The Unanswered Questions on the Winners from AI

Introduction

For years, AI has been more academically focused as a sector of technology that was always an afterthought. This was the case until a small open-source AI company known mainly for trying to get robots to beat humans at video games experimented with a 2017 research paper from Google known as “Attention is all you need”. While we provide the link, for most readers there will be no “ah ha” moment, but to those in the know these findings allowed for breakthrough thinking, which eventually led to the development of what is now known as ChatGPT and ushered in this new age of AI. Seeing all the things these new models can do changed the way people look at the future of technology. When taking a closer look, it seems that technology is not the only sector being impacted from this change in outlook.

The investment phases of most booms consist of three layers:

- Innovator(s)

- Picks and shovels

- Beneficiaries

- Innovator(s): The company or idea that enables the potential. In 1994, it was Intel which had the road map for PCs becoming faster and cheaper, eventually allowing for many other success stories. It was potentially Cisco, which allowed for faster internet access across the globe. Today it is clearly NVIDIA, the company that builds and designs chips that allow for continued growth in AI computation at scale, but that might not be the case forever.

- Picks & Shovels: In the late 1990’s it was Netscape and Lycos (that enabled the use of the technology), the expansive increase in telecom infrastructure (that allowed for bits to move to all corners of the planet at faster and faster speeds), the telecom providers, the semiconductor supply chain, the PC makers and security companies. These businesses enabled the use and success of the PC and the Internet. For AI, the likely epicenter of the “picks and shovels” layer are the companies that enable the data centers, from transmission wire to HVAC. We discuss them later in this paper.

- Beneficiaries: The long list of players that benefit from the productivity of the new tools at scale. In the early 2000s that was the Internet media players like Facebook and Google that were able to use the new infrastructure to create new business models in media that were just better than traditional models. Once most of the developed world consumers had PCs and Internet access, Amazon was able to launch their business model. We will discuss the potential winners later in the paper, but today it feels largely like speculation as we are still early in the adoption phase and the low-cost infrastructure and ubiquity of solutions has not been formalized.

- Our belief is that the market has correctly identified one of the largest capital spending phenomenons in our lifetime with the “innovators” pricing in massive growth. Over the past couple of months the market has also begun to sort out some of the winners of the “pick and shovel” layer. However, we believe it’s too early to understand the true downstream beneficiary winners.

The Prospect of AI

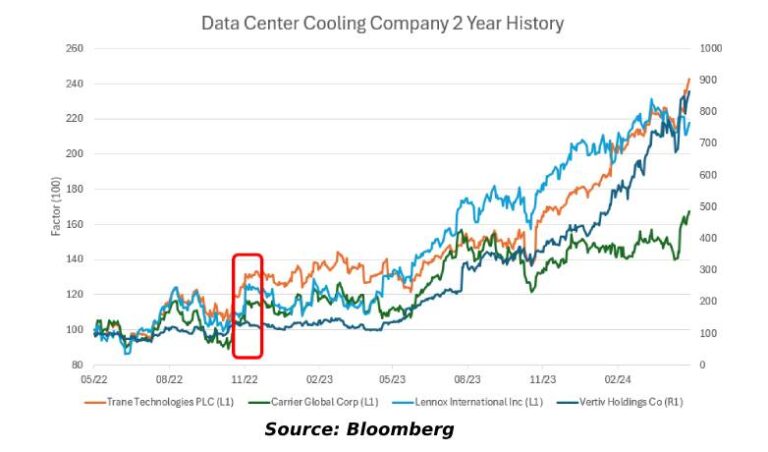

Starting in early 2020, people were reliant on new software and social media to work from home and follow social distancing protocols due to the pandemic, allowing for substantial growth in the technology sector. As the pandemic started to wane in late 2021, the sector entered a cooling period until November 2022, when OpenAI released their DALL-E 2 and, more importantly, ChatGPT models to the public.

Since then, the technology sector has rallied rapidly, led by the major players in the AI space, e.g., Microsoft (MSFT), Alphabet (GOOGL), Apple (AAPL) and NVIDIA (NVDA).

These trends can be seen in the price of the Global X Artificial Intelligence & Technology ETF (AIQ).

