TwinFocus Global Research Team Note: Modern Monetary Theory, Fact or Folly? (April 2024)

INTRODUCTION

We are writing this opinion piece today because we believe that all investors are currently placing their bets, whether passively or actively, on Modern Monetary Theory (MMT) as the new driving force behind economic markets. Investors seem to implicitly trust in the validity of MMT, which is reflected in the relative calmness and high(er) prices in fixed income and equity markets, as well as the lack of distinction in currency markets for large, indebted countries. Given that both leading candidates in the upcoming US presidential election are discussing new expansive fiscal policies, we believe it is an opportune moment to shed light on the theory and its potential pitfalls. As seasoned market participants and economists, we are naturally skeptical of theories that we believe lack common sense, and MMT falls into that category.

Modern Monetary Theory (MMT) gained considerable interest in the 2010s. One reason was the inability of monetary policy to generate sustained economic growth or obtain consumer inflation targets, instead promoting asset price inflation and widening income inequality. The explanation for this failure generally centers on the reliance on banks as the monetary policy transmission mechanism, using bank reserves to buy existing assets, which resulted in higher reserves but not an increase in the money supply. Banks were not willing to lend, choosing to hold reserves to repair balance sheets and satisfy reserve requirements, while households were not willing to borrow, preferring to save to pay down debt.

This prompted some to call for a “reform” of capitalism1 and others for a shift in focus from monetary to fiscal policy. Fiscal policy resolves the transmission problem by directly increasing the money supply through spending. MMT provides a justification for accommodative fiscal policy, appearing to offer a silver bullet of unlimited spending, without the risk of default, that generates economic growth, resulting from direct government-driven demand and full employment (i.e., 0% unemployment) while narrowing wealth and income inequality.

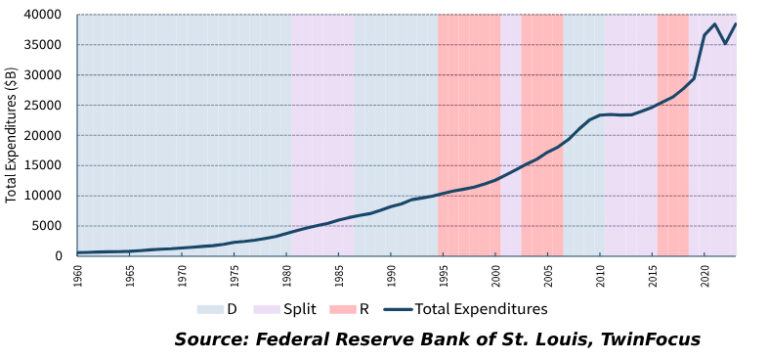

Unsurprisingly, MMT (or at least the assertion that deficits don’t matter) has been embraced by both parties, it is and has been the de facto (if not admitted) policy of both parties, despite protestations and the ongoing theater around the debt ceiling².

Republicans have increased deficits by cutting taxes while demanding austerity to control debt when not in control. Democratics can propose expanded spending without corresponding tax increasesto offset the increase in the deficit. As a result, total government expenditures have risen consistently regardless of which party controls the White House and/or Congress. The largest average annual increases have occurred when Republicans are in the White House and Congress is split, with Democrats controlling the House. The smallest average annual increases when Democrats control the White House and Senate with Republicans controlling the House.

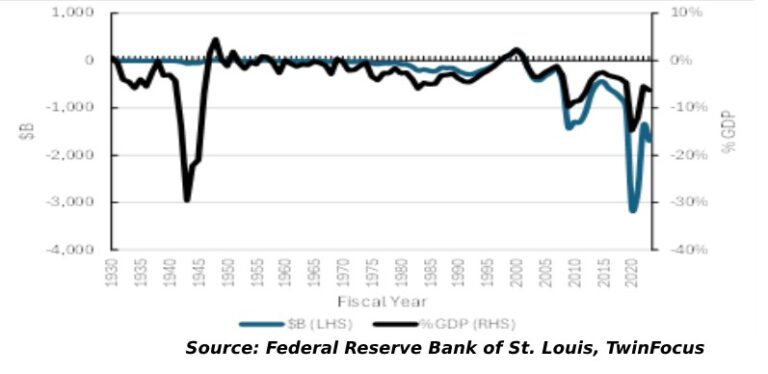

As a result, the federal deficit as a percentage of GDP has grown since 2001 and is currently at a level only surpassed during WWII, the GFC and COVID despite solid growth and relatively tight labor markets.

