TwinFocus Research / Alternative Assets - Gold’s Surge: A Safe Haven in Shifting Markets

Spot gold markets posted fresh highs north of US$3,500/oz to begin September, driven by a confluence of macro factors — ongoing steepening in developed-market government bond curves, politicization of the Federal Reserve and significant U.S. policy uncertainty.

The Fed is widely expected to cut interest rates by 25 basis points at the September FOMC, but questions have been (re)raised about its independence and apolitical decision-making process heading into 2026 — and the potential negative impact that could have on the U.S. dollar.

Yes, the U.S. has struck some trade deals, but U.S.-China geostrategic tensions persist, with yet another extended trade deadline now pushed to November between the two economies responsible for ~45% of global GDP.

Yes, the White House signed the OBBBA fiscal bill, but its stimulative impact raises concerns about the U.S. debt trajectory, deficit expansion, and inflation impulse.

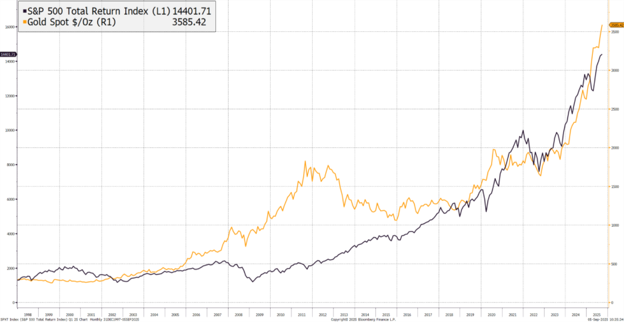

This is a lot to digest. Unmistakable though, is the fact that the second-best performing stock in the S&P 500 is Newmont Corp. (NEM), the largest gold producer in the index — up nearly 100% and trailing only Palantir (PLTR). Meanwhile gold as an underlying asset is up 35%+, outperforming most assets globally.

Longer term, gold has truly been an incredible asset. Since 1998, it has outperformed the best performing market in the world — the S&P 500.

We highlight the historical returns of gold and the more recent drivers of its performance, closing with our musings on the recent drivers of its performance.

Gold Bugs vs. Stock Bugs: Who Is Right?

In our Q3-2024 letter we wrote:

“If you call someone a bug, that cannot be a good thing. A requested summary of ‘gold bugs’ from ChatGPT provides a direct link that explains that gold bugs tend to harbor conspiracy theories about the government or market manipulation. The term was coined in the 1930s when trust in traditional investments waned. It is still alive today, as though favoring gold somehow makes you a person who believes in things with less than obvious proof or somehow believes in things that question the status quo. We are not in that camp; we just follow the data. The data leads us to an obvious conclusion — gold has proven its ‘metal’ over many decades.”

As many long-time TwinFocus clients are aware, we believe that gold is a reasonable and logical holding for any investor looking to improve risk-adjusted returns. The current status quo of ever-larger fiscal deficits funded by promissory notes ensures that gold will continue to have value as an antidote to this trend. While gold performs well during panics, as the cartoon suggests, there are other forces at work in addition to global uncertainty.

Is gold a bug in a portfolio? Are investors who own gold irrational or conspiracy theorists? We believe not. They have reached a logical conclusion based on the common-sense appeal of gold.

Who has been buying gold?

