TwinFocus’ Multi-Faceted Philanthropic Approach

Wealth planning goes beyond caring for your loved ones. It extends to your community and the causes that are important to you.

Our team at TwinFocus is passionate about working with families to incorporate their charitable and philanthropic objectives into their overall investment plan. We make it as easy as possible for our families to effectively and seamlessly give to causes they care about most by identifying and implementing strategies that maximize the benefits to their chosen charities, their family foundation, their portfolio, and their estate.

Our Approach

Within a family office setting, common industry practice entails the gifting of cash and/or appreciated securities to charities primarily through Donor Advised Funds (DAFs). This exercise is performed in isolation of all other wealth structuring exercises and in isolation of any financial modeling and stress testing, which helps avoid material inefficiencies and errors.

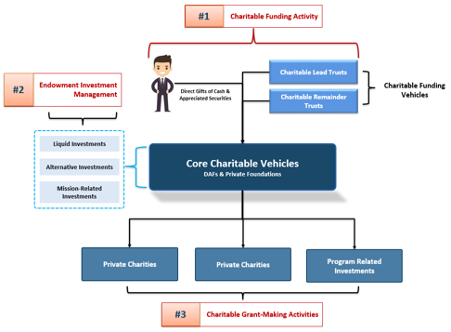

Within this context, we divide our charitable family office practice into three functional areas to ensure a holistic view of a client’s wealth and the impact of their philanthropic approach:

Funding. We help optimize funding for the family office philanthropic program through an in-depth analysis of charitable vehicles, depending on the composition of the investment portfolio and family balance sheet, family mission statement, multi-generational planning, family participation, domestic/international factors, and overall goals. Assets on the balance sheet are optimized based on the amount and type of giving and the type of charitable vehicle(s) that are ultimately selected.

Endowment Investment Management. Once charitable pools of assets are funded, it is necessary to establish investment management policies that adhere to fiduciary rules and regulations in conjunction with any Internal Revenue Code-specific mandates.

This may further involve integration with Mission-Related Investing and alternative investments. For example, we may design the investment management of the charitable endowment to help achieve the family’s mission, not only with grant-making but with investments that aim to incentivize certain behavior to achieve specific objectives.

Grant-Making Activities. We help to tackle the complexity of grants based on the family’s objectives. This could entail direct grants to non-profit and/or for-profit organizations or Program-Related Investments that function like venture capital investments, such as seed funding for technologies that will bring about targeted social change.

Aligning Family Goals

At TwinFocus, the funding decision is only the start of our holistic and integrated approach. We have found philanthropy to be an incredibly cohesive family aggregation tool, which allows the entire family to participate in the following:

- Designing and formulating the mission statement(s) of various pools of charitable assets

- Conducting regular meetings to review and discuss funding and gifting decisions

- Educating younger members about prudent stewardship of assets, financial/investment management skills, and effective communication skills that they can apply to their personal lives

- We have found that certain family members may find professional fulfillment in becoming employed by the family foundation

- Establishing a dispute resolution system when differences of opinion occur, ensuring all perspectives are heard

Our process begins by defining the vehicles and tools that will form the family office and serve as core charitable holding companies, which are in place as platforms for further charitable gifting. These vehicles are typically divided into two groups:

- Private Family Non-Operating Foundations

- Donor Advised Funds (DAFs)

These foundational elements are funded by several different types of charitable vehicles in the form of “split interest vehicles,” as they achieve not only charitable objectives but other multigenerational end results, such as funding trusts for the benefit of future generations. This is in addition to the direct gifting of cash and assets to charities directly, which provides an immediate unilateral benefit.

Within this context, the decision of which vehicle to leverage depends on the following:

- Facts and circumstances of the family, including any cross-border complexities

- Family’s longer-term objectives and legacy plans

- Family’s balance sheet and income statement

With an in-depth knowledge of our clients’ objectives and a thorough understanding of family dynamics based on our deep and long-standing relationships, we are well-positioned to identify the best vehicles that not only fulfill philanthropic goals but also ensure the long-term viability of a respective estate.

Disclosure: Case studies may not be representative of the experiences of other TwinFocus clients.