Though popular interest in MMT has waned, markets appear to accept MMT as policy and the premise that deficits do not matter, or at least the Fed can target rates and manufacture a soft landing. The US Treasury curve is basically flat from 2 years and longer while inflation expectations remain grounded between 2 and 2.5%.

Though popular interest in MMT has waned, markets appear to accept MMT as policy and the premise that deficits do not matter, or at least the Fed can target rates and manufacture a soft landing. The US Treasury curve is basically flat from 2 years and longer while inflation expectations remain grounded between 2 and 2.5%.

While MMT may work in theory, we do not believe there is a silver bullet. Economic policy involves trade-offs, i.e., promoting growth and employment means accepting higher inflation and/or a larger deficit that eventually has to be repaid. The risk is that these trade-offs become binding, resulting in falling growth or rising inflation volatility and inflation expectation that push longer-term borrowing costs higher across developed countries with meaningful implications for financial portfolios.

This note summarizes the foundations and policy implications of MMT as well as the implications for portfolio allocation. In short, we agree with Sean Corrigan’s assessment of MMT that “It’s not Modern; It’s not Monetary; and it’s not really much of a Theory.”

MODERN MONETARY THEORY

Foundations

Modern Monetary Theory (MMT) advocates using the central bank to finance government deficits. Its foundation is “chartalism,” a theory outlined in 1905 that claims money originated with the government’s attempt to control economic activity, rather than developing naturally as a medium of exchange that allowed for more efficient transactions.

Since the government has a monopoly on the currency and all taxes must be paid in that currency, the government must first issue currency to individuals before it can then tax those individuals. This interpretation reverses / breaks the link between taxes and government spending.

- In the traditional view, government spending is limited by the willingness of lenders / taxpayers to fund a growing deficit.

- Since government spending is ultimately financed by taxation, a growing deficit implies higher taxes will be needed in the future to pay down the debt. In anticipation of higher taxes, lenders / taxpayers demand higher interest rates in compensation.

- Rising rates and interest costs consume an increasing proportion of government revenue, limiting spending and the size of the deficit.

Further, the accounting identity that assets equal liabilities is interpreted to equate government debt with savings. Spending as a liability on the government balance sheet results in a corresponding asset, which is claimed to prove that spending does not pull forward growth, reducing future growth and passing a burden on to future generations.

Policy Implications

The policy implications derived from MMT mirror those of “functional finance” a concept developed by Abba Lerner in 1947.

- Deficits do not matter. A country borrowing in its own currency faces no constraint on debt. Government borrowing is local currency denominated, so the government can always service the debt by printing more currency. If the currency is free floating, there is no need to maintain reserves and no constraint from having to maintain a fixed exchange rate relative to other currencies. As a result, there is no need for a government to default.

- The government should borrow and spend until the economy is at full employment with stable prices. Full employment is defined as 0% unemployment. The Job Guarantee is a program within MMT where the government hires anyone unemployed but willing to work, providing a floor on wages and benefits. The idea is to hire in the public sector all those not employed in the private sector.

- The nominal risk-free interest rate is 0%. The direct central bank financing of government deficits removes banks as the transmission mechanism, breaking the link between government debt and interest rates. Rather than being set by the market, rates are set artificially low as it is unnecessary for the government to pay the central bank interest.

- The only constraint on government spending is inflation. Inflation only occurs if the government spends beyond the productive capacity of the economy and from excess pricing power of businesses.

- Taxation is used to dampen inflation by reducing the money supply and spending.

