Research Investment Process White Paper Series - Manifesto

Manifesto

Introduction

Our investment goal at TwinFocus is to generate superior risk-adjusted returns for our clients. Our investment research process is our key tool supporting this objective.

We believe it is possible to generate superior returns, but it requires a repeatable and repeated investment process, grounded in a deeply held research identity and common-sense decision-making. Even then, there are no guarantees.

Why is it easy to state the what and the how of investing, yet so difficult to consistently realize?

Investing resists reductionism.

Investing balances the quantitative and qualitative. Theory and empiricism. Micro and macro. Science and art. It is a practice that is best learned by doing.

Our team expertise spans these facets. We have written research papers and textbooks, met with thousands of fund managers, and managed portfolios of everything from stocks and bonds to large funds of funds.

Our research identity and process are the synthesis of our decades of experience. Our process provides an ability to execute repeatably and in what we believe to be a thoughtful, unique approach to asset management. The process is designed to evolve over time, with new information, new experiences, new investment opportunities and new people.

At the risk of immediately contradicting ourselves, we have tried to reduce our process to three key beliefs we elaborate on below:

- It is possible to generate superior investment performance.

- Superior investment performance requires a repeatable and repeated investment process grounded in common sense.

- Integrity is non-negotiable.

Beliefs

These beliefs we lay out below are the foundation upon which our investment process is built. They have been formed by our decades of experience, and while there might be slight evolution in the details, the key tenets are unlikely to change.

1. It is possible to generate superior investment performance.

In our experience, most markets are priced efficiently most of the time. But not always. This inconsistency creates challenges—yet also opportunities—to generate superior returns.

Source: freepik.com

Imagine shoppers lined up outside a store.

A crowd suggests the product is desirable. It also signals information — perhaps those waiting have done their research and know the product is worth buying.

Investing follows a similar pattern, but with a key difference. In a store, everyone pays the same price. In markets, each successive buyer often pushes the price higher. An undervalued asset may no longer be a bargain by the time you reach the front of the line. If the goal is to buy low and sell high, you don’t want to be last.

The ideal position? Near the front of a line so that you either get a bargain, or so you can sell it to someone further back in the line.

How do you improve your chances of getting there?

We believe it starts with a different framework — a different way of thinking about markets.

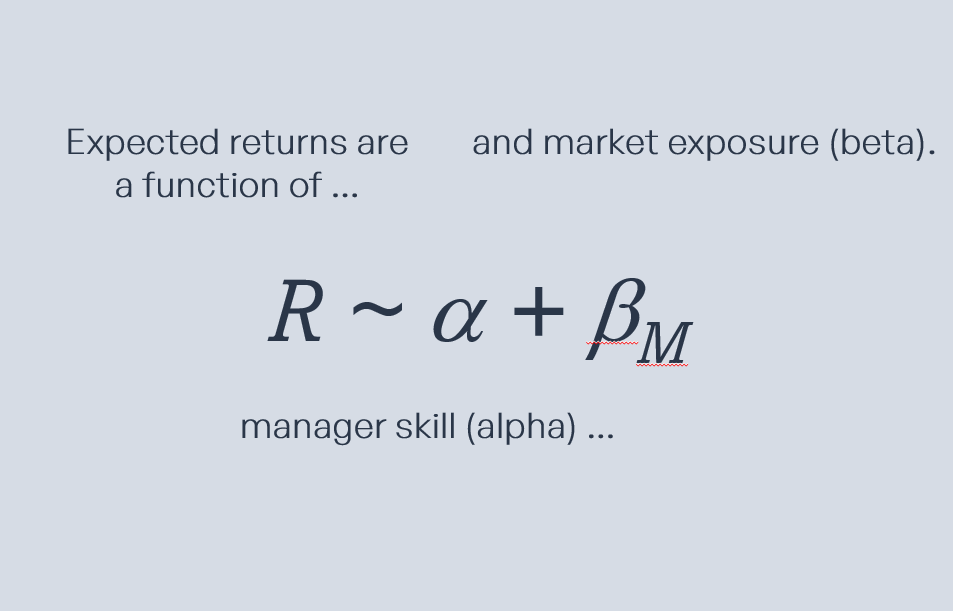

The conventional framework for identifying and measuring inefficiencies is the Capital Asset Pricing Model (CAPM), where expected returns are decomposed into two sources:

- Beta (b) – A measure of returns explained by broad market exposure.

