2024 YEAR In Review

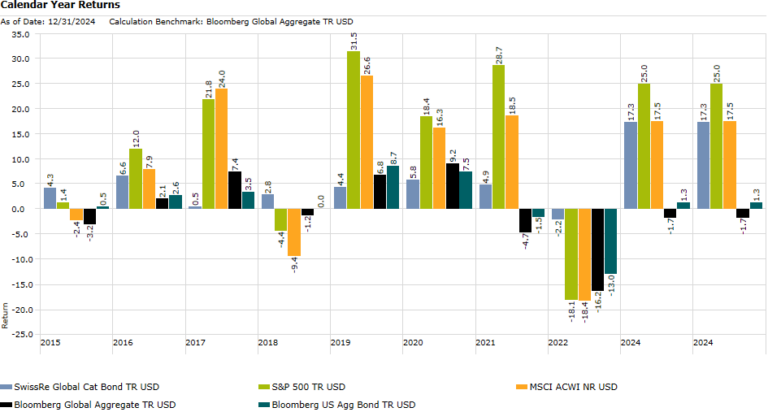

Insurance-linked Securities (ILS) markets and strategies performed well in 2024, the result of higher premiums and below average total insured damages despite above average activity during hurricane season. The Swiss Re CAT Bond TR Indes, which tracks global USD-denominated CAT bonds, returned +17.6%. CAT Bonds allow insurers/reinsurers to sell peak loss and tail risk to the market.

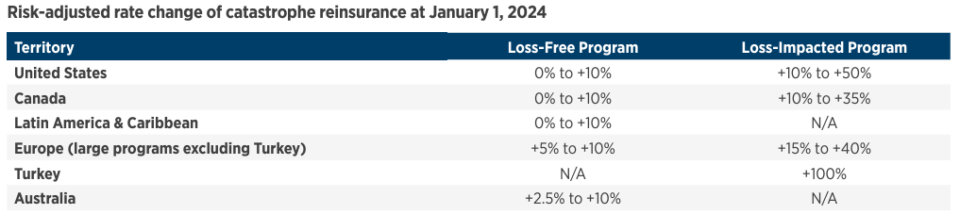

- As expected, the ILS market remained “hardened”, with capital demand largely outweighing supply, in 2024. The January renewal period, during which about 60% of global reinsurance transactions are finalized, exhibiting strong increases in loss-impacted premiums, while April (~10-15% of transactions focused on Japan) and June (~25-35% focused on US hurricane) were flat to slightly lower on a risk-adjusted basis.

Source: Amundi Pioneer - The ILS market also benefitted from elevated short-duration yields, collateral is held in Treasury bills, with the 1-year bill averaging a ≥5% yield over the year.

- Swiss Re forecasts 2024 global reinsured losses at $110 B, with the majority from wind and flood, relative to an average of $161 B from 2015 – 2023. In addition, higher retention levels, the losses held by primary insurers, mitigated the losses to reinsurers.

- US wind generally represents a third of portfolio peril exposure. The 2024 hurricane season (Jun – Nov) experienced above-average activity with 18 named storms, 11 hurricanes and 5 major hurricanes. This was in the range of the NOAA forecast of 17-25 named storms, 8-13 hurricanes and 5-7 major hurricanes, with La Nina and warmer-than-average ocean temperatures driving above-normal activity, and above the 1991-2020 averages of 14.4, 7.2 and 3.2 respectively.

2025 Outlook

The market outlook for 2025 remains positive, though the tailwinds that supported markets and the fund in 2024 are not expected to be as strong.

- Early indications suggest the ILS markets remain hardened, though more balanced. The January renewal period is not finalized, but expectations are for elevated loss-adjusted premiums with the more favorable terms and conditions of the past few years remaining in place.

- Total returns will be impacted if the Fed cuts rates and the front end of the US Treasury curve continues to shift lower. The Treasury curve steepened meaningfully in 2024 with the 1-year yield falling from 4.84% to 4.15%.

- Tropical Storm Research is forecasting average activity in 2025, with 15 named storms, 7 hurricanes and 3 major hurricanes. Historically, however, there is not a strong correlation between the extended forecast (made in December and generally centering on long-term averages) and the actual number of major storms. Further, insured damages are heavily dependent where storms make landfall, which is impossible to predict before the storms form and difficult to predict even after the storms have formed.

California Wildfires

As of Jan 20th, the Palisades Fire had covered ~37 square miles, damaged or destroyed 6,000+ structures and was 59% contained. The Eaton Fire had covered ~22 square miles, damaged or destroyed 10,000+ structures and was 87% contained.

The preliminary industry insured loss estimates are in the $20 to $25 B range, but given the early stages of the event the impact on particular securities still uncertain:

- Some CAT bonds have priced lower to reflect the increase in potential insured losses.

- Quota shares are private, invitation-only contracts, so it is still too early to determine potential losses. Quota shares allow reinsurers to reduce risk by selling a portion of their insurance book, with buyers receiving a fixed proportion of premiums and losses.

The potential mitigating factors:

- The California market is dominated by the nationwide insurers who tend to retain a higher level of insured losses.

- The California FAIR Plan, the insurer of last resort providing basic fire insurance when it is not available in the private markets, will likely absorb a portion of the wildfire loss. The Plan reports receiving 3,600+ claims with potential exposure of ~$4.8B, insuring ~22% of structures (~$4 B exposure) affected by the Palisades fire and 12% ($775 MM) by the Eaton fire.

Conclusion

Barring a surprise during the January renewals, we continue to expect ILS markets to provide solid long-term risk-adjusted returns, capturing risk premiums that are unrelated to public markets, a profile we find particularly attractive given our cautious outlook for risk assets at current valuations.

Source: Morningstar Direct

- As we’ve seen, however, there is always the potential for negative returns in years where insured losses exceed expectations, which can occur in consecutive years, alongside negative returns in public markets and take several years to recover.

- While the run of high-teen returns may not continue, given the potential for lower Treasury yields, ILS is expected to benefit from a hardened market and higher retention levels.

- Risk models are backward looking, so there is always the potential they do not fully reflect catastrophic outcomes. However, broad diversification across perils combined with higher retention levels is expected to mitigate downside tail risk.

- The insurance industry is aware of and adapting to climate change. Over time, reinsurance is unprofitable if the industry consistently undercharges for the risks taken. The ILS market reprices annually, with premiums and retention levels adjusting after losses, while the climate is evolving over a much longer horizon.

Memorandum Disclaimers & Disclosures

This Memorandum is confidential and may contain legally privileged and proprietary information of Twin Focus Capital Partners LLC (“TwinFocus”). It is intended solely for the use of the Recipients to which it is addressed. If you are not the intended recipient, you are hereby notified that any dissemination, copy, disclosure, use or action taken based on this Memorandum or any information herein is strictly prohibited and may be unlawful. If you received this Memorandum in error, please contact the sender immediately and destroy the material in its entirety, whether electronic or hard copy.

This Memorandum may not be otherwise redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the express written consent of Twin Focus Capital Partners LLC.

Investments involve numerous risks, including, among others, market risk, counterparty default risk and liquidity risk. In some cases, securities, strategies and other financial instruments may be difficult to value or sell and reliable information about the value or risks related to the security, strategy or financial instrument may be difficult to obtain. Income from such securities, strategies and other financial instruments, if any, may fluctuate and that price or value of such securities, strategies and instruments may rise or fall and, in some cases, investors may lose their entire principal investment. Foreign currency rates of exchange may adversely affect the value, price or income of any security or financial instrument mentioned in this Memorandum. Investors in such securities and instruments effectively assume currency risk. Additionally, before investing in any mutual fund strategies, Recipients are advised to obtain and closely review prospectuses and related information for those strategies before making any final investment decision.

Hedge fund and other alternative investments are generally unregulated and considered inherently very risky and you can lose material portions of your principal in very short periods of time. Prior to making any investments in any hedge fund managers and alternative investment strategies, you should thoroughly review all subscription documents and confidential offering memoranda provided by the managers/strategies, paying particular attention to the risk disclosures. You should not invest in such managers/strategies if you are not thoroughly comfortable with these risk disclosures or do not understand and/or appreciate the increased levels of risks associated with such strategies. Additionally, this Memorandum may provide information regarding private funds/strategies/investments which are exempt from registration under the Investment Company Act of 1940 pursuant to Section 3(c)(1) and/or 3(c)(7) which were offered as private placements in reliance on Regulation D of the Securities Act of 1933. Each individual fund/strategy and NOT TwinFocus shall have the sole responsibility for (i) formally qualifying prospective investors to ensure they meet the suitability criteria to invest in each relevant fund/strategy and, once qualified, (ii) sending the formal offering documents and other materials to each prospective investor.

Any information relating to the tax status of financial instruments and/or strategies discussed herein is not intended to provide tax advice or to be used by anyone to provide tax advice. Recipients are urged to seek tax advice based on their particular circumstances from an independent tax professional. Any waiver by TwinFocus of any section of this Memorandum Disclaimer Statement should not be construed as a general waiver of any other section and/or the entire Memorandum Disclaimer Statement.

The information, including but not limited to forecasts and estimates, in this Memorandum was obtained from various sources and TwinFocus does not guarantee its accuracy. Although the information contained in this Memorandum are from sources believed to be reliable, no representation or warranty, expressed or otherwise, is made to, and no reliance should be placed on its fairness, accuracy, completeness or timeliness.

All opinions, projections and estimates are as of the date of the Memorandum and are subject to change without notice. TwinFocus is under no obligation to update this Memorandum and Recipients should therefore assume that TwinFocus will not update any fact, circumstance or opinion contained in this Memorandum unless specifically requested. TwinFocus and any director, officer or employee of TwinFocus do not accept any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this Memorandum or its contents.

This Memorandum may contain current opinions of third-party authors and not necessarily those of TwinFocus. Such opinions are subject to change without notice.

This Memorandum may contain references to market indices. Such information is presented to show the general trends in certain markets for the periods indicated and is not intended to imply that the strategy(s) discussed and/or reviewed are similar to the indices either in composition or element of risk. TwinFocus does not make any representations as to whether the indices may or may not be unmanaged, not investable, have any expenses and may or may not reflect reinvestment of dividends and distributions. Index data is provided for comparative purposes only. A variety of factors may cause an index to be an inaccurate benchmark for a particular portfolio/manager/strategy and the index does not necessarily reflect the actual investment strategy of the portfolio/manager/strategy discussed and/or presented in the Memorandum. Current period returns may be estimates. Actual index returns and/or estimates are calculated and presented to TwinFocus through third party software providers and as such, may differ from the final figures produced by the index provider.

Any investment in any Qualified Opportunity Fund (“QOF”) may be made only by delivery of the Fund’s Private Placement Memorandum to accredited purchasers and qualified investors. Investors should rely solely on the applicable offering documents in making any investment decision, as well as assessing the risks on an ongoing basis. Such offering documents contain important information, including, among other information, a description of an investment’s risks, investment approach, and fees and expenses, and should be read carefully, as part of any review of ongoing materials.

Opportunity zone investments are subject to unique risks, including potential regulatory change. For example, a proposed bill could significantly change the qualification requirements under the opportunity zone program, with many of these provisions having retroactive effect. As one example, these changes would terminate the designation of certain tracts as qualified opportunity zones, significantly change some of the requirements for qualification as a qualified opportunity zone business and make some other changes to the opportunity zone provisions, with many of these changes having retroactive effect to the date of the original enactment of the opportunity zone provisions.

In addition, the state and local tax conformity to the opportunity zone tax benefits varies from jurisdiction to jurisdiction. Although some state and local tax jurisdictions fully conform to the opportunity zone tax benefits, other jurisdictions may offer parallel benefits or no similar benefits.

As such, it is possible that any investment that is considered an opportunity zone may fail to meet the requirements and there can be no guarantee that any investor will realize any tax advantages of investing in a qualified opportunity zone as a result of any such investment.