Assumptions

The challenge is that MMT is based on a number of dubious assumptions:

- MMT is a form of socialism and presumes the government is better placed to set economic targets, to allocate capital than individuals (through markets) to obtain these targets and that the investments will produce cash flows sufficient to repay the debt.

- As Mises proved nearly 100 years ago, and as history has confirmed, socialism can never generate the unique information required to properly allocate and coordinate resources.

- MMT assumes that all spending is sufficiently productive to produce a positive return on capital, so the asset can retire the liability. This seemingly ignores the law of diminishing returns and the distortions to incentives as the government becomes the lender and borrower of last resort, e.g., the incentive provided by low interest rates for companies to generate artificial growth through share buybacks rather than real growth through capital investment.

- The government can accurately measure the productive capacity of the economy.

- The forecasting record of economists for pretty much any economic indicator is abysmal. The difficulty in measuring inflation, with the inherent flaws of CPI, suggests no reason to expect they will fare any better with such a broad measure as productive capacity.

- The government can and will be able to issue debt in its own currency at the desired level. This requires there is sufficient demand for local currency debt.

- This requires that citizens are willing to buy all the debt. If not, the government must rely on foreign buyers, who are unlikely to accept the currency if unlimited spending and currency debasement is government policy. If the debt is foreign currency-denominated, the country may be unable to acquire sufficient foreign reserves to service the debt.

- It is presumed this problem is resolved if the debt is issued in the global reserve currency. This might be the case up to a point, but lenders can and may seek to diversify into other currencies. In addition, the issuer of the reserve currency has changed through time.

- That politicians will be prudent stewards, spending only up to the needs of the economy, and will raise taxes to slow spending should inflation arise.

- Public choice theory suggests that politicians have an incentive to spend (which is popular with their constituencies) and have no incentive to raise taxes (which is unpopular with all voters).

CONCLUSION

Economics can be defined as the study of allocating finite resources to satisfy infinite human wants. MMT assumes away the concept of finite resources, either physical or the means to repay borrowing, and concludes that there is no limit on deficits. History has shown that at some point lenders will demand higher compensation, either in recognition of higher potential default risk, in anticipation of higher taxes to repay a growing deficit, or due to inflation. For example, during Liz Truss’s short reign as prime minster of the United Kingdom, she espoused aggressive MMT beliefs and the bond vigilantes effectively had her run out of town in less than 2 months.

- MMT is inflationary. The result of too much (infinite) spending chasing finite resources given the political incentive to spend, with higher inflation driving rates higher. Historically, money-financed fiscal deficits have resulted in hyperinflation, with consequent social and economic upheaval, followed by the imposition of more conventional economic policies.

- Japan is held out as an example of central bank monetization of government debt that has not resulted in higher interest rates and higher inflation. However, Japan is an anecdote (the exception that proves the rule?) relative to the larger sample of countries which have experienced hyperinflation. Research suggests that while the level of government debt is high and the Bank of Japan has monetized budget deficits, Japan has not crossed the thresholds which preceded previous hyperinflationary episodes.

- MMT will not promote sustainable growth or address income/wealth inequality. Cantillon effects mean those closest to the spending (capital providers) benefit first, while those further away (wage earners) see prices rise on goods and services before they see wages rise. In addition, inflation disproportionately hurts lower income individuals as consumption accounts for a greater fraction of income.

The portfolio allocation implications include favoring real assets and stores of value over financial assets and long volatility over short volatility. It also requires a reconsideration of 60/40 portfolio construction.