- Alpha (a) – Generally interpreted as a measure of returns explained by manager skill.

CAPM is elegant and proffers a simple formula for measuring skill and selecting investments. However, skill is difficult to quantify, and alpha is actually a measure of returns not explained by broad market exposure, which could include pure luck.

While alpha may eventually identify skill, it takes time, and the opportunity may have passed. As a result, we believe this is a largely useless exercise if we seek to be early.

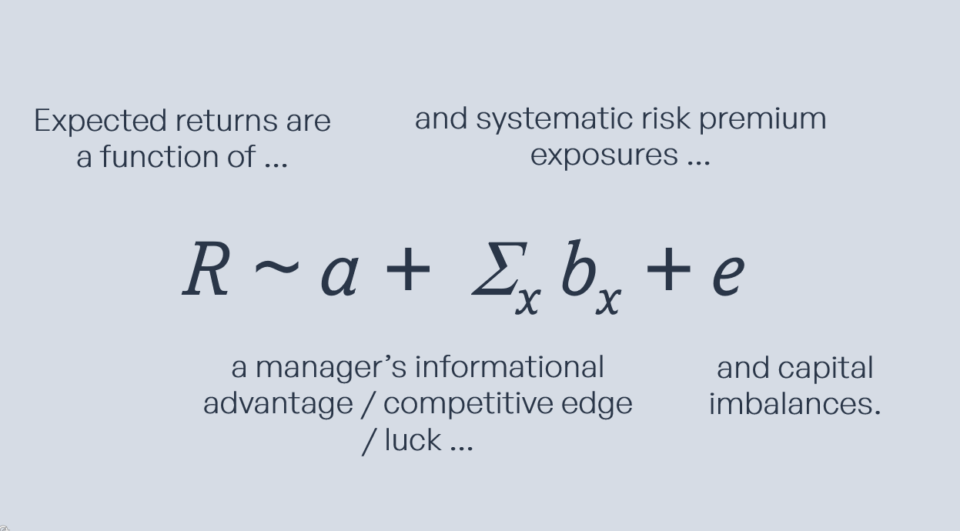

Instead, we reframe CAPM, retaining its simplicity, but revising and expanding the potential return sources:

- Competitive Edge (a) – The ability to generate excess returns from having a sustainable advantage across a number of potential sources.

- Market Risk Premiums (b) – The return received for holding exposures across different market risks that other investors choose not to hold, for example, large v. small, growth v. value, domestic v. international stocks. We are not unique here, there are nearly as many factor portfolios as there are fund managers out there.

- Capital Imbalances (e) – The returns resulting from a mismatch between the demand and supply for capital within a market. Imbalances reflect constraints (discussed further below) that are either imposed on investors or self-imposed by investors. Capital imbalances are easier to identify and represent a more attractive and sustainable source of expected returns.

What are the sources of imbalances and competitive edge?

Information – know something others don’t.

If you only know what others know, it seems unlikely you will consistently be first or near the front of the line. To do that you need to be smarter than nearly everyone else about how to use available information. And in our judgement, there is nearly an infinite number of smart people in our industry.

Otherwise, you need information others do not, and if you can do this reliably, it can be a real advantage. This private information can be gained directly through proprietary sources or by extracting information before others, due to structural or quantitative advantages.

Network – know someone others don’t.

A key proprietary source is networks. A wide and deep network can provide for a broader set of potential investments or an early look at new ideas or opportunities. Wider and more diverse sources improve the odds of identifying unique (front of the line) opportunities.

Outlook / Process – be willing to invest where others aren’t.

Excess returns are compensation in excess of the risk accepted. As noted, we believe capital imbalances provide for attractive and sustainable sources of expected returns. Capital imbalances often arise when market participants are buyers or sellers for non-economic reasons dictated or motivated by underlying constraints.

External constraints are those imposed on investors, typically regulatory and legal restrictions.

Internal constraints are those self-imposed by the investor, typically the result of personal bias, heuristics or misalignment of interests.

Identifying market imbalances requires two key abilities: recognizing constraints that affect others and minimizing your own biases.

External constraints are easier to identify. An example – in 2008-09, changing bank regulations either precluded banks from participating in some markets or made it unprofitable. The departure of bank capital created an imbalance, one of which led to Bloomberg headlines including phrases like The Golden Age of Private Credit.