Picks & Shovels is the Data Center and It’s Exploding

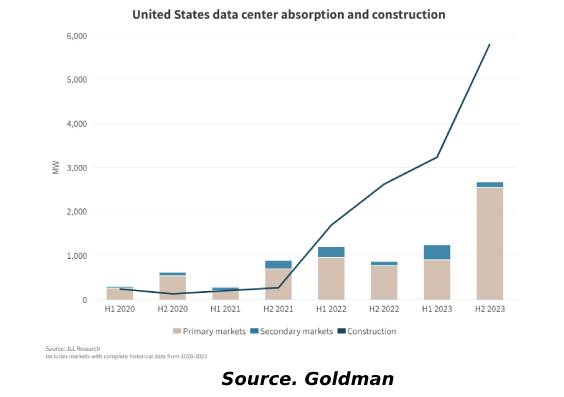

With expectations around the capabilities of generative AI growing, computational power needs to respond in lockstep. This meant that during 2023 demand for data centers grew at a rapid pace. The power used by data centers, an indicator of data center supply, increased from almost 800 megawatts (MW) in H2 2022 to 2,500 MW in H2 2023, a truly staggering increase of 3.3x.

At the same time, the number of data centers constructed measured in power needs doubled. With this growth in demand, the power grid needs to respond. The scale of this power need is reported in the chart below from Goldman Sachs, which shows their forecast of power needs in the US relative to GDP. While the prior two decades were marked by power consumption lagging GDP, we do not believe that is the future!

The chart below plots the planned construction for data centers, informing Goldman’s forecast. The line indicates a material jump in the amount of construction relative to existing supply (indicated by the bars). This will require the equipment to fill the data centers, but also the transmission and power plants to supply these centers with electricity.

Chips and the Race for FLOPs

At the heart of the data center lie the chips driving the new technology boom. The chips can be in the form of GPUs, CPUs, ASICs or FPGAs, but the formula is the same: Data comes in, data goes out. The main priority for these chips currently is not necessarily how much power the chips need or how efficient the chips are in getting from the input to the output. Instead, it is how fast a server can deliver your desired output. This is where we see the true dominance of tech’s biggest superstar: NVIDIA. When looking through rose-tinted glasses, NVIDIA dominates. Thanks to the announcement of NVIDIA’s Blackwell Architecture of AI chips, no competitor comes within 70% of the new flagship’s performance based on FLOPs in FP16 with sparsity, the only common publicly available comparison of the NVIDIA, Intel, and AMD flagship chips.

While this might not be the only reason for NVIDIA’s spike to almost 70% market share in the data center space, it seems to be an indicator of their success. This does not mean that the chips are flawless; sporting a 1000W TDP (the amount of power a chip is rated for) and a $30,000-$40,000 price per chip brings into question whether competitors can sneak in by undercutting these sore points.

The Biggest Winner is Cooling?

With chips requiring such a large amount of power, the heat produced by data centers is astronomical. This is why in large scale data centers climate control can consume nearly half of a data center’s entire energy bill. The question then becomes, with the drastic increase in demand for data centers, does the demand for cooling increase as well?

The share prices of HVAC and liquid cooling companies such as Vertiv (VRT), Trane Technologies (TT), Carrier (CARR) and Lennox (LII) have increased by at least 60% since the aspect of OpenAI’s major model launches. This increase seems to move in line with the doubling of data centers constructed. We can therefore surmise these stock prices have become proxies for future data center construction.

Where Does the Power Come From?

NVIDIA’s previous generation H100 GPU chip uses approximately the same amount of power as the average individual uses at home in a year. Read that again.

NVIDIA’s upcoming B100 and B200 chips will require up to 33% more power than the H100. The high- power consumption of these chips puts more strain on the power grid, and as a result the data center market is geographically limited. This leads to primary marketplaces for data centers emerging, including:

- Northern Virginia

- Dallas-Ft. Worth

- Chicago

- Silicon Valley

- Phoenix

- Atlanta

- Hillsboro, OR

- New York

As data center demand grew, power demand grew in tandem, leading to a drastic increase in the asking rate for power in these markets (18.6% average increase from 2022 into 2023).