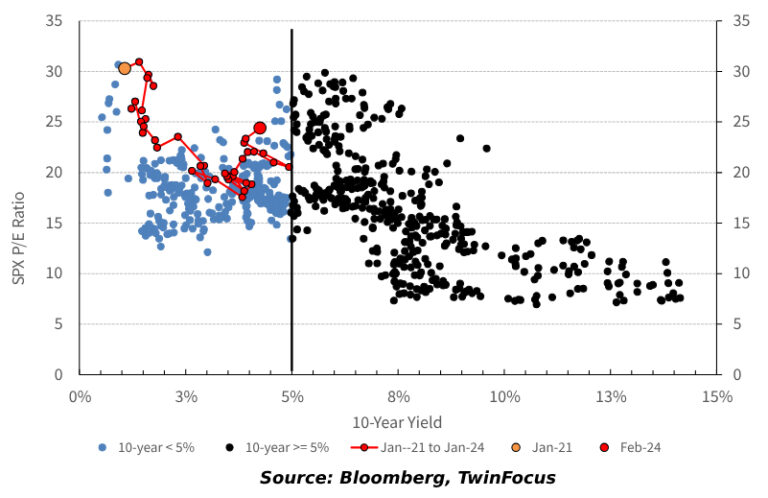

- Rising rates weigh on bond prices and historically equity PE multiples have been lower at high levels of inflation and rates, declining as the 10-year Treasury yield rises above ~4 to 5%.

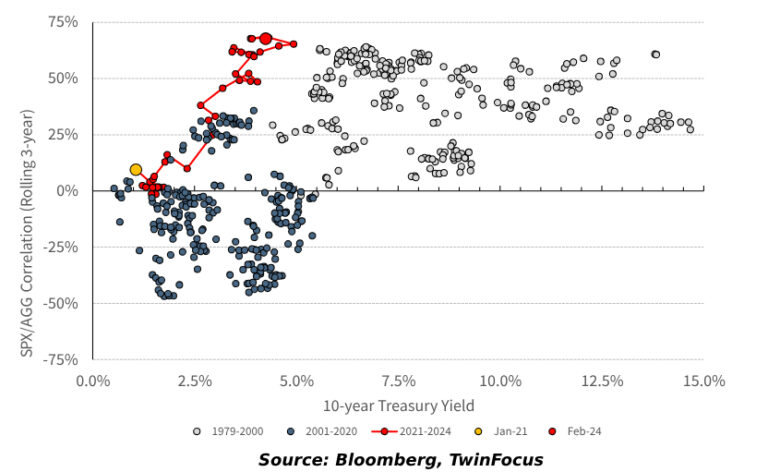

- The correlation between stocks (SPX) and bonds (AGG) has increased with inflation and rates. Though this correlation has been negative over the most recent decades, the long-run average is positive.

In short, MMT is perhaps best summarized by Henry Hazlitt, who said of Keynes’ General Theory that it “contains much that is original and much that is true. Sadly, that which is true is not original and that which is original is not true.”

MEMORANDUM DISCLOSURES

This Memorandum is confidential and may contain legally privileged and proprietary information of Twin Focus Capital Partners LLC (“TwinFocus”). It is intended solely for the use of the Recipients to which it is addressed. If you are not the intended recipient, you are hereby notified that any dissemination, copy, disclosure, use or action taken based on this Memorandum or any information herein is strictly prohibited and may be unlawful. If you received this Memorandum in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy.

This Memorandum may not be otherwise redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the express written consent of Twin Focus Capital Partners LLC.

Investments involve numerous risks, including, among others, market risk, counterparty default risk and liquidity risk. In some cases, securities, strategies and other financial instruments may be difficult to value or sell and reliable information about the value or risks related to the security, strategy or financial instrument may be difficult to obtain. Income from such securities, strategies and other financial instruments, if any, may fluctuate and that price or value of such securities, strategies and instruments may rise or fall and, in some cases, investors may lose their entire principal investment. Foreign currency rates of exchange may adversely affect the value, price or income of any security or financial instrument mentioned in this Memorandum. Investors in such securities and instruments effectively assume currency risk. Additionally, before investing in any mutual fund strategies, Recipients are advised to obtain and closely review prospectuses and related information for those strategies before making any final investment decision.