Internal constraints are more subtle. They stem from behavioral biases, often shaped by the prevailing narratives in the market, and require having differentiated outlook.[1]

- Narratives are the stories told to explain what is happening in the markets.

- If you accept the same narratives as others and respond in the same way as others, you are likely to join the same lines as others.

- To find shorter lines, you need to understand the narratives and respond differently.

Structural – be able to consider a broader or different set of investment opportunities.

The ability to profit from investments that others can’t or don’t want to make, examples include:

- Scale, e.g., the ability to make investments that are too small for larger investors to care about or too large for smaller to make.

- Speed and certainty. The ability to analyze and commit to time-sensitive investments, capturing opportunities that others cannot evaluate in time.

- The ability to increase the value of the investment, e.g., implementing operational improvements that make an investment that is unprofitable for others profitable for you.

- Lower cost structure that allows you to pay a higher price and capture opportunities that are unprofitable for others.

- Alignment with managers – this is different than pure integrity. Managers may not lack integrity, but they may not make optimal decisions if incentives are not aligned.

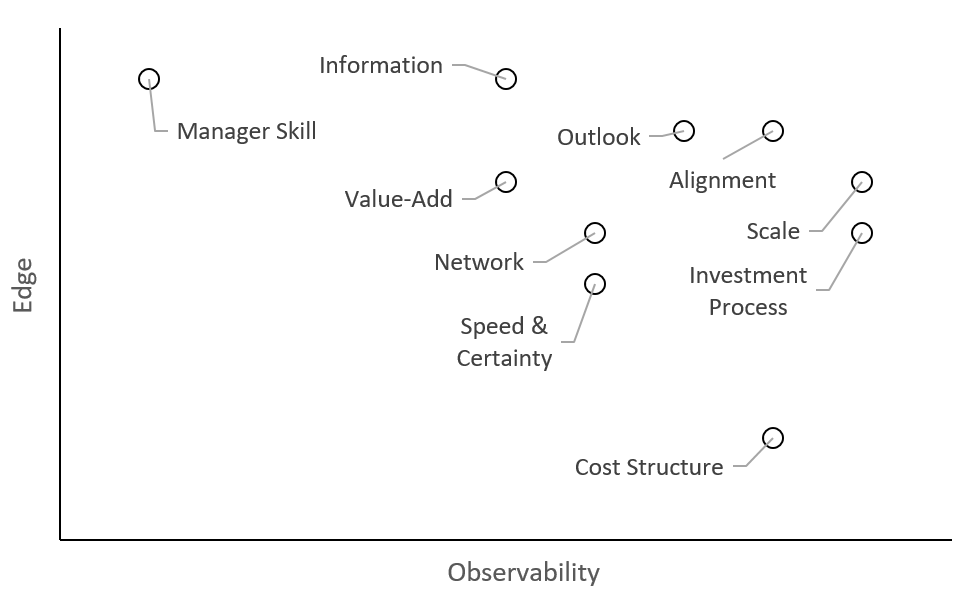

The challenge in evaluating competitive edge is observability.

We seek to focus on those advantages that we consider meaningful, that we can observe and assess our confidence in their sustainability.

Source: TwinFocus

The challenge lies in the tradeoff between visibility and value. A strong competitive edge is often harder to observe.

Persistent manager skill, for example, can be a significant advantage, but it’s difficult to measure. On the other hand, scale is more transparent, yet it comes with risks —greater competition and the potential for a manager to take on too much capital, diluting returns.

This chart plots our unscientific, highly stylized representation of this relationship.

2. Superior investment performance requires a repeatable and repeated investment process grounded in common sense.

In our experience, most investors claim their investment decisions are disciplined. We generally believe this only when decisions are supported by a rigorous well-defined investment process built to avoid behavioral traps and heuristics.

We believe this is true for all investors; fund managers, individual investors and us. It is not enough to just have an investment process.

“Everybody has a plan until they’re punched in the mouth.” – Mike Tyson.

A repeatable process plans for volatility and unexpected outcomes that can result in emotional responses. Inconsistent decision-making can negate the benefits of a strong framework.

-

- Disciplined. A repeatable process requires an adherence to a core set of foundational principles rather than a broad set of specific circumstances. The desire to deviate from an investment process often arises in response to unexpected outcomes, with deviations from the process resulting in inconsistent implementation and likely inconsistent results.