With so much energy being used on data centers, (240-340 terrawatt hours (TWh) in 2022 or 1-1.3% of total global energy demand, where is all the power coming from? Over half of the world’s energy supply comes from two resources: coal and natural gas. Globally, coal accounts for about 1/3 of total energy production, and natural gas contributes 22.5%. In the US, however, natural gas is a significantly larger portion of energy production, being 40% of all US energy generated.

Shown below is the stock performance for the data center “picks and shovels”. MLPs started moving first as the market discounted the need for more transport of natural gas to utilities, then the unregulated utilities and lately even natural gas, which is likely the easiest feed stock for electric companies and has been in constant oversupply since the beginning of the shale revolution.

Blocks of Copper

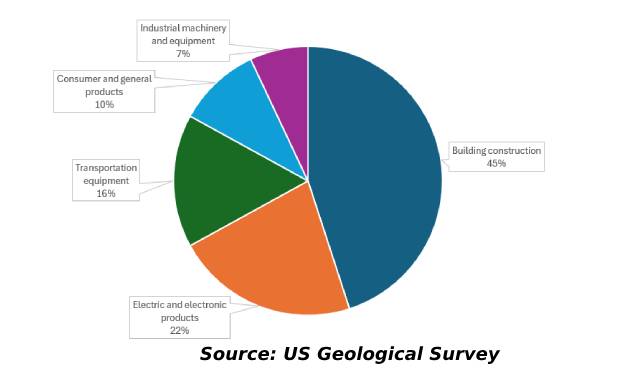

In a broad sense, a data center is a clever way of merging blocks of silicon and blocks of copper. Each MW that a data center has been designed to use requires approximately twenty-seven tons of copper. From that number, an estimated 68,747 tons of copper are currently in operational data centers, with an estimated 144,208 tons of copper needed for the construction of new data centers. This is approximately 12.4% of all copper used in the US in 2023 and this demand could easily double in 2 years, which will put a significant strain on an industry that takes almost 10 years to add capacity. We suspect that to slow demand the price of copper will need to rise substantially to squeeze out marginal buyers.

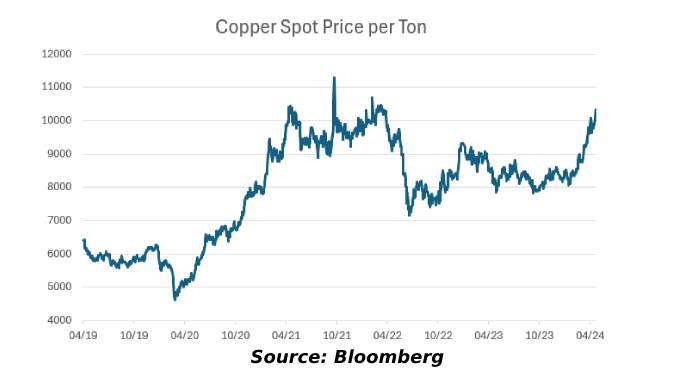

Plotted below is the spot price per ton of copper. The strong rebound in the past few months may be just the beginning.

In addition, other sectors still use copper in similar amounts to previous years with building construction remaining the dominant use.

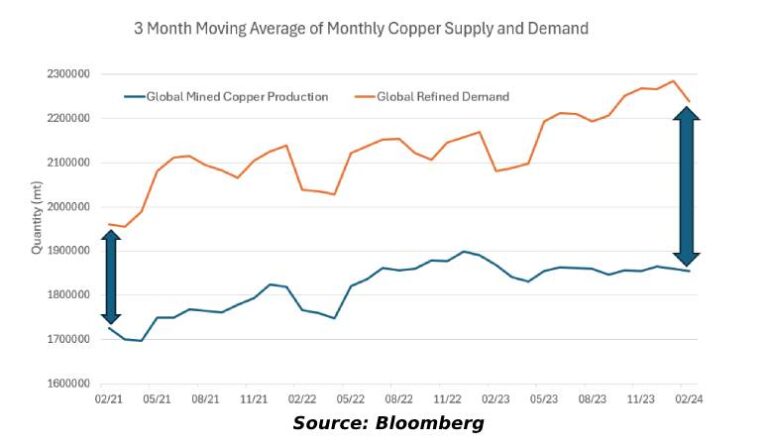

The separation between the production and demand for copper has already been widening in the past 3 years as shown in the 3 month moving average of monthly copper supply and demand. This is exacerbated by the fact that demand seems to be growing at a much more rapid pace than production.