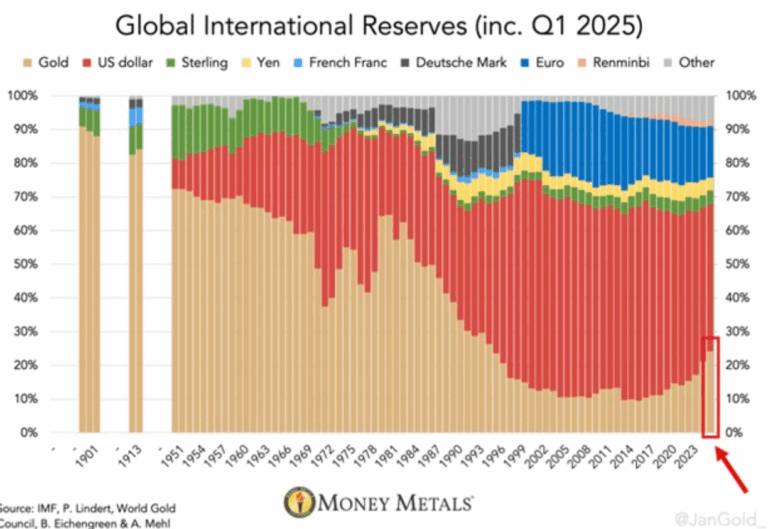

As a measure of who cares, central bank ownership of gold as collateral against foreign currency reserves is telling. International central bank reserves of gold declined for much of the past century, but starting around 2010—when the U.S. began aggressive yield curve control—foreign banks began diversifying away from G7 bonds and into gold. The rationale is simple: as yields were suppressed, it made little sense to own more bonds, and gold emerged as a logical hedge.

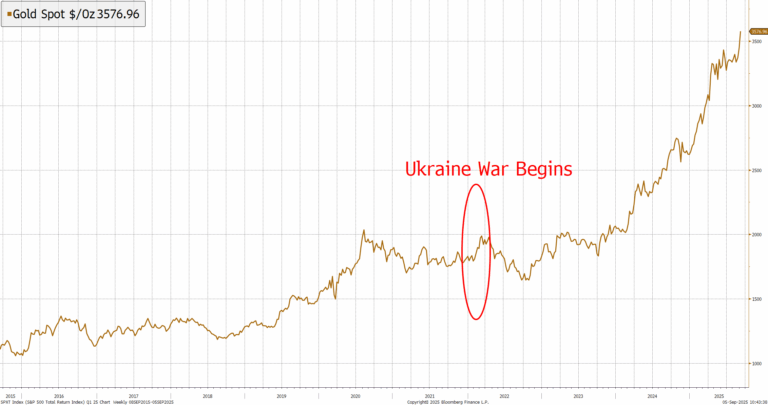

The takeaway from the chart is clear: central banks still covet gold, and since the global financial crisis, their holdings have steadily increased. As we highlighted last year, this trend accelerated following the Ukraine war, when the U.S. effectively weaponized the dollar. But there are also deeper undercurrents that make it logical for central banks to diversify their reserves.

Interestingly, for the first time since the 1970s, we see a reversal of a long-standing trend. With memories fresh of high inflation, central banks routinely held gold at two times their bond holdings; as the memory of inflation dissipated, central banks divested gold continuously for three decades.

Further to the point, the impact of sanctions related to Ukraine was unprecedented in scale, even targeting wealthy citizens. This likely awakened some of the deepest fears among our global partners and further escalated foreign demand for a “neutral asset,” with gold emerging as the most credible alternative.

Source: Bloomberg

What about inflation as a cause?

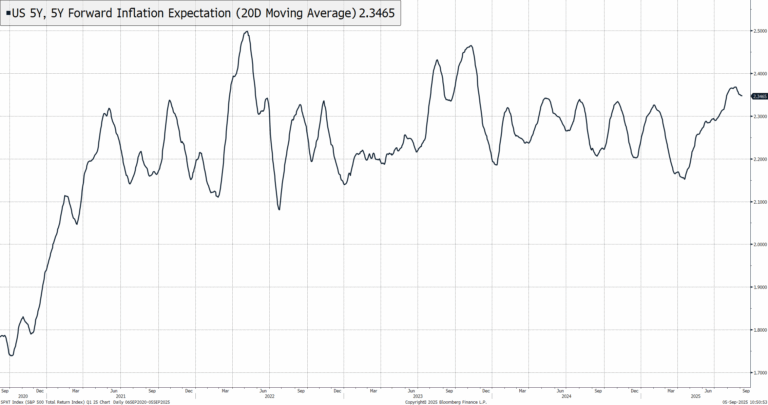

Gold is also viewed as an effective hedge against currency debasement or inflation, shown below is the market’s best gauge of inflation expectations, the 5-year forward embedded expectations in the TIPS market.

Source: Bloomberg

Inflation expectations have barely budged from their five-year trend. At least in this case, it appears that gold is not running due to inflation expectations. Gold may be discounting a different path or outcome than what is implied by the TIPS curve, but it is unlikely that inflation expectations are the short-run cause.

Is uncertainty caused by Trump’s approach and tariffs a cause?