- Open-minded. Constructing resilient portfolios, ones with the potential to consistently generate superior risk-adjusted returns, requires an awareness of and sensitivity to uncertainty and bad luck that considers multiple potential outcomes, not a singular expected outcome.

- Financial theory is based on expected outcomes, that is, it assumes a world of risks that you are aware of, i.e., the known unknowns in the vernacular of former Defense Secretary Donald Rumsfeld. Even in this case, unlikely outcomes (bad luck) can still result.

- Reality is more complex and involves uncertainty, i.e., the risks you are not aware of (unknown unknowns).

Checklists encourage discipline and repeatability.

We have distilled our beliefs and process into an Investment Checklist, the key questions that underpin our investment and due diligence processes.

- Does the investment capture desired risk premiums or capital imbalances, i.e., fit within a positive thematic view and/or supported by a market dislocation?

- Does the manager have a competitive edge that allows them to successfully implement the investment and generate attractive risk-adjusted returns?

- Does the investment structure promote alignment and is it appropriate for the investment?

We have to be able to answer “yes” to each question to move forward with an investment.

When a measure becomes a target, it ceases to be a good measure.” – Goodhart’s Law

We believe the inputs and outputs of the framework need to be based in common sense and align with the sensibilities and principles of the individuals involved. Otherwise, the process is not likely to be repeatable or implemented repeatedly. A few of the behaviors we look out for include:

- “What gets measured, gets managed”. Measure what matters and do not ignore what is not easily measured. While quantitative analysis is necessary, it may not be sufficient as important information may not be easily quantified.

- Confusing more data with more precision. Large data sets can promote a false sense of confidence and accepting insufficient compensation for the risks taken. For additional data to be value-add it needs to provide new information that is reliable. As they say, “garbage in, garbage out”.

- An overreliance on models and ignoring intuition. It is better to be approximately right than precisely wrong. Models are a tool, but not reality. Which is why investing is a blend of science and art.

- Confusing measures for goals. The goal is attractive risk-adjusted returns, with the focus on whether we are adequately compensated for the risks we accept. The measure is realized returns. Targeting returns without consideration of the risks accepted can lead to performance chasing and disappointing returns.

3. Integrity is Non-Negotiable

Though listed last, perhaps the most important belief. Outperformance requires an alignment of interests, both structural and personal, between the manager and investor.

Incentives drive behavior.

Almost every investment involves an agent-principal relationship and the potential for a misalignment of interests, with the manager acting in their own interests to the detriment of the investor.

There is no perfect alignment between investors and managers, but we want to minimize the gap between interests and incentives. This requires evaluating the structure of the investment and having confidence in the manager’s motivation and character.

- Structural alignment arises from the regulatory and legal environment, as outlined in the investment documents, as well as the limitations placed on the manager by the manager’s investment and operational policies and procedures. The terms of the relationship between the manager and investor are outlined in the investment documents as well as the manager’s written policies and procedures. Considerations include:

- Does the fee structure align incentives? Too often the manager can make ample money from simply running the investment rather than running the investment well. When possible, manager compensation should be linked more to investment performance.

- What rights, if any, do investors have to remove the manager if performance is disappointing or the investment is not being managed as expected?

- Are the manager’s policies and procedures complete and properly implemented to prevent operational errors and fraud?

- Manager compensation should make the investment matter as much or more to the manager as to the investor with the manager only making money if the investor makes money.

- What are the level and basis of fees?

- Does the manager earn greater fees from AUM or performance?

- Does the manager have a meaningful personal investment in the fund and firm?

- While structure and compensation can promote alignment, ultimately how the manager will behave when punched in the mouth.

- Does the manager’s past performance, behavior and economic interest in the investment align with investors’ interests?

- Is the manager forthcoming with information, both good and bad, about the fund and firm?

- Are there examples of clear alignment or integrity issues?

Conclusion

Our beliefs have been developed over decades of experience. They are the foundations of our decision-making framework and investment process which seeks to generate superior risk-adjusted returns for our clients. While easily said, this goal is a challenge to consistently realize.

However, we believe that outperformance is possible. It requires a disciplined, repeatable investment process grounded in common sense that is applied consistently over long time frames and multiple decisions.

While we have committed to paper, this framework is not etched in stone and will evolve over time, with new information, new experiences, new investments and new people. Although the core tenets should remain the same, how we approach investing should be ever improving.