While forecasting supply/demand for any asset is tricky, due to the length of time to bring a new copper mine into production and the long regulatory process, these supply forecasts are likely more correct than most and as a result it is pretty clear the price of copper will need to rise to limit demand.

Productivity is the Output as the Beneficiaries Put AI to Work

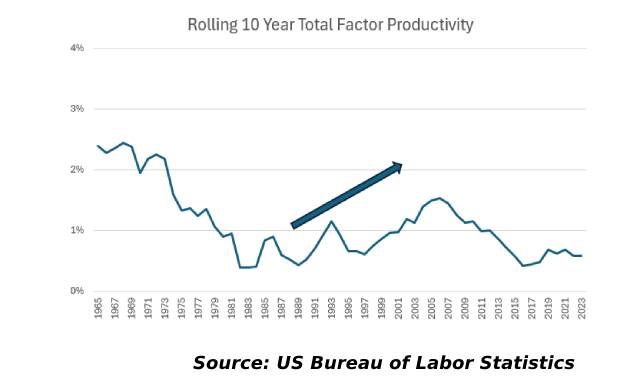

One of the main draws of AI is its expected effect on productivity in the workplace. The last major productivity growth point was the advent of the PC. More specifically, it was the combination of both the personal computer and the Internet that allowed for the rapid productivity growth between the 1990s and 2000s. The hope for AI is that it will be the tool that allows for another period of rapid growth. The main difference now is that AI does not have the same catalyst that PCs had with the Internet or maybe it just needs more time to develop, but so far productivity hasn’t budged at a national level. This does not necessarily mean that the expected productivity growth is incapable of being realized; AI’s potential is immense and the capital expenditure to realize these gains is ever-present. Typically, in revolutionary productivity regimes, much like the railroads at the turn of the century, large capital expenditures lead the productivity benefits, which is likely what we see today.

While predicting exactly what fields are going to be the most impacted is a fruitless endeavor, there are still areas that pique our interest.

- Biotech and healthcare, extremely data-driven sectors, where AI is seen developing more precise predictions for drugs and helping catch diseases at earlier stages.

- Legal services, where legal documents can be written and verified significantly faster when analyzed and written by GenAI.

- Financial services, a field where AI can help parse data, create pitch decks and streamline client communications.

- Autonomous driving and robotics are winners as AI and data capabilities allow these tools to be far more efficient and accurate.

- Most white-collar businesses should see some improvement in worker productivity, while lower skilled areas like call centers should see dramatic improvement in quality and speed.

- Software programmers can develop code with more accuracy and speed than in years past. Innovators in this space have a good chance to change the world.

- Finally, we are certain of one thing: This technology will bring things we can’t imagine today, e.g., the railroads allowed for habitation of land once thought too far from waterways like Las Vegas or the Internet allowing for the beginning of direct-to-consumer ad-supported business.

In some ways, AI is like the perfect intern that can multiply the work completed each day. We can all see the benefit of that!

The chart below shows 10-year factor productivity. Notice the large improvement over trendline in the late 1990s and 2000s as the beneficiaries of the PC/Internet boom began to use the infrastructure (picks and shovels) that had been installed in the prior years.

Looking Forward

The main questions surrounding the AI investment thesis include:

- NVIDIA has shown dominance, but will the competition (AMD and Intel) be able to catch up and compete with NVDA, mirroring the downfall of Cisco in 2000?

- Will energy grid constraints and energy reform bring NVIDIA’s current “brawn over brain” (power over efficiency) strategy to its knees? Can the US’s complicated and largely regulated electricity grid grow quickly enough?

- Can AI keep its promises? Or is it a hyped fad, whose expectations will take years to fully realize? Will innovation in chips win out with higher computation able to be accomplished by NVIDIA and its competitors?

- What is the “killer application” coming from this breakthrough? We feel there are still many unanswered questions, but one thing seems certain: The large data center buildout will continue. We believe investors can benefit through semiconductors and their suppliers, utilities and their providers, HVAC and their suppliers and certainly copper. We are less sure of how to play the productivity winners as the timing and precession of benefit are hard to calibrate today.