Hedge fund and other alternative investments are generally unregulated and considered inherently very risky and you can lose material portions of your principal in very short periods of time. Prior to making any investments in any hedge fund managers and alternative investment strategies, you should thoroughly review all subscription documents and confidential offering memoranda provided by the managers/strategies, paying particular attention to the risk disclosures. You should not invest in such managers/strategies if you are not thoroughly comfortable with these risk disclosures or do not understand and/or appreciate the increased levels of risks associated with such strategies. Additionally, this Memorandum may provide information regarding private funds/strategies/investments which are exempt from registration under the Investment Company Act of 1940 pursuant to Section 3(c)(1) and/or 3(c)(7) which were offered as private placements in reliance on Regulation D of the Securities Act of 1933. Each individual fund/strategy and NOT TwinFocus shall have the sole responsibility for (i) formally qualifying prospective investors to ensure they meet the suitability criteria to invest in each relevant fund/strategy and, once qualified, (ii) sending the formal offering documents and other materials to each prospective investor.

Any information relating to the tax status of financial instruments and/or strategies discussed herein is not intended to provide tax advice or to be used by anyone to provide tax advice. Recipients are urged to seek tax advice based on their particular circumstances from an independent tax professional. Any waiver by TwinFocus of any section of this Memorandum Disclaimer Statement should not be construed as a general waiver of any other section and/or the entire Memorandum Disclaimer Statement.

The information, including but not limited to forecasts and estimates, in this Memorandum was obtained from various sources and TwinFocus does not guarantee its accuracy. Although the information contained in this Memorandum are from sources believed to be reliable, no representation or warranty, expressed or otherwise, is made to, and no reliance should be placed on its fairness, accuracy, completeness or timeliness.

All opinions, projections and estimates are as of the date of the Memorandum and are subject to change without notice. TwinFocus is under no obligation to update this Memorandum and Recipients should therefore assume that TwinFocus will not update any fact, circumstance or opinion contained in this Memorandum unless specifically requested. TwinFocus and any director, officer or employee of TwinFocus do not accept any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this Memorandum or its contents.

This Memorandum may contain current opinions of third-party authors and not necessarily those of TwinFocus. Such opinions are subject to change without notice. This Memorandum may contain references to market indices. Such information is presented to show the general trends in certain markets for the periods indicated and is not intended to imply that the strategy(s) discussed and/or reviewed are similar to the indices either in composition or element of risk. TwinFocus does not make any representations as to whether the indices may or may not be unmanaged, not investable, have any expenses and may or may not reflect reinvestment of dividends and distributions. Index data is provided for comparative purposes only. A variety of factors may cause an index to be an inaccurate benchmark for a particular portfolio/manager/strategy and the index does not necessarily reflect the actual investment strategy of the portfolio/manager/strategy discussed and/or presented in the Memorandum. Current period returns may be estimates. Actual index returns and/or estimates are calculated and presented to TwinFocus through third party software providers and as such, may differ from the final figures produced by the index provider.

Any investment in any Qualified Opportunity Fund (“QOF”) may be made only by delivery of the Fund’s Private Placement Memorandum to accredited purchasers and qualified investors. Investors should rely solely on the applicable offering documents in making any investment decision, as well as assessing the risks on an ongoing basis. Such offering documents contain important information, including, among other information, a description of an investment’s risks, investment approach, and fees and expenses, and should be read carefully, as part of any review of ongoing materials.

Opportunity zone investments are subject to unique risks, including potential regulatory change. For example, a proposed bill could significantly change the qualification requirements under the opportunity zone program, with many of these provisions having retroactive effect. As one example, these changes would terminate the designation of certain tracts as qualified opportunity zones, significantly change some of the requirements for qualification as a qualified opportunity zone business and make some other changes to the opportunity zone provisions, with many of these changes having retroactive effect to the date of the original enactment of the opportunity zone provisions.

In addition, the state and local tax conformity to the opportunity zone tax benefits varies from jurisdiction to jurisdiction. Although some state and local tax jurisdictions fully conform to the opportunity zone tax benefits, other jurisdictions may offer parallel benefits or no similar benefits.

As such, it is possible that any investment that is considered an opportunity zone may fail to meet the requirements and there can be no guarantee that any investor will realize any tax advantages of investing in a qualified opportunity zone as a result of any such investment.