[1] This analogous to Keynes’ Beauty Contest. While the markets may be a weighing machine over the long term (prices reflect fundamentals) they are a voting machine over the near term (prices reflect what investors believe other investors believe).

Memorandum Waivers & Disclaimers

This Memorandum is confidential and may contain legally privileged and proprietary information of Twin Focus Capital Partners LLC. It is intended solely for the use of the Parties or Entities to which it is addressed. If you are not the intended recipient, you are hereby notified that any dissemination, copy, disclosure, use or action taken based on this message or any information herein is strictly prohibited and may be unlawful. If you received this Memorandum in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy.

This Memorandum may not be otherwise redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the express written consent of Twin Focus Capital Partners LLC. This Memorandum should not be regarded by the Parties stated hereunder as a substitute for the exercise of their own judgment and they are encouraged to seek independent, third-party research on any strategies or economic outlook covered in or impacted by this Memorandum.

This information has been distributed for educational informational purposes only and neither the information nor any opinion expressed constitutes an offer or an invitation to make an offer, to buy or sell any securities, strategies or other financial instrument or any derivative related to such securities or instruments (e.g., options, futures, warrants, and contracts for differences). This Memorandum is not intended to provide personal investment advice and it does not take into account the specific investment objectives, financial situation and the particular needs of any specific person. All Parties stated hereunder should seek financial advice regarding the appropriateness of investing in financial instruments and implementing investment strategies discussed or recommended in this Memorandum and should understand that statements regarding future prospects may not be realized.

Securities, strategies and other financial instruments discussed in this Memorandum may not be insured by the Federal Deposit Insurance Corporation and are not deposits or other obligations of any insured depository institution. Investments in general and, derivatives, in particular, involve numerous risks, including, among others, market risk, counterparty default risk and liquidity risk. In some cases, securities, strategies and other financial instruments may be difficult to value or sell and reliable information about the value or risks related to the security, strategy or financial instrument may be difficult to obtain. Please note that income from such securities, strategies and other financial instruments, if any, may fluctuate and that price or value of such securities, strategies and instruments may rise or fall and, in some cases, investors may lose their entire principal investment. Foreign currency rates of exchange may adversely affect the value, price or income of any security or financial instrument mentioned in this Memorandum. Investors in such securities and instruments effectively assume currency risk. Additionally, before investing in any mutual fund strategies, it is recommended and emphasized that the Parties Stated hereunder should obtain and closely review prospectuses for those strategies before making any final investment decision.

To the extent this Memorandum discusses any legal proceeding or issues, it has not been prepared as nor is it intended to express any legal conclusion, opinion or advice. The Parties stated hereunder should consult their own legal advisers as to issues of law relating to the subject matter of this Memorandum. Any information relating to the tax status of financial instruments and/or strategies discussed herein is not intended to provide tax advice or to be used by anyone to provide tax advice. The Parties stated hereunder are urged to seek tax advice based on their particular circumstances from an independent tax professional. Any waiver by Twin Focus of any section of this Memorandum Disclaimer Statement should not be construed as a general waiver of any other section and/or the entire Memorandum Disclaimer Statement.

The information, including but not limited to forecasts and estimates, in this Memorandum was obtained from various sources and TwinFocus does not guarantee its accuracy. While the information contained in this Memorandum are from sources believed to be reliable, no representation or warranty, expressed or otherwise, is made to, and no reliance should be placed on its fairness, accuracy, completeness or timeliness. Additionally, this Memorandum may contain links to third-party websites. TwinFocus is not responsible for the content of any third-party website or any linked content contained in a third-party website. Content contained on such third-party websites is not part of this Memorandum and is not incorporated by reference into this Memorandum. The inclusion of a link in this Memorandum does not imply any endorsement by or any affiliation with TwinFocus.

The returns presented in this Memorandum are calculated in methodologies consistent with calculation methodology outlined in the Global Investment Performance Standards (GIPS®). However, Twin Focus does not claim compliance with GIPS®, nor have these returns been examined as part of a GIPS® verification or performance examination.

All opinions, projections and estimates are as of the date of the Memorandum and are subject to change without notice. TwinFocus is under no obligation to update this Memorandum and the Parties stated hereunder should therefore assume that TwinFocus will not update any fact, circumstance or opinion contained in this Memorandum unless specifically requested. TwinFocus and any director, officer or employee of TwinFocus do not accept any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this Memorandum or its contents.