As alluded to in the cartoon, gold is known as a hedge against the unknown — and at present, we have more unknowns than usual. President Trump appears to keep the world on guard most days, so it is logical that the uncertainty stemming from his actions could be contributing to increased market fear. While this argument has some intuitive appeal, the data does not seem to support policy uncertainty as the primary driver of gold’s rally. In fact, much of gold’s recent performance has occurred while policy uncertainty was falling, not rising — particularly post “Liberation Day.”

If aggressive yield curve control is now in the ninth inning, what happens?

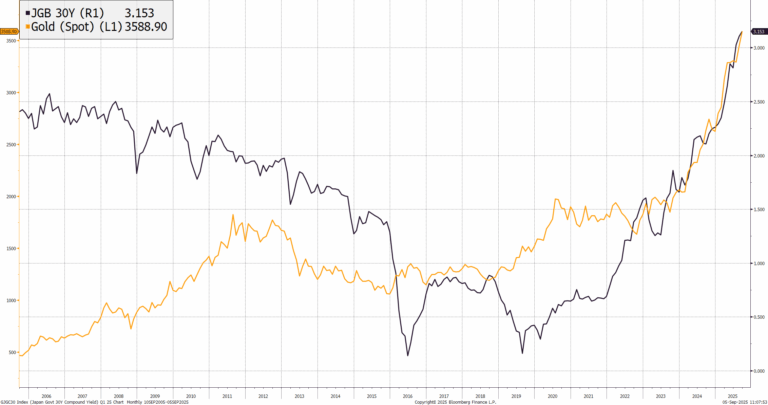

Interestingly and counterintuitively, gold has shown an unusual relationship with long-term rates in Japan. The typical argument is that gold is inversely correlated with interest rates, yet in this case, it appears positively correlated. So, what has changed?

We suspect that, on the margin, demand for bonds has fallen as the “dream” of the perfect 60/40 hedge has come into question. Bonds as the complement to Equities in many portfolios has served investors well during Yield Curve Control, however as we exit QE globally, bonds will no longer be a solid diversifier. Japan is the first proxy as they have engineered yield curve and rate suppression for longer than others, as the market discounts their exit, the value of a bond hedges moves from exceptional to negative.

We have written about this extensively, but to reiterate, bonds are likely not inversely correlated with equities, except during periods of yield curve control. As markets exit the era of yield curve control in Japan first, then Europe, and then the U.S., demand for uncorrelated assets increases — and gold has been the primary beneficiary.

What about U.S. retail and institutional buyers?

Are they driving up the price?

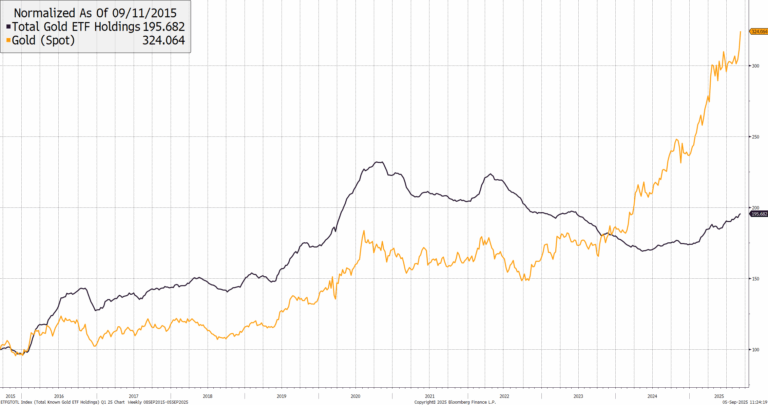

No. We see scant evidence, at least in ETF net creation, that there is substantial retail interest in gold assets through ETF structures. While we acknowledge that in Asia, speculation is higher through other vehicles, at least in North America, we can be confident that investors are not meaningfully long gold relative to prior trends. Shown below is an overlay of performance of gold vs. ETF creation: in recent years, investor demand has been tepid.

Source: Bloomberg

Is the Fed now more political?

Could their more dovish stance be a catalyst for gold?