MEMORANDUM WAIVERS & DISCLAIMERS

This Memorandum is confidential and may contain legally privileged and proprietary information of Twin Focus Capital Partners LLC. It is intended solely for the use of the Parties or Entities to which it is addressed. If you are not the intended recipient, you are hereby notified that any dissemination, copy, disclosure, use or action taken based on this message or any information herein is strictly prohibited and may be unlawful. If you received this Memorandum in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy.

This Memorandum may not be otherwise redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the express written consent of Twin Focus Capital Partners LLC. This Memorandum should not be regarded by the Parties stated hereunder as a substitute for the exercise of their own judgment and they are encouraged to seek independent, third-party research on any strategies or economic outlook covered in or impacted by this Memorandum.

This information has been distributed for educational informational purposes only and neither the information nor any opinion expressed constitutes an offer or an invitation to make an offer, to buy or sell any securities, strategies or other financial instrument or any derivative related to such securities or instruments (e.g., options, futures, warrants, and contracts for differences). This Memorandum is not intended to provide personal investment advice and it does not take into account the specific investment objectives, financial situation and the particular needs of any specific person. All Parties stated hereunder should seek financial advice regarding the appropriateness of investing in financial instruments and implementing investment strategies discussed or recommended in this Memorandum and should understand that statements regarding future prospects may not be realized.

Securities, strategies and other financial instruments discussed in this Memorandum may not be insured by the Federal Deposit Insurance Corporation and are not deposits or other obligations of any insured depository institution. Investments in general and, derivatives, in particular, involve numerous risks, including, among others, market risk, counterparty default risk and liquidity risk. In some cases, securities, strategies and other financial instruments may be difficult to value or sell and reliable information about the value or risks related to the security, strategy or financial instrument may be difficult to obtain. Please note that income from such securities, strategies and other financial instruments, if any, may fluctuate and that price or value of such securities, strategies and instruments may rise or fall and, in some cases, investors may lose their entire principal investment. Foreign currency rates of exchange may adversely affect the value, price or income of any security or financial instrument mentioned in this Memorandum. Investors in such securities and instruments effectively assume currency risk. Additionally, before investing in any mutual fund strategies, it is recommended and emphasized that the Parties Stated hereunder should obtain and closely review prospectuses for those strategies before making any final investment decision.

To the extent this Memorandum discusses any legal proceeding or issues, it has not been prepared as nor is it intended to express any legal conclusion, opinion or advice. The Parties stated hereunder should consult their own legal advisers as to issues of law relating to the subject matter of this Memorandum. Any information relating to the tax status of financial instruments and/or strategies discussed herein is not intended to provide tax advice or to be used by anyone to provide tax advice. The Parties stated hereunder are urged to seek tax advice based on their particular circumstances from an independent tax professional. Any waiver by Twin Focus of any section of this Memorandum Disclaimer Statement should not be construed as a general waiver of any other section and/or the entire Memorandum Disclaimer Statement. The information, including but not limited to forecasts and estimates, in this Memorandum was obtained from various sources and TwinFocus does not guarantee its accuracy. While the information contained in this Memorandum are from sources believed to be reliable, no representation or warranty, expressed or otherwise, is made to, and no reliance should be placed on its fairness, accuracy, completeness or timeliness. Additionally, this Memorandum may contain links to third-party websites. TwinFocus is not responsible for the content of any third- party website or any linked content contained in a third-party website. Content contained on such third-party websites is not part of this Memorandum and is not incorporated by reference into this Memorandum. The inclusion of a link in this Memorandum does not imply any endorsement by or any affiliation with TwinFocus.

The returns presented in this Memorandum are calculated in methodologies consistent with calculation methodology outlined in the Global Investment Performance Standards (GIPS®). However, Twin Focus does not claim compliance with GIPS®, nor have these returns been examined as part of a GIPS® verification or performance examination.