This Memorandum may contain forward-looking statements within the meaning of the United States federal securities laws. Forward-looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters. For example, forward-looking statements may predict future economic performance, describe plans and objectives of management for future operations and make projections of revenue, investment returns or other financial items. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “believe,” expect,” “anticipate,” intend,” contemplate,” “estimate,” “assume,” or other similar expressions. Such forward-looking statements are inherently uncertain, because the matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond the Funds’ control. No representations or warranties are made as to the accuracy of such forward-looking statements. Past performance is no guarantee of future results. This Memorandum may contain current opinions of third-party authors and not necessarily those of TwinFocus. Such opinions are subject to change without notice.

This Memorandum may contain references to Market Indices. Such Index information which may be provided is presented merely to show the general trends in certain markets for the periods indicated and is not intended to imply that the strategy(s) discussed and/or reviewed are similar to the indices either in composition or element of risk. TwinFocus does not make any representations as to whether the indices may or may not be unmanaged, not investable, have any expenses and may or may not reflect reinvestment of dividends and distributions. Index data is provided for comparative purposes only. A variety of factors may cause an index to be an inaccurate benchmark for a particular portfolio/manager/strategy and the index does not necessarily reflect the actual investment strategy of the portfolio/manager/strategy discussed and/or presented in the Memorandum. Current period returns may be estimates. Actual index returns and/or estimates are calculated and presented to Twin Focus through third party software providers and as such, may differ from the final figures produced by the index provider.

Please note that all trading requests originated by the Client(s) must be communicated to TwinFocus through oral communications. Trade requests/instructions made solely in writing will not be accepted. Upon receipt of Client trading requests/instructions, TwinFocus will use best efforts to execute in a timely manner with respective custodians through the use of limit orders, stop limit orders, market orders and/or any other trading conventions that TwinFocus deems in its full discretion suitable to effectuate such trading requests/instructions. TwinFocus cannot guarantee that such trading requests/instructions will be executed within a certain period of time upon receipt of such trading requests/instructions from clients. TwinFocus will not be held responsible for any trading errors by the custodian to the extent such errors are not within the direct control of TwinFocus. Upon subsequent execution, the client will receive a written summary confirmation by TwinFocus via electronic mail.

Hedge Fund and other Alternative Investments are unregulated and considered inherently very risky and you can lose material portions of your principal in very short periods of time. Prior to making any investments in any hedge fund managers and alternative investment strategies, you should thorough review all subscription documents and Confidential Offering Memoranda provided by the managers/strategies, paying particular emphasis on the risk disclosures. You should not invest in such managers/strategies if you are not thoroughly comfortable with these risk disclosures or do not understand and/or appreciate the increased levels of risks associated with such strategies. Additionally, this Memorandum may provide information regarding private funds/strategies/investments which are exempt from registration under the Investment Company Act of 1940 pursuant to Section 3(c)(1) and/or 3(c)(7) which may have been conducted as private placements in reliance on Regulation D of the Securities Act of 1933 and/or other exemptions provided by pertinent federal/state securities laws. Each individual fund/strategy and NOT TwinFocus shall have the sole responsible for (i) formally qualifying Prospective Investors to ensure they meet the suitability criteria to invest in each relevant Fund/strategy and, once qualified, (ii) sending the formal offering documents and other materials to each Prospective Investor.

This Memorandum may be in the form of an encrypted PDF file. Twin Focus employs encryption technologies provided by the Adobe Acrobat software for this service. The purpose of encryption is to prevent unauthorized distribution of inherently personal and sensitive information, data and intellectual property. All of TwinFocus’s encrypted memoranda, presentations, and reports will be secured in this format unless otherwise stated. As this technology is owned by Adobe Acrobat and Twin Focus has no control over this technology or encryption methodology, Twin Focus will not be held liable under any circumstances on the product and any damages of any nature occurring as a result of malfunction of this technology. Additionally, for those clients who specifically request that Twin Focus not encrypt memoranda, reports and presentations, Twin Focus will not be held liable under any circumstances for damages, both direct and indirect, as a result of failure to encrypt this Memorandum as per the client’s request.

IRS CIRCULAR 230 DISCLOSURE: To ensure compliance with requirements imposed by the IRS, we inform you that any U.S. federal tax advice contained in this Memorandum (including any attachments, exhibits or addendums) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein.