Why Own Fixed Income? Our Purpose-Driven Approach

Views from a Legend

David Swensen, the late Yale endowment CIO, is a legend in the asset allocation game. His book Pioneering Portfolio Management should be required reading for anyone in the investment management business.

In the book, Swensen presents a pointed critique of fixed income, stopping short of calling the asset class obsolete, but firmly arguing that it adds limited value in the context of endowment portfolios. In Yale’s most recent financial reports, we see less than a 5% allocation to fixed income – underscoring the lasting influence of Swenson’s investment legacy.

His central thesis was that bonds offer nearly no real return over the long run, offering limited upside outside of the protection benefits of long end treasuries, and exposing portfolios to potentially significant downside in extreme scenarios. Further, for endowments, which offer a perpetual time horizon, your primary concern is preserving purchasing power against inflation. Within this context, the modest volatility-dampening benefits are not sufficient to compensate for the vulnerability to unexpected inflation.

Generally, for Ultra High Net Worth (UHNW) clients, we agree.

However, we do not agree that fixed income does not serve any purpose. For our clients, whose time horizon is not perpetual, the role of fixed income is more nuanced. The key question we have to ask is “what purpose does a fixed income investment serve within a portfolio?”

Unlike tax-exempt endowments, UHNW families operate within a set of real-world constraints, including taxes, liquidity requirements, and specific risk management objectives. UHNW portfolios are designed not only for maximizing perpetual endowment growth, but also for multi-faceted goals, including capital preservation, steady income for funding spending needs, and multi-generational wealth transfer, all while managing complex tax considerations. Within this context, dismissing fixed income entirely would be as imprudent as relying on it indiscriminately.

In short, we do not view fixed income as mindless “ballast” or filler, but rather as a suite of precise and targeted tools. If a bond does not serve a clear purpose or adequately compensate for its risks, we will not include it. This philosophy underpins how TwinFocus constructs fixed income allocations for UHNW clients – purpose-driven and not formula-driven.

Not Just a Ballast – Fixed Income as a Toolkit

Traditional 60/40 portfolios often treat the 40% in bonds as a homogeneous shock absorber – ballast meant to stabilize the equity component, often assuming a negative correlation to equity returns. In contrast, TwinFocus views fixed income as a versatile toolkit of instruments, each serving a distinct and objective-driven role.

We do not allocate to bonds simply to “check a box” or rely on historical correlations, a more recent phenomenon that may not prove enduring. Instead, we employ specific fixed income strategies selectively and intentionally – only when they serve defined objectives or risk mitigation purposes.

We’ve written a number of pieces over the past several years highlighting our thoughts – expressing caution about owning corporate bonds when spreads are tight relative to risk, and owning long-duration bonds during periods of yield curve inversion resulting in unattractive convexity to returns. Conversely, we have highlighted opportunities captured by owning closed-end municipal bond funds that trade at material discounts to NAV, which can be present compelling and attractive alpha opportunities.

The common theme in our investment process – particularly within fixed income – is that there must be a clear thesis for each investment. If expected bond returns are unattractive and we have other effective tools to manage risk, the TwinFocus Portfolio Management Team may maintain a much lower allocation to fixed income or selectively favor specific segments of the bond market. Conversely, when market conditions present compelling fixed income opportunities – high-yield bonds following a market dislocation, or floating-rate loans in a rising interest rate environment – we will utilize those fixed income segments more heavily.

We do hold longer-term strategic allocations to US treasuries and municipal bonds, which have traditionally been viewed as staples for UHNW portfolios. However, we calibrate the size and duration of these positions based on the specific objectives we have identified and established for each of our UHNW families. Actively managed bond allocations can and may vary widely over time and across portfolios – in today’s dynamic and fluid environment, fixed income allocations should not be premised on static buy-and hold strategies.

The Vast and Complex Fixed Income Universe

Another reason we reject a “one-size-fits-all” approach for bonds is the sheer size and complexity of the fixed income universe. Fixed income is often mistakenly treated as a single, monolithic category (“bonds”). In reality, it encompasses a vast collection of sub-markets, including corporate bonds, municipal bonds, agency MBS, CLOs, commercial paper, all the private credit options, and more. For example, the US corporate bond market alone contains over 500,000 unique bond issues by some estimates. This immense variety leads to a far greater dispersion in outcomes across fixed income than in more consolidated markets such as the S&P 500 equity index.

Why does this matter? First, both opportunity and risk in fixed income are highly diverse. With tens of thousands of bonds in the market, the range of potential returns in any given year is vast. For example, in a single year one bond might default and result in a total loss, while another bond might rally and return +20%. Even within the same credit rating category, outcomes can diverge – a BB-rated high-yield bond may trade down on company news while another BB-rated bond may rally on a positive buyout offer. Moreover, the breadth within the fixed income market (i.e., government bonds, corporate bonds across industries/sectors, mortgages, municipals, structured notes, etc.) makes it misleading to generalize about “bond performance.” For example, one investor could be invested in a 30-year US Treasury yielding 4%, another investor could hold a short-term AAA corporate note yielding 5%, while a third could have exposure to a distressed emerging-market bond, yielding 15%.

Second, the complexity and size of credit markets creates opportunities for active management and selection. In a universe of thousands of individual bonds, dispersion – the gap between winners and losers – can be significant. Skilled managers can focus on segments offering more attractive risk/reward and avoid segments that do not. Unlike a stock index where returns are typically driven by a handful of dominant companies and index returns are hard to outperform, bond indices often carry significant “dead weight” and structural inefficiencies – they are often debt-weighted, meaning the most indebted issuers have the largest weights in the indices. By being selective in such a broad universe, seasoned credit managers can add meaningful value over a passive approach.

A Structured Risk Framework for Fixed Income

When we evaluate bonds for inclusion in a UHNW portfolio, we break down their risk and return profile across several dimensions. Our risk considerations focus on three key components (with a “3A” being taxes):

- Duration: Duration risk is the bond’s sensitivity to interest rate moves. Bonds with longer duration (longer maturity or lower coupons) will fall more in price if interest rates rise. For example, a 30-year Treasury has a duration around 18–20, meaning a 1 percentage-point rise in rates might cause an ~18% price drop. In contrast, a 1-year bill has negligible price sensitivity.

There are times where we intentionally want exposure to duration – for instance, as a hedge in a deflationary scenario, or to lock in a high yield for the long term. But in current credit environments, we have been steadfast in our view to maintain shorter duration, using floating rate products, short-term Treasuries, and high yielding products (such as some of our private credit fund recommendations). The compensation for taking on longer duration is insufficient to reward for the risk, and this has worked to our advantage on multiple occasions over the last few years.

- Spread Risk: Changes in market perception of credit risk will affect a bond’s market value and spreads can widen. Even if the actual underlying profile of the issuer doesn’t change, it changes the returns for investors. For corporate and high-yield bonds, spread risk is often the dominant source of volatility – e.g. in a recession scare, credit spreads typically jump (prices drop) across the board. Spread risk offers significant negative asymmetry – while the potential upside from tightening spreads is limited, the downside can be substantial when spreads inevitably widen. For these reasons, we only take on spread risk when we believe the compensation is compelling, and we size positions carefully, recognizing that spreads can swing significantly with market sentiment.

- Default Risk: Beyond spread fluctuations, there is the risk of actual credit loss – the issuer failing to pay interest or principal. We will also include “downgrade risk” in this bucket, which can force prices down or cause forced selling by some institutional holders. We ask: What is the probability of permanent loss here? For high-quality bonds (Treasuries, Aaa/Aa munis, etc.), credit loss risk is minimal. For high-yield corporates or certain project bonds, credit loss is a significant consideration. We require adequate compensation for whatever credit loss risk we assume. For example, if a bond offers an 8% yield but we estimate an average annual 1% default loss (with recoveries considered), the net expected credit return might be ~7%. We compare that to other options and to equity returns. If the margin isn’t attractive, we won’t take the credit exposure. We also evaluate recovery values (secured vs unsecured debt, etc.) – a senior secured loan might have less loss severity than a subordinated unsecured bond by the same issuer. All these factors affect our assessment of a fixed income instrument’s true credit risk.

- Tax Risk (Consideration?): Lastly, for all of the above, when evaluating risk relative to return across fixed income investments, we also focus on after-tax returns since, for most fixed income securities, the return profile can be cut in half after taxes, with exceptions such as municipal bonds, agencies, and certain other specific exceptions. When owning fixed income, income is the return stream, and for UHNW clients, that typically means paying at the highest marginal tax rates. When evaluating after-tax returns to opportunities that benefit from long-term capital gains treatment, the relative appeal of taking on certain fixed income risks diminishes even further.

What Do Our Fixed Income Allocations Look Like Today?

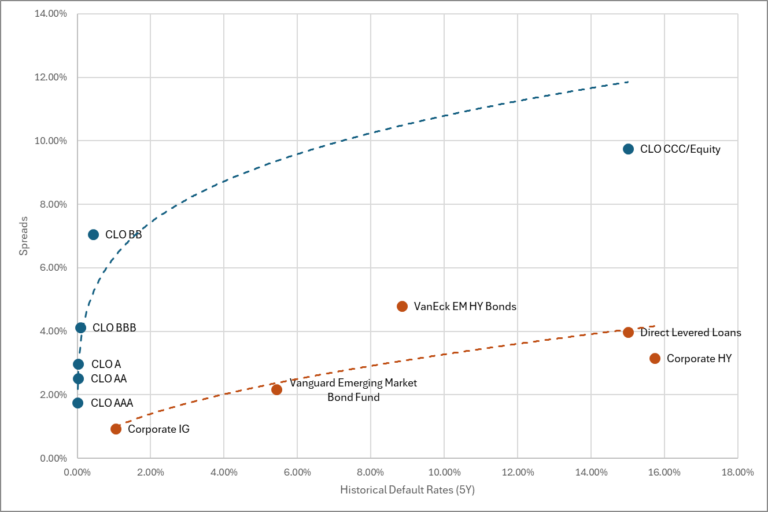

We highlighted the following illustration in our year-end letter simplifying the thousands of options in the fixed income market:

Source: Bloomberg, Morningstar

The numbers have changed slightly, but this highlights what we’re thinking about – where are spreads relative to real risk of loss? Are our investors being compensated for the risks they’re taking?

We had a meeting with a large institutional fixed income manager earlier this month, and their deck had all the disclosures on not re-publishing their data, but they had a very similar chart, highlighting similar thinking – where are returns relative to risk today? (CLOs, developed market IG bonds, some emerging markets were their highlights, though that was prior to recent market volatility)

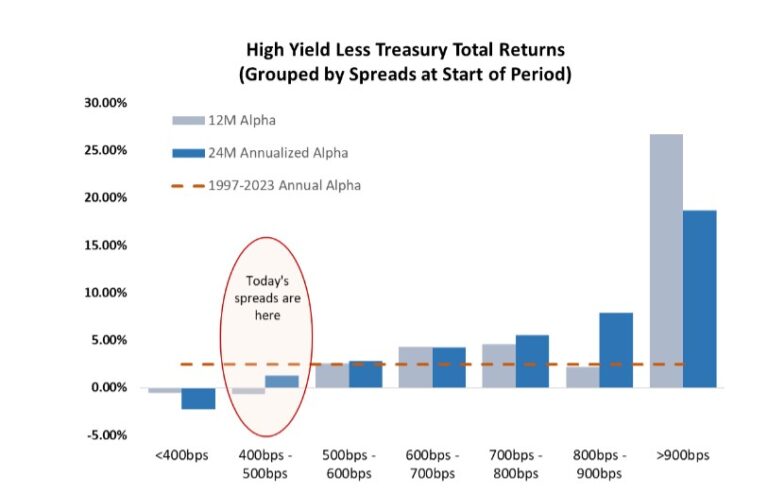

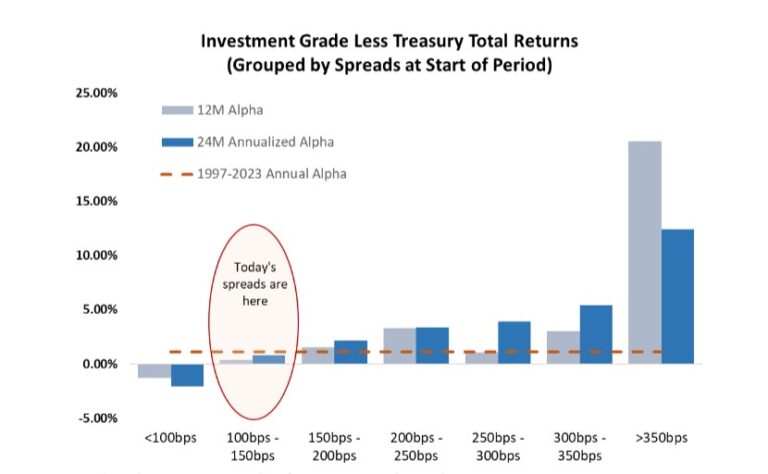

In a practical example of why it matters what we’re getting paid, we wrote a piece in 2023 for clients talking about the corporate bond market, and we included two (still relevant) charts of returns:

Source: Federal Reserve Bank of St. Louis, Bloomberg, TwinFocus Investment Research

Source: Federal Reserve Bank of St. Louis, Bloomberg, TwinFocus Investment Research

When spreads are tight, returns are generally low, and since spreads bottomed well below 400bps and 100bps earlier this year, Treasuries have been the place to be…

You get the point.

Beyond Theoretical, Where Would we Focus Today? Where Not?

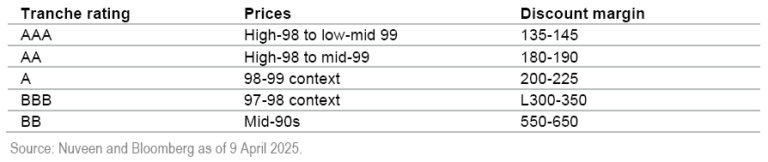

Parts of the CLO market look interesting, and we might barbell any exposure. AAA spreads are still north of 140 bps, adding better spreads than investment grade corporates, with loss rates that are historically lower, and a floating rate structure that offers nearly zero duration risk in an environment where we still like the short end of the curve. CLO equity is not without material downside risk today, given all of the economic uncertainty, but in a positive environment, returns can be materially higher than standard leveraged loan returns.

CLO Pricing (04/09/2025)

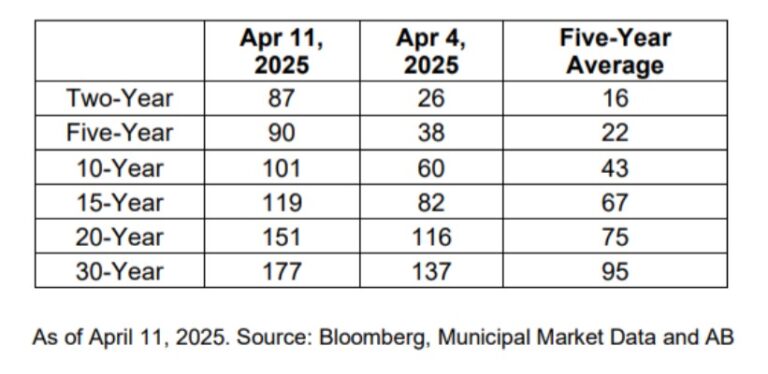

Closed-End Muni Funds are Again Trading at Steep Discounts to NAV. We evaluated several funds in 2024, presenting a compelling opportunity when they traded at steep discounts, but those discounts closed, and the opportunity became less attractive. In recent months, they have again widened, and municipal bond exposure can be gained at a 10%+ discount to the underlying, in some instances offering over an 8% tax-equivalent yield in higher-quality municipal bonds. This is coupled with the fact that tax-equivalent yields in municipals are more attractive relative to Treasuries today than they have been in several years:

Municipal/Treasury After-Tax Spreads (bps)

“Private Credit” That isn’t Your Standard Middle Market Lending Strategy. In order to tie up capital in what can be multi-year funds (and longer duration as a result), we seek commensurate higher relative returns. “Low double digit” returns for lending to corporates likely isn’t sufficient when we see tax-equivalent yields of ~8% in the municipal space today. Rather, we’ve sought (and found) opportunities to generate 20%+ net returns in narrower parts of the credit market like lending to defense contractors or real estate projects or investing in renewables projects to earn preferred dividends.

We’re Avoiding “the golden age of Private Credit”. While we will not name names, a review of the public filings from most publicly traded BDCs reveals that a vast majority of their portfolio holdings are marked at or near par, or at recovery values. These filings often present binary outcomes – i.e., assets are either performing perfectly or classified as “disasters”. This raises the question of how we evaluate the situations that fall in between where investments are either underperforming or haven’t blown up.

For example, in one portfolio of the 369 bonds of size, 276 (75%) were marked at or above par, 60 (16%) were marked within 5% of par, and 17 (5%) were marked at what appears to be recovery values. These results indicate that of the 369 bonds, only 4% were marked somewhere between “perfect” and “default”. While this is not a scientific exercise, common sense suggests that in this type of vehicle, it is quite likely to see investments shift rapidly from perfect to defaulted with little prior warning.

We’re not (generally) Adding Public Corporate Bonds. See our above charts. Even today spreads haven’t moved anywhere near historical levels. You may hear “the quality is better now” but we view this as equivalent to saying “this time it is different.”

Conclusion: Purpose-Driven Fixed Income – The TwinFocus Difference

Swensen’s very specific perspective on fixed income may be well-suited for institutions with forever capital, like the Yale endowment. However, our clients have different objectives and constraints, so we do not fully reject the asset class. Bonds can help achieve client objectives – through predictable cash flow, episodic diversification, and tax advantages, provided they are priced to compensate for duration, credit, and liquidity risks.

The right allocation is situational, not formulaic. When yields are low and spreads are tight, keeping duration short and risk light may be prudent. When spreads widen or niche segments (e.g., discounted munis, senior CLO tranches) offer better payoffs, bond exposure can expand. The constant discipline is to test every position against its intended role and after‑tax, risk‑adjusted return.

Put simply: own bonds for a purpose, not out of tradition, and deploy capital only where the expected reward justifies the risk exposure.