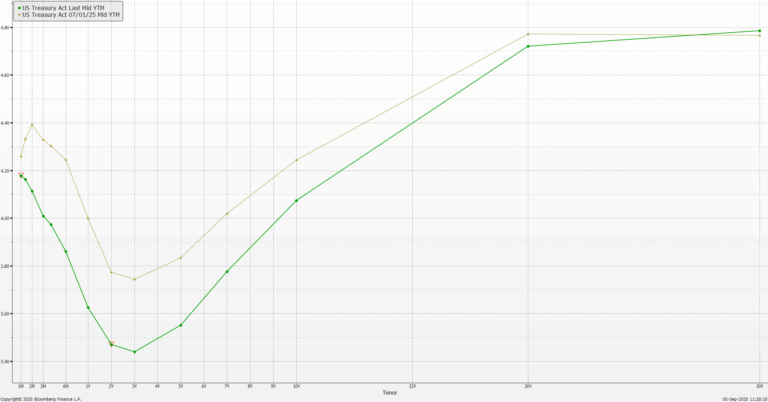

Likely yes. Shown below is the futures curve for each interval of rates. The lighter line represents market expectations for rates on July 1, and the darker line reflects expectations as of September 4, 2025. The move is modest, but it does appear that Trump’s rhetoric — and similar commentary — has led markets to price in slightly more dovishness in the forward rate curve, approximately 10–20 basis points over the next three years. While not large, this shift lowers effective real rates, which increases demand for gold as its carry cost relative to other currencies has declined.

This move alone signals relative calm in bond markets. Although, we suspect that it had more impact on assets like gold, which carry more exposure to worst-case scenarios.

Source: Bloomberg

So why is gold up?

In the short run, during Q3 of this year, gold’s performance appears strongly correlated with Trump’s aggressive posture toward the Fed, which led to slightly lower real rates. This increase in gold’s price brought algorithmic and technical investors into the market, and gold took off. Potentially the broader fight between our central bank, treasury and presidency signal the end of Bretton Woods II, but we won’t know that until the dust has settled.

In the long run, the rally since around 2010 appears driven by several key factors:

- First, this is not yet an investor demand story, it is a central bank demand story. The increasing need to diversify away from global bonds has driven more demand for gold. In our view, this trend remains intact, and these buyers are largely price-insensitive, as geopolitics and diversification — not profits — are the primary drivers.

- The retreat from explicit yield curve control have created global demand for truly uncorrelated assets. Gold is a likely winner in this environment.

- While difficult to quantify, the rise in policy uncertainty may be casually related to gold’s price. However, it does not appear that a significant “fear premium” is embedded in the asset.

- Finally, inflation — despite its prominence in media narratives — does not appear to be a meaningful driver of gold’s recent price increases.

We believe gold belongs in well diversified, multi-asset portfolios, with sizing dependent on the diversity of other holdings and the particulars of each investor. The recent 25-year performance is not a bug — it is the logical conclusion to the end of an era. Gold is now proving a fantastic diversifier for dollar-based assets, and stocks and bonds are acting more like the same trade.

Memorandum Disclosures & Disclaimers

This Memorandum is confidential and may contain legally privileged and proprietary information of Twin Focus Capital Partners LLC (“TwinFocus”). It is intended solely for the use of the Recipients to which it is addressed. If you are not the intended recipient, you are hereby notified that any dissemination, copy, disclosure, use or action taken based on this Memorandum, or any information herein is strictly prohibited and may be unlawful. If you received this Memorandum in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy.

This Memorandum may not be otherwise redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the express written consent of Twin Focus Capital Partners LLC.

Investments involve numerous risks, including, among others, market risk, counterparty default risk and liquidity risk. In some cases, securities, strategies and other financial instruments may be difficult to value or sell and reliable information about the value or risks related to the security, strategy or financial instrument may be difficult to obtain. Income from such securities, strategies and other financial instruments, if any, may fluctuate and the price or value of such securities, strategies and instruments may rise or fall and, in some cases, investors may lose their entire principal investment. Foreign currency rates of exchange may adversely affect the value, price or income of any security or financial instrument mentioned in this Memorandum. Investors in such securities and instruments effectively assume currency risk. Additionally, before investing in any mutual fund strategies, Recipients are advised to obtain and closely review prospectuses and related information for those strategies before making any final investment decision.

Hedge fund and other alternative investments are generally unregulated and considered inherently very risky and you can lose material portions of your principal in very short periods of time. Prior to making any investments in any hedge fund managers and alternative investment strategies, you should thoroughly review all subscription documents and confidential offering memoranda provided by the managers/strategies, paying particular attention to the risk disclosures. You should not invest in such managers/strategies if you are not thoroughly comfortable with these risk disclosures or do not understand and/or appreciate the increased levels of risks associated with such strategies. Additionally, this Memorandum may provide information regarding private funds/strategies/investments which are exempt from registration under the Investment Company Act of 1940 pursuant to Section 3(c)(1) and/or 3(c)(7) which were offered as private placements in reliance on Regulation D of the Securities Act of 1933. Each individual fund/strategy and NOT TwinFocus shall have the sole responsibility for (i) formally qualifying prospective investors to ensure they meet the suitability criteria to invest in each relevant fund/strategy and, once qualified, (ii) sending the formal offering documents and other materials to each prospective investor.

Any information relating to the tax status of financial instruments and/or strategies discussed herein is not intended to provide tax advice or to be used by anyone to provide tax advice. Recipients are urged to seek tax advice based on their particular circumstances from an independent tax professional. Any waiver by TwinFocus of any section of this Memorandum Disclaimer Statement should not be construed as a general waiver of any other section and/or the entire Memorandum Disclaimer Statement.

The information, including but not limited to forecasts and estimates, in this Memorandum was obtained from various sources and TwinFocus does not guarantee its accuracy. Although the information contained in this Memorandum are from sources believed to be reliable, no representation or warranty, expressed or otherwise, is made to, and no reliance should be placed on its fairness, accuracy, completeness or timeliness.

All opinions, projections and estimates are as of the date of the Memorandum and are subject to change without notice. TwinFocus is under no obligation to update this Memorandum and Recipients should therefore assume that TwinFocus will not update any fact, circumstance or opinion contained in this Memorandum unless specifically requested. TwinFocus and any director, officer or employee of TwinFocus do not accept any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this Memorandum or its contents.

This Memorandum may contain current opinions of third-party authors and not necessarily those of TwinFocus. Such opinions are subject to change without notice.

This Memorandum may contain references to market indices. Such information is presented to show the general trends in certain markets for the periods indicated and is not intended to imply that the strategy(s) discussed and/or reviewed are similar to the indices either in composition or element of risk. TwinFocus does not make any representations as to whether the indices may or may not be unmanaged, not investable, have any expenses and may or may not reflect reinvestment of dividends and distributions. Index data is provided for comparative purposes only. A variety of factors may cause an index to be an inaccurate benchmark for a particular portfolio/manager/strategy and the index does not necessarily reflect the actual investment strategy of the portfolio/manager/strategy discussed and/or presented in the Memorandum. Current period returns may be estimates. Actual index returns and/or estimates are calculated and presented to TwinFocus through third party software providers and as such, may differ from the final figures produced by the index provider.

Any investment in any Qualified Opportunity Fund (“QOF”) may be made only by delivery of the Fund’s Private Placement Memorandum to accredited purchasers and qualified investors. Investors should rely solely on the applicable offering documents in making any investment decision, as well as assessing the risks on an ongoing basis. Such offering documents contain important information, including, among other information, a description of an investment’s risks, investment approach, and fees and expenses, and should be read carefully as part of any review of ongoing materials.

Opportunity zone investments are subject to unique risks, including potential regulatory change. For example, a proposed bill could significantly change the qualification requirements under the opportunity zone program, with many of these provisions having retroactive effect. As one example, these changes would terminate the designation of certain tracts as qualified opportunity zones, significantly change some of the requirements for qualification as a qualified opportunity zone business and make some other changes to the opportunity zone provisions, with many of these changes having retroactive effect to the date of the original enactment of the opportunity zone provisions.

In addition, the state and local tax conformity to the opportunity zone tax benefits varies from jurisdiction to jurisdiction. Although some state and local tax jurisdictions fully conform to the opportunity zone tax benefits, other jurisdictions may offer parallel benefits or no similar benefits.

As such, it is possible that any investment that is considered an opportunity zone may fail to meet the requirements and there can be no guarantee that any investor will realize any tax advantages of investing in a qualified opportunity zone as a result of any such investment.