All opinions, projections and estimates are as of the date of the Memorandum and are subject to change without notice. TwinFocus is under no obligation to update this Memorandum and the Parties stated hereunder should therefore assume that TwinFocus will not update any fact, circumstance or opinion contained in this Memorandum unless specifically requested. TwinFocus and any director, officer or employee of TwinFocus do not accept any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this Memorandum or its contents. This Memorandum may contain forward-looking statements within the meaning of the United States federal securities laws. Forward-looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters. For example, forward- looking statements may predict future economic performance, describe plans and objectives of management for future operations and make projections of revenue, investment returns or other financial items. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “believe,” expect,” “anticipate,” intend,” contemplate,” “estimate,” “assume,” or other similar expressions. Such forward-looking statements are inherently uncertain, because the matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond the Funds’ control. No representations or warranties are made as to the accuracy of such forward-looking statements. Past performance is no guarantee of future results. This Memorandum may contain current opinions of third-party authors and not necessarily those of TwinFocus. Such opinions are subject to change without notice.

This Memorandum may contain references to Market Indices. Such Index information which may be provided is presented merely to show the general trends in certain markets for the periods indicated and is not intended to imply that the strategy(s) discussed and/or reviewed are similar to the indices either in composition or element of risk. TwinFocus does not make any representations as to whether the indices may or may not be unmanaged, not investable, have any expenses and may or may not reflect reinvestment of dividends and distributions. Index data is provided for comparative purposes only. A variety of factors may cause an index to be an inaccurate benchmark for a particular portfolio/manager/strategy and the index does not necessarily reflect the actual investment strategy of the portfolio/manager/strategy discussed and/or presented in the Memorandum. Current period returns may be estimates. Actual index returns and/or estimates are calculated and presented to Twin Focus through third party software providers and as such, may differ from the final figures produced by the index provider.

Please note that all trading requests originated by the Client(s) must be communicated to TwinFocus through oral communications. Trade requests/instructions made solely in writing will not be accepted. Upon receipt of Client trading requests/instructions, TwinFocus will use best efforts to execute in a timely manner with respective custodians through the use of limit orders, stop limit orders, market orders and/or any other trading conventions that TwinFocus deems in its full discretion suitable to effectuate such trading requests/instructions. TwinFocus cannot guarantee that such trading requests/instructions will be executed within a certain period of time upon receipt of such trading requests/instructions from clients. TwinFocus will not be held responsible for any trading errors by the custodian to the extent such errors are not within the direct control of TwinFocus. Upon subsequent execution, the client will receive a written summary confirmation by TwinFocus via electronic mail.

Hedge Fund and other Alternative Investments are unregulated and considered inherently very risky and you can lose material portions of your principal in very short periods of time. Prior to making any investments in any hedge fund managers and alternative investment strategies, you should thorough review all subscription documents and Confidential Offering Memoranda provided by the managers/strategies, paying particular emphasis on the risk disclosures. You should not invest in such managers/strategies if you are not thoroughly comfortable with these risk disclosures or do not understand and/or appreciate the increased levels of risks associated with such strategies. Additionally, this Memorandum may provide information regarding private funds/strategies/investments which are exempt from registration under the Investment Company Act of 1940 pursuant to Section 3(c)(1) and/or 3(c)(7) which may have been conducted as private placements in reliance on Regulation D of the Securities Act of 1933 and/or other exemptions provided by pertinent federal/state securities laws. Each individual fund/strategy and NOT TwinFocus shall have the sole responsible for (i) formally qualifying Prospective Investors to ensure they meet the suitability criteria to invest in each relevant Fund/strategy and, once qualified, (ii) sending the formal offering documents and other materials to each Prospective Investor.

This Memorandum may be in the form of an encrypted PDF file. Twin Focus employs encryption technologies provided by the Adobe Acrobat software for this service. The purpose of encryption is to prevent unauthorized distribution of inherently personal and sensitive information, data and intellectual property. All of TwinFocus’s encrypted memoranda, presentations, and reports will be secured in this format unless otherwise stated. As this technology is owned by Adobe Acrobat and Twin Focus has no control over this technology or encryption methodology, Twin Focus will not be held liable under any circumstances on the product and any damages of any nature occurring as a result of malfunction of this technology. Additionally, for those clients who specifically request that Twin Focus not encrypt memoranda, reports and presentations, Twin Focus will not be held liable under any circumstances for damages, both direct and indirect, as a result of failure to encrypt this Memorandum as per the client’s request.

IRS CIRCULAR 230 DISCLOSURE: To ensure compliance with requirements imposed by the IRS, we inform you that any U.S. federal tax advice contained in this Memorandum (including any attachments, exhibits or addendums) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein.