Is this China’s “whatever it takes” moment that changes the long-term view of investors?

China has successfully followed the early stages of the Asian Tiger growth model, driving growth through state-directed investments. However, to sustain growth, the next phase requires a shift toward domestic consumption, which means moving investment decisions from the state to the individual. It is not clear that this transition will happen anytime soon. Chinese government policy remains primarily focused on maintaining the Communist Party’s power, with its legitimacy tied to delivering economic growth, primarily through exports, as evidenced by its unprecedented investment in photovoltaics, electric vehicles and rare earth minerals.

Although the government presents its policies as addressing inequality, promoting common prosperity, and ensuring data security and financial stability, there has been a clear shift under Xi Jinping’s leadership away from promoting prosperity through capital markets and toward state control, in his attempt to end China’s “Century of Humiliation” by having it emerge as the global superpower.

While the stimulus package demonstrates more determination and includes the most aggressive measures since the pandemic — offering a direct boost to markets — it does not address deeper structural issues like aging demographics, loss of cost competitiveness, heavy reliance on declining property markets and export-driven growth. We believe local governments also pose a problem, as moving away from investment-led growth requires shifting income away from bankrupt local governments to the consumer. In our view, the package largely follows the old growth model and as long as policy remains focused on maintaining party control, long-term growth prospects and the regulatory environment will remain uncertain.

The risk is that similar to previous stimulus packages, the immediate market rally reflects only a reflexive response to stimulus. Interestingly, while the equity markets moved higher, bond yields were essentially unchanged.

In early November, the government announced a $1.4T plan to allow local governments to refinance “hidden debt” and lower borrowing costs as fiscal revenues have fallen short of targets. Markets appeared disappointed, seemingly expecting a larger monetary package and more fiscal stimulus MCHI rose +39.9% at its peak following the announcement but has since retraced -15.9% as economic numbers have yet to reflect the stimulus and/or have not met expectations.

The US presidential election also raises additional uncertainty. While the Biden administration largely maintained the tariffs increases of the first Trump administration, President-elect Trump has threatened to increase tariffs 60% or more on Chinese goods with China hawkishness a rare bipartisan view.

Source: Bloomberg, TwinFocus

CONCLUSION

While it remains unclear if the stimulus package portends the policy changes needed to address long-term structural growth issues, the rhetoric around supporting the economy has clearly changed and increases the likelihood of further aggressive actions with the possibility that internal party processes have delayed the fiscal “bazooka” until next year.

In our view, the stimulus package may make China a potential short-term trade but not a long-term investment.

——————————————————————————————————————–

MEMORANDUM DISCLAIMERS & DISCLOSURES

This Memorandum is confidential and may contain legally privileged and proprietary information of Twin Focus Capital Partners LLC (“TwinFocus”). It is intended solely for the use of the Recipients to which it is addressed. If you are not the intended recipient, you are hereby notified that any dissemination, copy, disclosure, use or action taken based on this Memorandum or any information herein is strictly prohibited and may be unlawful. If you received this Memorandum in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy.

This Memorandum may not be otherwise redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the express written consent of Twin Focus Capital Partners LLC.

Investments involve numerous risks, including, among others, market risk, counterparty default risk and liquidity risk. In some cases, securities, strategies and other financial instruments may be difficult to value or sell and reliable information about the value or risks related to the security, strategy or financial instrument may be difficult to obtain. Income from such securities, strategies and other financial instruments, if any, may fluctuate and that price or value of such securities, strategies and instruments may rise or fall and, in some cases, investors may lose their entire principal investment. Foreign currency rates of exchange may adversely affect the value, price or income of any security or financial instrument mentioned in this Memorandum. Investors in such securities and instruments effectively assume currency risk. Additionally, before investing in any mutual fund strategies, Recipients are advised to obtain and closely review prospectuses and related information for those strategies before making any final investment decision.

Hedge fund and other alternative investments are generally unregulated and considered inherently very risky and you can lose material portions of your principal in very short periods of time. Prior to making any investments in any hedge fund managers and alternative investment strategies, you should thoroughly review all subscription documents and confidential offering memoranda provided by the managers/strategies, paying particular attention to the risk disclosures. You should not invest in such managers/strategies if you are not thoroughly comfortable with these risk disclosures or do not understand and/or appreciate the increased levels of risks associated with such strategies. Additionally, this Memorandum may provide information regarding private funds/strategies/investments which are exempt from registration under the Investment Company Act of 1940 pursuant to Section 3(c)(1) and/or 3(c)(7) which were offered as private placements in reliance on Regulation D of the Securities Act of 1933. Each individual fund/strategy and NOT TwinFocus shall have the sole responsibility for (i) formally qualifying prospective investors to ensure they meet the suitability criteria to invest in each relevant fund/strategy and, once qualified, (ii) sending the formal offering documents and other materials to each prospective investor.

Any information relating to the tax status of financial instruments and/or strategies discussed herein is not intended to provide tax advice or to be used by anyone to provide tax advice. Recipients are urged to seek tax advice based on their particular circumstances from an independent tax professional. Any waiver by TwinFocus of any section of this Memorandum Disclaimer Statement should not be construed as a general waiver of any other section and/or the entire Memorandum Disclaimer Statement.

The information, including but not limited to forecasts and estimates, in this Memorandum was obtained from various sources and TwinFocus does not guarantee its accuracy. Although the information contained in this Memorandum are from sources believed to be reliable, no representation or warranty, expressed or otherwise, is made to, and no reliance should be placed on its fairness, accuracy, completeness or timeliness.

All opinions, projections and estimates are as of the date of the Memorandum and are subject to change without notice. TwinFocus is under no obligation to update this Memorandum and Recipients should therefore assume that TwinFocus will not update any fact, circumstance or opinion contained in this Memorandum unless specifically requested. TwinFocus and any director, officer or employee of TwinFocus do not accept any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this Memorandum or its contents.

This Memorandum may contain current opinions of third-party authors and not necessarily those of TwinFocus. Such opinions are subject to change without notice.

This Memorandum may contain references to market indices. Such information is presented to show the general trends in certain markets for the periods indicated and is not intended to imply that the strategy(s) discussed and/or reviewed are similar to the indices either in composition or element of risk. TwinFocus does not make any representations as to whether the indices may or may not be unmanaged, not investable, have any expenses and may or may not reflect reinvestment of dividends and distributions. Index data is provided for comparative purposes only. A variety of factors may cause an index to be an inaccurate benchmark for a particular portfolio/manager/strategy and the index does not necessarily reflect the actual investment strategy of the portfolio/manager/strategy discussed and/or presented in the Memorandum. Current period returns may be estimates. Actual index returns and/or estimates are calculated and presented to TwinFocus through third party software providers and as such, may differ from the final figures produced by the index provider.

Any investment in any Qualified Opportunity Fund (“QOF”) may be made only by delivery of the Fund’s Private Placement Memorandum to accredited purchasers and qualified investors. Investors should rely solely on the applicable offering documents in making any investment decision, as well as assessing the risks on an ongoing basis. Such offering documents contain important information, including, among other information, a description of an investment’s risks, investment approach, and fees and expenses, and should be read carefully, as part of any review of ongoing materials.

Opportunity zone investments are subject to unique risks, including potential regulatory change. For example, a proposed bill could significantly change the qualification requirements under the opportunity zone program, with many of these provisions having retroactive effect. As one example, these changes would terminate the designation of certain tracts as qualified opportunity zones, significantly change some of the requirements for qualification as a qualified opportunity zone business and make some other changes to the opportunity zone provisions, with many of these changes having retroactive effect to the date of the original enactment of the opportunity zone provisions.

In addition, the state and local tax conformity to the opportunity zone tax benefits varies from jurisdiction to jurisdiction. Although some state and local tax jurisdictions fully conform to the opportunity zone tax benefits, other jurisdictions may offer parallel benefits or no similar benefits.

As such, it is possible that any investment that is considered an opportunity zone may fail to meet the requirements and there can be no guarantee that any investor will realize any tax advantages of investing in a qualified opportunity zone as a result of any such investment. In our view, the stimulus package may make China a potential short-term trade but not a long-term investment.